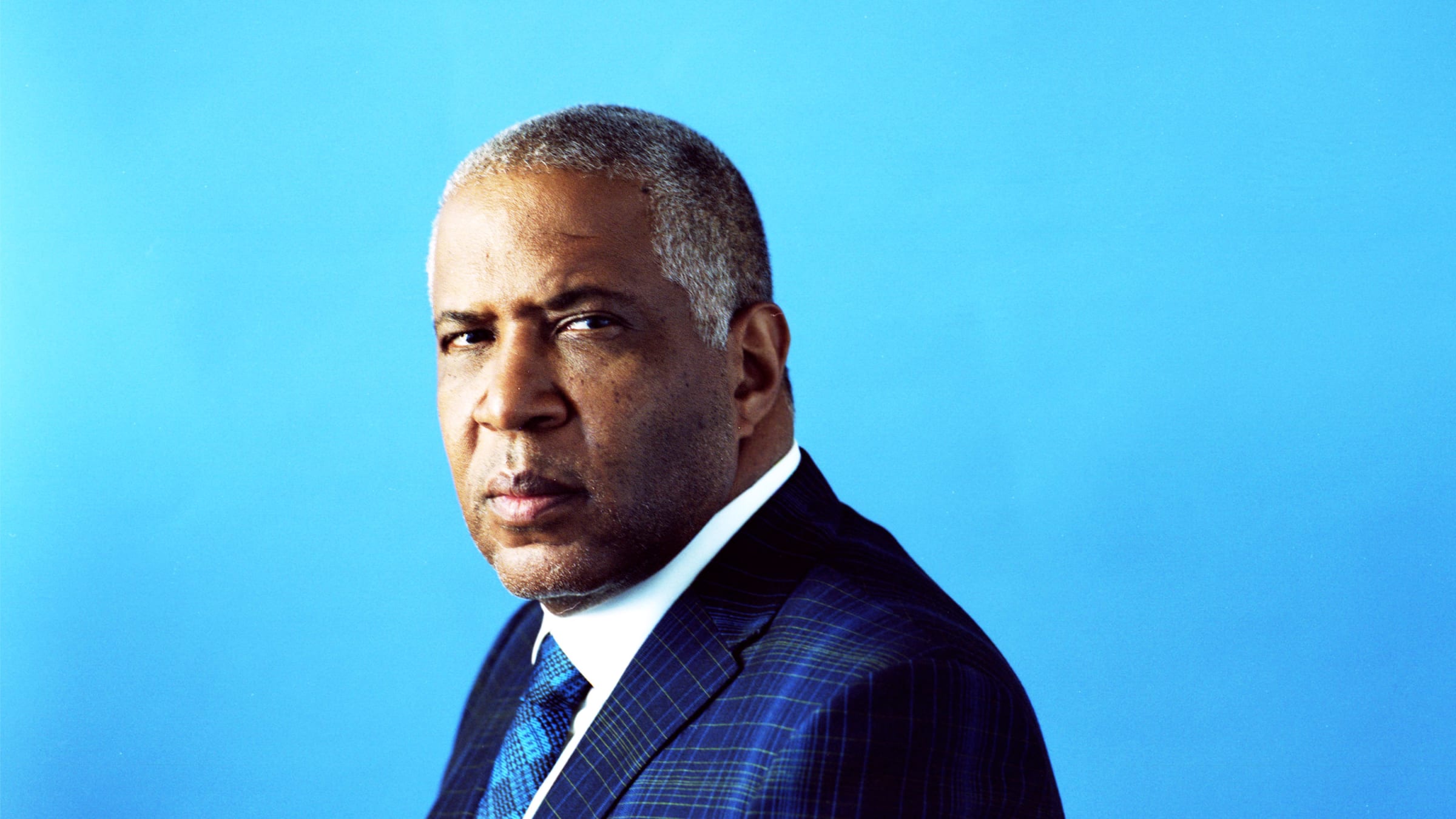

This Billionaire Wants Everyone to Move on From His Crimes

Christian K. Lee/Getty

But Robert F. Smith is still embroiled in the largest tax evasion prosecution in U.S. history.

The lineup for “The Gathering For Harry,” a virtual surprise party on the eve of singer Harry Belafonte’s 94th birthday, included a long list of well-known names. The Feb. 28 livestream was emceed by Tiffany Haddish and Charlamagne tha God. Oprah Winfrey and Martin Scorsese spoke. Danny Glover popped in. Aloe Blacc performed. Politicians from Pete Buttigieg to Bernie Sanders to Stacey Abrams sent in videos offering thanks.

Not long before the grand finale—DJ Khaled presenting the “Gatekeeper of Truth Award” to Jay-Z—billionaire investment banker Robert F. Smith, the richest Black person in America according to the Bloomberg Billionaires Index, delivered a short birthday toast. “Thank you for being uniquely you, my good and noble brother,” a suited Smith said into his desktop camera. “Happy birthday.”

The banker’s name, which appeared on the event’s promotional materials, flashed across the screen several times throughout the stream; Smith was one of its four sponsors. The star-studded Zoom was one of many high-profile appearances Smith has made since October—when he admitted in a federal affidavit to a 15-year tax-evasion conspiracy involving a decade of faked IRS filings, a network of offshore entities, and four luxury properties across France and California.

The billionaire, whose net worth has nearly doubled in the past two years to over $7 billion, has made clear that he plans to move on from the tax saga. He remains chief executive of Vista Equity Partners, has doled out tens of millions in donations as he seeks absolution, and has been making strategic appearances. But a legal drama unfolding in a Texas courthouse—the biggest tax evasion prosecution in U.S. history, targeting a billionaire associate of Smith—may make it difficult for him to put his crimes completely behind him.

That case revolves around Robert Brockman, the Houston businessman who made most of his estimated $6 billion net worth as CEO of Reynolds & Reynolds, the car software company that owns DocuPad. Back in 1997, Smith met Brockman while working at Goldman Sachs, where they collaborated for several years. In 2000, according to Smith’s affidavit, Brockman approached him about starting a private equity firm, at which Smith would serve as CEO and Brockman as a limited partner investor, contributing $300 million and eventually $1 billion to its funds through an untaxed offshore structure. Smith named the firm Vista Equity Partners.

In October, federal prosecutors charged Brockman with multiple counts of tax evasion, money laundering, evidence tampering, and conspiracy to defraud the United States, alleging his collaboration with Smith was just one part of a complex scheme to hide some $2 billion in income over two decades. The case has turned into a battle of soap-opera proportions, with authorities portraying Brockman as a maniacal control freak who used code names to cover his tracks: “Redfish” for one accomplice, “King,” “Bonefish,” and “Snapper” for others. On the other side, Brockman’s attorneys describe him as a decrepit old man, incapable of appearing in court due to a case of sudden dementia.

Just as Brockman’s indictment came out, investigators unsealed documents on Smith. They revealed that the Justice Department had been on Smith’s tail for four years, investigating whether he’d paid taxes on some $200 million in assets kept in a slew of secret offshore accounts and shell companies. Smith confirmed as much—admitting in writing that he had schemed for years to hide money in Belize and the Caribbean island Nevis and used the untaxed assets to buy a luxury home in Sonoma County, California, some commercial land in the French Alps, and two ski properties nearby.

Had Smith been charged with tax evasion, the private equity investor might have faced prison time and been forced out of the $64 billion firm he founded with Brockman. But the confession did not come with charges. Instead, Smith signed a “Non-Prosecution Agreement,” or NPA—a rare arrangement usually reserved for corporations. As part of the settlement, Smith agreed to pay $139 million in taxes and penalties, abandon a $182 million tax refund claim for charitable giving, and pay interest. Perhaps more importantly, he agreed to cooperate with authorities in their case against Brockman.

Former tax prosecutor Paul Pelletier, who is now in private practice, is highly critical of the deal. “It sends a horrible message,” he told The Daily Beast. “It says that wealthy people with well-heeled lawyers who come from the same law firm as the attorney general can cleanse themselves of long-standing, conspiratorial, harmful crimes that people of lesser economic means cannot do. NPA now means that ‘No Poor need Apply.’”

As a cooperating witness, Smith detailed his financial schemes in a six-page statement, and may have to appear at trial—where he could be forced to recount his crimes before a judge, jury, and the press and face a cross-examination undoubtedly designed to impeach his credibility. “Robert has agreed to be supportive of the government in its case against Bob Brockman, which could possibly include serving as a witness if the case does proceed to trial,” a source familiar with the case told The Daily Beast. (Smith and his attorneys declined to comment for this article.)

And yet Smith, from all appearances, has continued to operate as if little has changed. Days after the NPA was announced, Smith donated $50 million to the Student Freedom Initiative, a non-profit that helps students at historically Black colleges and universities eliminate their student loan debt. The same week, his firm was named one of 2020’s “50 Best Private Equity Forms for Entrepreneurs and Founders.” Not long after, he shelled out $48.19 million to Rockstar energy drink founder Russ Weiner for two mansions in North Palm Beach. In December, in an ironic twist for a confessed tax cheat, he pledged $1 million to the National Society of Black CPAs, to support Black accountants.

If Smith seemed to give himself a pass, some press and peers evidently accepted it. In December, Smith gave a talk at The New York Times’ DealBook Online Summit, about what business can do for Black communities. Just last month, Inside Philanthropy dedicated several pages to a profile of Smith headlined “Moving Forward.” “Now, I have made right with the government,” Smith said in the interview. “We have an agreement and I’ll abide by the agreement. We’re moving forward, and that’s kind of that.”

Some news outlets have framed Smith as a victim. A longform piece on Brockman’s legal woes ran in Forbes under the headline: “The Manipulative, Little Known Billionaire Who Nearly Ruined The Country’s Richest Black Person.” Investors seem to have shared the same attitude. Two months after the Brockman indictment, Vista Equity Partners raised some $2.7 billion in investor funds––only one known investor, a New Mexico pension fund, canceled their commitment. Buyouts Insider quoted a Vista investor calling Smith’s tax fraud a “nothing burger.”

A source close to Smith offered an explanation for why he hasn’t been shunned, blaming the naivete of a “decision he made over 20 years ago in his thirties and four years after finishing graduate school.”

“People are quite forgiving about a situation where a young Black man in his thirties made a decision to take what became a billion-dollar ‘take it or leave it’ opportunity by a much older and more experienced billionaire investor, who Robert met when he was a young investment banker at Goldman Sachs and assigned to help Brockman explore the sale of his company,” the source said. “Robert had little reason to question it because of how it had been previously vetted.”

Smith holds prestigious advisory positions at several non-profits and universities. An alum of Cornell University, he serves on its Engineering College Council and Tech Board of Overseers; the college named the Robert Frederick Smith School of Chemical and Biomolecular Engineering after him, following a generous donation in 2016. He also has positions on the Columbia Business School Board of Overseers, the Boys and Girls Club of San Francisco’s Board of Trustees, and the board of the Robert F. Kennedy Center for Justice and Human Rights. He chairs Carnegie Hall’s Board of Trustees and won the organization's Medal of Philanthropy in 2019.

Robert F. Smith speaks during the 2019 Robert F. Kennedy Human Rights Ripple Of Hope Awards.

Michael Loccisano/Getty

While organizations often distance themselves from donors after scandals, none of these have elected to cut ties with Smith. “Recognizing the long-lasting and transformative impacts of Mr. Smith’s philanthropy on past, current and future generations of Cornell students, and in light of the government’s resolution of its investigation into unpaid federal taxes, Cornell is not considering the return of gifts received from Mr. Smith or the revocation of honors bestowed upon him,” Cornell University Director of Media Relations Rebecca Valli said.

Representatives for Carnegie Hall told the Daily Beast Smith had been an “an incredible partner” and that “that they fully support his continued role as Chairman.” The Boys and Girls Club of San Francisco said it looks forward to “many more years of continued partnership with him.” The Columbia Business School and Harry Belafonte’s non-profit, The Gathering for Justice, did not respond to requests for comment.

Smith’s relationship to Robert F. Kennedy Human Rights has changed since the NPA announcement; he had served as the organization’s chair since 2013, but stepped down in December. A spokesperson declined to comment on whether the move was related to Smith’s legal issues. “Robert F. Smith concluded his tenure as chair of Robert F. Kennedy Human Rights in December of 2020,” she said, noting only that the banker was “at the end of his term and did not look to renew and start a new term.”

“He continues to serve as a board member and we are grateful for his ongoing engagement in our work to advance human rights and social justice,” she said.

Over the past few years, Smith has poured a considerable amount of his energy and money into philanthropy, specifically dedicated to uplifting low-income Black communities. Most prominently, he concluded his 2019 commencement speech at Morehouse College with a promise to cover the entire class’ student debt—no small feat for a class of some 550 students paying nearly $30,000 a year. But his reputation for generosity is complicated by the ways in which his financial crimes and charitable giving are deeply intertwined.

Problems first arose for Smith in 2013, when his then-wife, Suzanne McFayden filed for what would become a nasty divorce. Smith would later remarry Hope Dworacyzk, a Playboy Playmate of the Year from 2010 and failed Celebrity Apprentice contestant, at a hotel on Italy’s Amalfi coast. With the family finances under strict review in the divorce proceedings, Bloomberg reported, Smith filed for amnesty with the IRS in 2014, using a program for Americans who failed to report offshore assets. But his claim was rejected, as the IRS usually does when they are already investigating the unreported assets.

After Smith lost his chance at amnesty, his charitable giving increased. In 2014, he directed $182 million in assets—the same amount he would later request as a refund on his taxes—from a Belize-based entity into a new charitable foundation called the Fund II Foundation. The organization has been the primary vehicle for Smith’s donations, granting some $250 million in gifts to the Susan G. Komen Foundation, the United Negro College Fund, and the National Park Foundation, among others. Smith has not been shy about using philanthropy as a shield; part of his initial defense to investigators, according to Bloomberg’s first report, hinged on his firm’s pledge to direct proceeds to charity.

455253013

Robert F. Smith and wife Hope Dworaczyk at an awards ceremony in 2013.

Stephen Lovekin/Getty

Chuck Collins, an author and director of the Institute for Policy Studies’ Program on Inequality and the Common Good, said Smith was not alone in this approach. “It’s a well-trod path to use philanthropy as a way to deflect and distract attention away from dodgy ways that wealth has been created,” he said. “The fact that [Smith] is bringing the money back from Belize—the grifter’s paradise, where you park your money where you don’t want the United States government to see it—and donating it to Morehouse or what have you, it’s a virtue-glossing tactic.”

“And it works, because we’re not talking about taxing the wealthy and we’re not talking about fixing the tax system to address systemic problems,” he said.

The circumstances of Smith’s bargain—walking away unscathed from involvement in a multi-year conspiracy to aid an allegedly record-setting tax fraud—were highly unusual, according to Pelletier, who spent several decades in the DOJ’s Tax Division.

“It’s highly unusual because federal prosecutors are prosecutors, they’re not non-prosecutors,” he said. “There’s nothing in the federal rules or criminal code that allows for a non-prosecution agreement of an individual… Over the past 10 or 15 years for some reason—and I’ve never done this as a prosecutor in 27 years—prosecutors and defense attorneys have latched on to what's done with corporations... in the area of individuals.”

Individuals looking to escape jail time may seek a “pre-trial diversion,” which puts them on probation for a certain amount of time. It’s typically granted for minor crimes from first-time offenders. “They’re never longstanding conspiracies and things like that,” Pelletier said. “I’ve given pretrial diversions to 75-year-old grandmothers and grandfathers in Medicare fraud. They’re not likely to do it again, so they’re put on pre-charge probation. But it’s rare.”

Allowing billionaires to skip out on their taxes or pay less through legal tactics like subsidies, loopholes, or rare legal arrangements like NPAs has clear and direct consequences, said Laurie Styron, executive director of CharityWatch. “We lose the collective ability to manage our society's resources equitably,” she explained. “Even if all of these resources were to hypothetically be shifted from tax payments to philanthropic gifts, the public still loses out for a few reasons.”

For one, Styron said, wealthy philanthropists often make their most significant gifts late in life. The taxes they might have paid throughout their careers are substituted with lump-sum gifts targeted at solving problems years later, rather than preventing them along the way. For another, they tend to favor a few charities working on pet causes important to them. “The public loses the power to participate in the decision-making process of how, where, and in what amounts those resources should be distributed,” Stryon said. “These decisions are instead being made by one wealthy person or a handful of people working for that person's foundation.”

To defend himself, Smith convened a coalition of prominent and well-connected attorneys, several of whom had deep ties to then-Attorney General William Barr. Two lawyers from Barr’s old firm, Kirkland & Ellis, are leading his defense: former acting Attorney General Mark Filip and Obama administration alum W. Neil Eggleston. Other members of his team included Charles Rettig, who has since become an IRS commissioner, and two IRS veterans, Fred Goldberg and Mark Matthews.

A Bloomberg investigation found that the road to Smith’s NPA was fraught with insider fighting between tax prosecutors, who rejected the deal, and national security officials, who championed it. The dispute was ultimately settled by Barr himself in July: Smith would not face jail time.

It remains unclear whether Smith will take the witness stand, opening himself up to cross-examination and complicating his plan to put his legal problems to rest. But to Pelletier, the deal alone sets a troubling precedent.

“I don’t care if he’s humiliated or he’s loved, the DOJ can’t have a different standard for poor people and rich people,” Pelletier said. “At the end of the day, every CEO that I have convicted has always told the court that they’ve given a lot of money to charity. You know what my response is? They should. They can. Poor people can’t. So there should be no benefit in the courtroom. Why should it inure to a wealthy person's benefit just because they have enough money to give to charity?”