7 Infamous CEO Grillings

Clockwise from top left: Landov; AP; Getty; Getty

Bob Diamond (Barclays)

Peter Macdiarmid / Getty Images

Tobacco CEOs

John Duricka / AP Photo

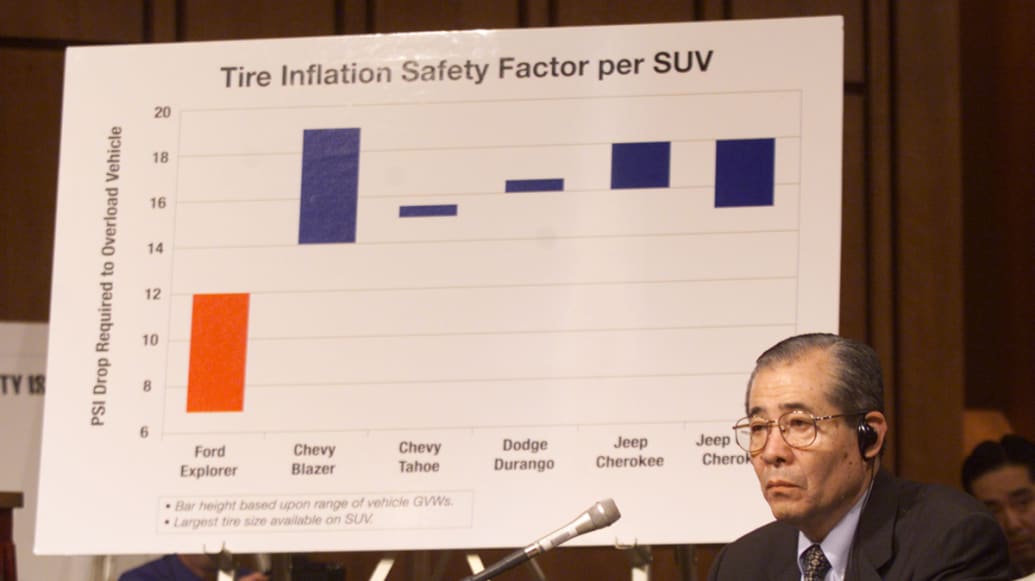

Masatoshi Ono (Bridgestone/Firestone)

Mark Wilson, Newsmakers / Getty Images

Auto CEOs

Brendan Hoffman / Getty Images

Tony Hayward (BP)

Rod Lamkey Jr., AFP / Getty Images

Rupert Murdoch (News Corp.)

Reuters / Landov

Jon Corzine (MF Global)

Susan Walsh / AP Photo