General Electric

Stan Honda, AFP / Getty Images

Wells Fargo

Eric Risberg / AP Photo

Verizon

Mark Lennihan / AP Photo

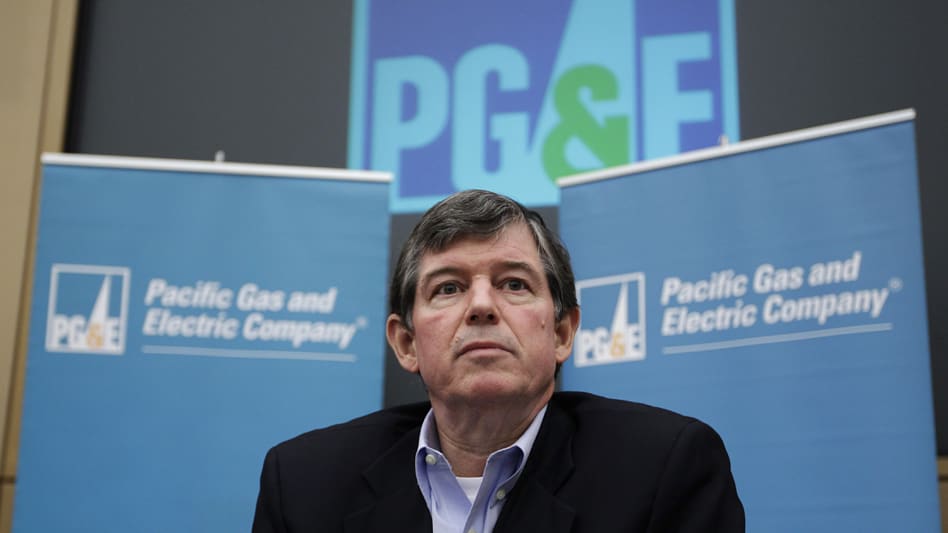

PG&E Corp

Paul Sakuma / AP Photo

Corning Inc.

David Duprey / AP Photo

Boeing

Barry Sweet / AP Photo

Mattel

Nick Ut / AP Photo

Duke Energy

Nell Redmond / AP Photo

DuPont

Getty Images