Jamie Dimon

Saul Loeb, AFP / Getty Images

John Paulson

AP Photo

Philip Falcone

AP Photo

Bernard Madoff

Hiroko Masuike / Getty Images

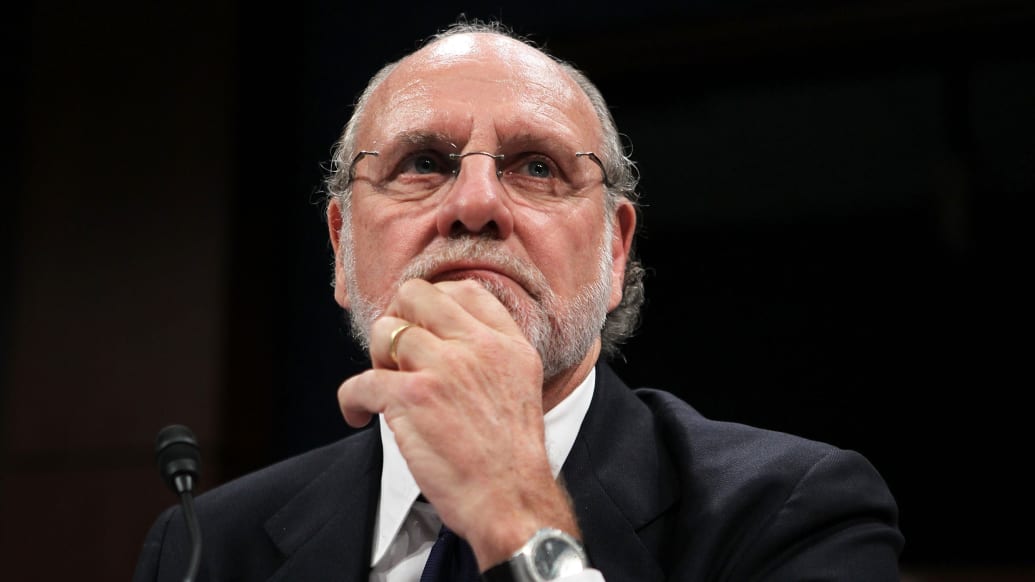

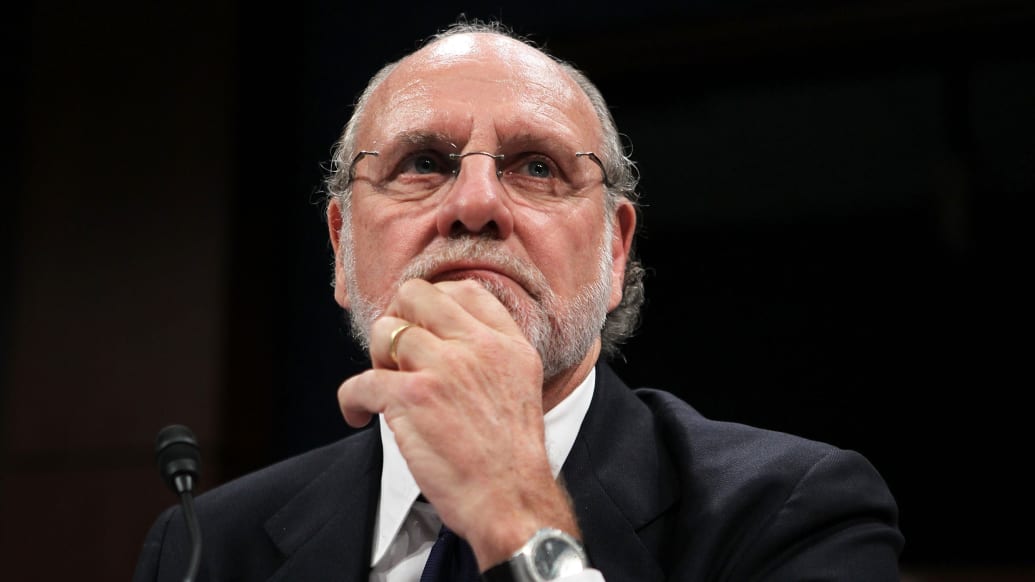

Jon Corzine

Alex Wong / Getty Images

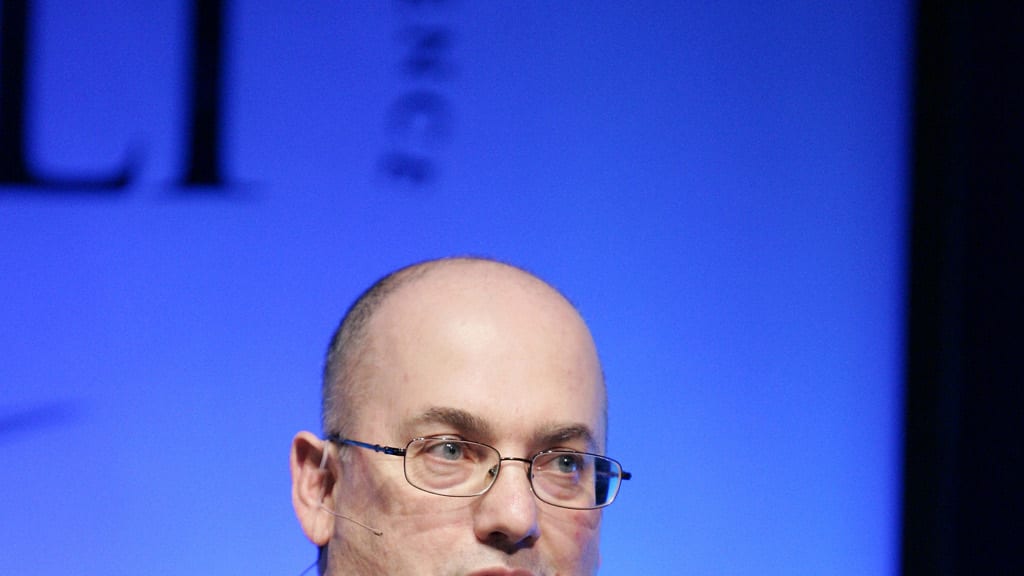

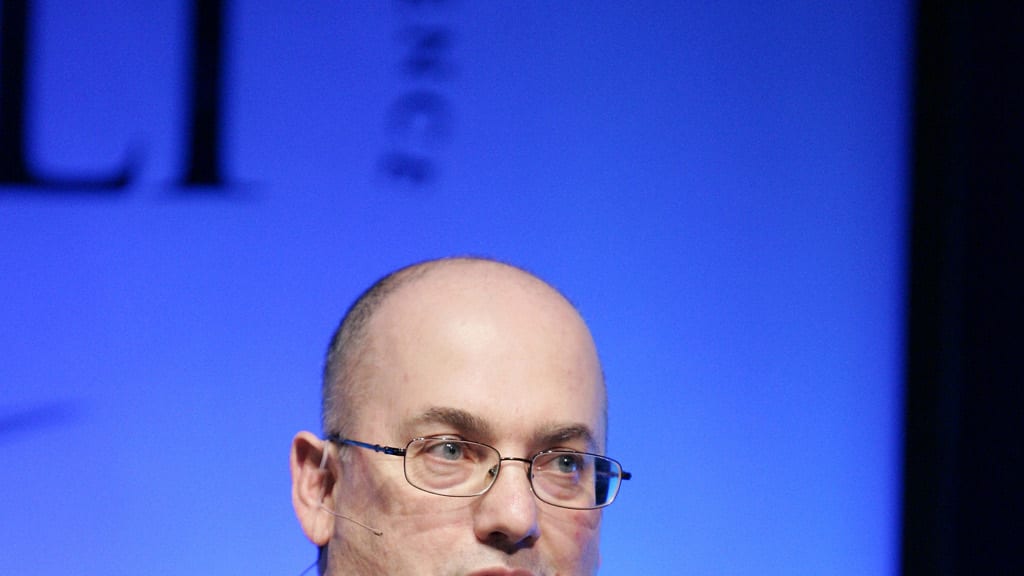

Stephen Schwarzman

Daniel Acker, Bloomberg News / Getty Images

Who is Robert Miller? From Jamie Dimon to Bernie Madoff, Dan Gross on the character’s real-life influences.

Got a tip? Send it to The Daily Beast here.