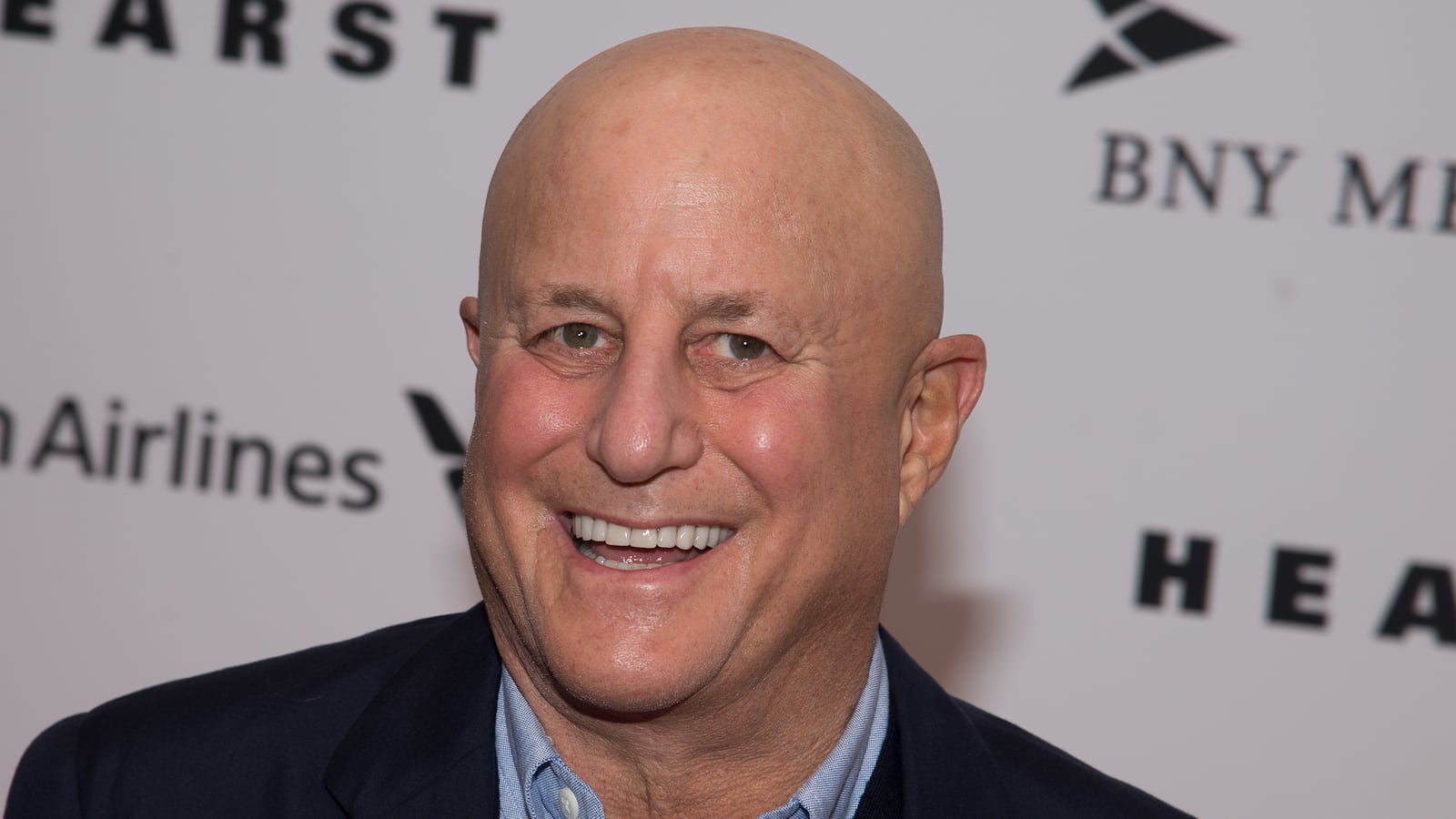

Billionaire Ron Perelman is losing the naming rights to a new residential college at Princeton after he failed to make good on a promised $65 million gift to the university.

He and his daughter Debra, the CEO of beauty company Revlon—in which Perelman’s firm, MacAndrews and Forbes, has an 86 percent stake—had pledged $65 million to the school in 2018 through their foundation. Evidently they never fully followed through.

“The University has terminated the gift agreement with the Perelman Family Foundation, Inc. to name a residential college because the Foundation has not made payments due under that agreement,” a Princeton spokesperson told The Daily Beast. “We remain grateful for the Perelman family’s long-standing support,” he added.

Debra Perelman graduated in 1996 from the Ivy League university, which had an endowment north of $26 billion as of last summer.

The would-be Perelman College, scheduled for completion in 2022, is currently known simply as Residential College 7. According to The Daily Princetonian, which previously reported the news, a new name has not yet been selected. The family’s name remains on Princeton’s institute for Judaic studies.

The reversal is highly unusual for a major gift. “Only a very small number of pledges go unfulfilled,” says Elizabeth Dale, interim director of nonprofit leadership at Seattle University. “Organizations understand that donors' circumstances change, and usually try to work with the donor to find a suitable outcome.”

Perelman had not made any payments toward his $65 million pledge, according to an individual familiar with the situation. He subsequently attempted to negotiate a revised payment schedule, but the university declined, the source said.

Perelman’s foundation pledged $65 million to Princeton, the Ivy League college in New Jersey.

William Thomas Cain/GettyPerelman’s liquidity has been the subject of fervent speculation for over a year. In 2020, he reportedly put his jet and yacht on the market, moved to offload hundreds of millions of dollars of art, and sold stakes in the Humvee Maker AM General and a culinary flavorings company. The selling spree was viewed as a fire sale.

“Like most American businesses, MacAndrews and Forbes and its portfolio businesses were hit hard by the coronavirus pandemic,” Perelman wrote in a statement about the transactions in September 2020. His spokesperson told Bloomberg that the sales were not made under duress and that he remained “committed to his considerable philanthropy.”

Perelman depicted the sell-off as a kind of financial housekeeping, framing it in terms decluttering guru Marie Kondo might appreciate. “I realized that for far too long, I have been holding onto too many things that I don’t use or even want,” he wrote. “I concluded that it’s time for me to clean house, simplify and give others the chance to enjoy some of the beautiful things that I’ve acquired.”

This spring he did some more cleaning, listing his massive Upper East Side townhouse for $60 million. The 10-bedroom property has not yet sold.

Perelman made much of his fortune as an aggressive dealmaker in the 1980s. Family money helped. As a kid, he attended board meetings at his dad’s holding company, and they reportedly did their first deal together during Pereleman’s freshman year at the University of Pennsylvania, buying a brewery for $800,000. They more than doubled their money after selling the business a few years later.

His recent trajectory has been rocky, and some of Perelman’s assets have underperformed. Revlon’s share price, as one example, has fallen by two-thirds over the last five years, though the stock has risen during the past twelve months.

Forbes currently estimates Perelman’s net worth at $3.5 billion, down from $12.5 billion in 2017.

Perelman’s foundation had just over $1 million in assets at the end of 2018, according to the most recently available public filings. That year, its expenses and distributions exceeded revenue by roughly $450,000.

A spokesperson for Perelman declined to comment.