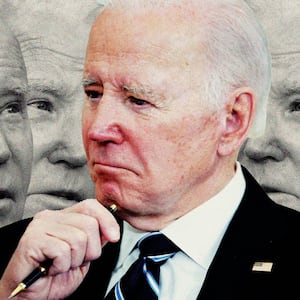

The eagerness of the Supreme Court’s conservative majority to assert its power was blatantly on display again in oral arguments over President Joe Biden’s proposed cancellation of federal student loans. In arguments heard Tuesday, the conservative justices repeatedly showed their interest in stopping Biden from relieving Americans of $400 billion dollars’ worth of student debt.

The two cases heard arose over a challenge to the plan by six Republican-led states—Nebraska, Missouri, Arkansas, Iowa, Kansas, and South Carolina—plus two individuals, relying on recent Supreme Court decisions utilizing the so-called “major questions” doctrine.

Deploying this doctrine as the conservative majority’s judicial activist weapon of choice, Chief Justice John Roberts made clear that he believes the Department of Education has no business deciding the loan terms of the loans it administers. Roberts asserted at oral argument his view that the forgiveness of student loan debt is a subject of such “great controversy” that he believes only Congress can act on it. His invocation of the term “great controversy” is critical to using the major questions doctrine—which in practice simply means actions by a Democratic administration that might offend conservatives should be viewed as too controversial for the high court to allow.

Roberts ushered in the new age of this doctrine in the 2022 decision West Virginia v. EPA where SCOTUS struck down the EPA’s ability to require power plants to move away from the use of coal. Small wonder that the dissent in that case, written by Justice Elena Kagan, characterized Roberts’ majority opinion as “announc[ing] the arrival of the ‘major questions’ doctrine.” Its use allows the conservative majority to impose its views on what it deems should be important to Americans.

An excellent example of the lack of legal basis for these views is Justice Samuel Alito’s claim that the ordinary colloquial meaning of “major questions” encompassed “what the government proposes to do with student loans.” This is the equivalent of claiming that if you looked up “major questions” in Black’s Law Dictionary you’d find a picture of Biden’s plan to cancel student loans. It’s the kind of non-legal analysis that would get a first-year law student raked over the coals in class by their law professor.

The doctrine is always cloaked in the idea that “controversial” issues of “major” importance must be left to Congress to decide rather than allowing the Executive branch to act. The fallacy of that argument in this case is—as pointed out by Justice Kagan—that Congress already acted. Specifically, the Higher Education Relief Opportunities for Students Act of 2003, known as the “HEROES Act” empowers the Education Department to “waive or modify any statutory or regulatory provision” to protect borrowers affected by a national emergency like the COVID-19 pandemic.

If you don’t believe Justice Kagan, just ask the Trump administration—which relied upon that exact statute to pause student loan repayments and suspend interest accrual because of the national emergency caused by COVID-19.

Significant issues of whether the states and individuals even have standing to challenge the Biden plan were identified by both conservative and liberal justices. Standing is the legal doctrine for federal courts that prevents cases from being brought “simply on the ground that an individual or group is displeased with a government action or law.” Cases must involve actual “cases and controversies” where the party suing has suffered an actual injury connected to the conduct at issue that can be redressed by a court decision.

It is difficult to see how that basic standard is met here.

Put simply, the Republican states suing don’t have a dog in this fight because they are not parties to any of the student loans. Those contracts are between the students and the government, not between the students and the states.

As Justice Kagan pointed out, the actual non-profit state agency in Missouri tasked with administering student loans did not even join the suit. The two individuals suing at least actually had student loans—although one student only had loans from commercial entities, not loans held by the government. But Justice Neil Gorsuch, part of the conservative majority, was dismissive of their standing.

In a pre-Federalist Society dominated federal judiciary, questions like standing served as an important guard at the courthouse doors. But that is unlikely to work in this case, as SCOTUS’ conservative majority seems particularly concerned about the “fairness” of forgiving student loans. Chief Justice Roberts seemed particularly troubled by fairness, when he wondered why the owner of a small lawn mowing business wouldn’t get their business loan forgiven, but students would get this benefit. He seemed oblivious to Justice Kagan’s point that Congress did not pass a law that dealt with repayment for lawn businesses.

The chief justice’s hypothetical question might seem humorous to some and bizarre to others—somehow conjuring up a stereotypical white suburban fantasy a la Wandavision—but it accurately reflects a disconnect between the world that justices like Roberts live in versus the reality of most everyday Americans.

Justice Sonia Sontomayor told the Nebraska solicitor general the financial problems for those who default includes consequences that grow exponentially, and that he was asking to “give judges the right to decide how much aid to give them.” If Roberts and his conservative brethren are really concerned about “fairness” then they would leave the administration of federal education loans in the hands of the Department of Education.