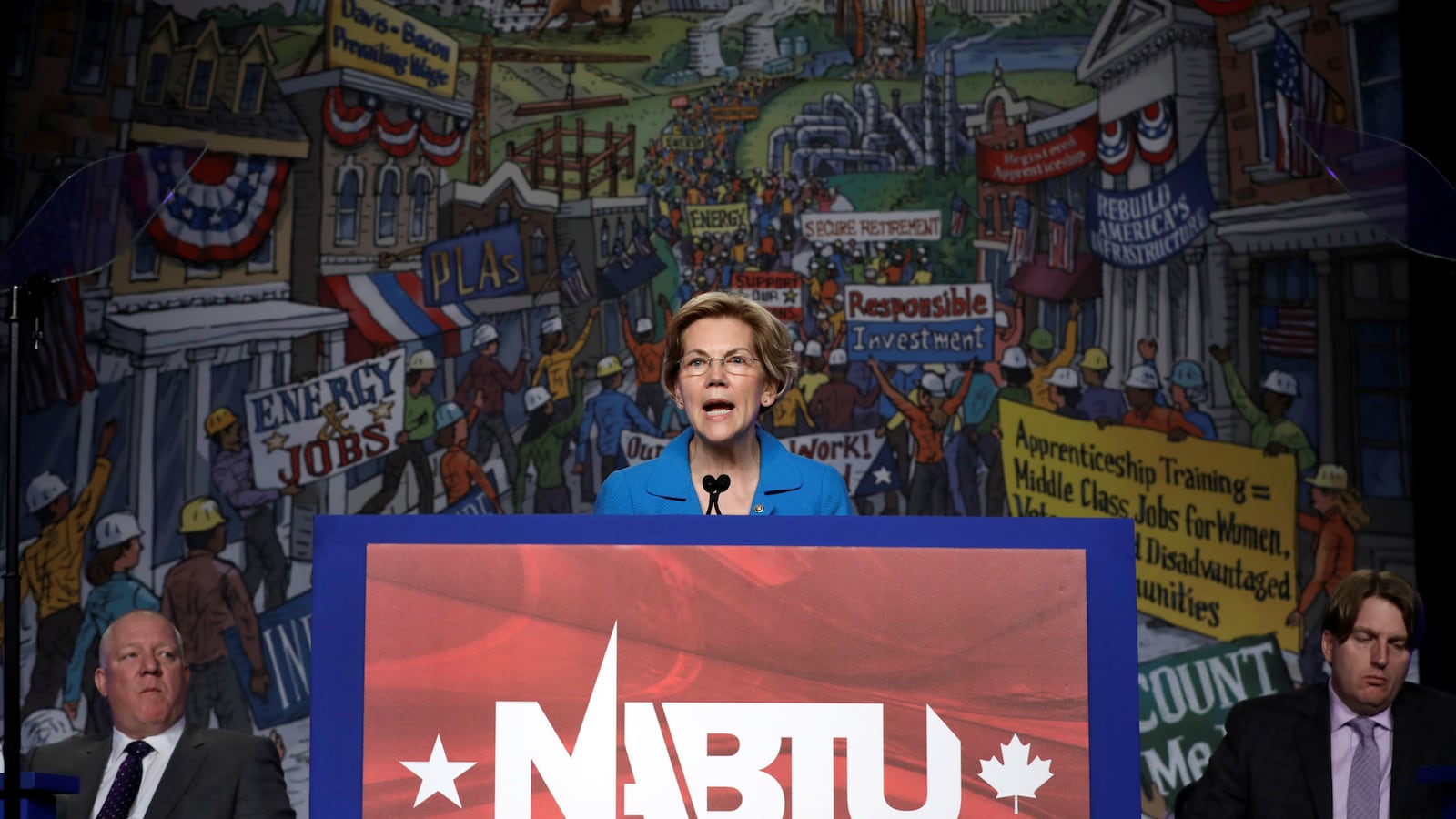

Sen. Elizabeth Warren (D-MA), who has defined her 2020 candidacy with a series of detailed policy proposals, has a plan to impose a new tax on America’s largest companies like Amazon.

“It’s almost Tax Day, and chances are you’ll be paying federal taxes this year. Maybe it’s a lot, maybe it’s a little,” Warren writes in a Medium post unveiling the policy. “Well, guess what? You will be paying more for running the federal government than a bunch of big American corporations that made billions of dollars in profits in the last year.”

The “Real Corporate Profits Tax,” revealed on Thursday morning applies to companies that report more than $100 million in profits. The first $100 million would not be touched, but under the plan, for every dollar of profit above that $100 million, the corporation would pay a 7 percent tax.

Warren estimates that Amazon would pay $698 million as opposed to zero federal corporate income tax and that Occidental Petroleum would pay $280 million.

“It’s a small new tax—but because our richest, biggest corporations are so skilled at minimizing their taxes under our current system, that small new tax will generate big new revenue,” she writes. “According to an estimate from economists Emmanuel Saez and Gabriel Zucman at the University of California-Berkeley, the tax will bring in $1 trillion in revenue over the next ten years—just from the massive profits of the thousand or so richest companies in the country.”

An Amazon spokesperson responded to the proposal by saying: “Amazon pays all the taxes we are required to pay in the U.S. and every country where we operate, including paying $2.6 billion in corporate tax and reporting $3.4 billion in tax expense over the last three years."

Warren explains that the new tax is a better fix than simply raising the corporate tax rate because the “corporate tax code is so littered with loopholes that simply raising the regular corporate tax rate alone is not enough.”

The tax would apply to worldwide profits of all American corporations that report more than $100 million in net income in a given year, foreign companies with “significant” U.S. operations and profits would also be subject to it and Warren promises “robust enforcement” of anti-inversion rules to prevent large companies from reincorporating abroad to avoid tax.

In a letter to Warren from Saez and Zucman, they estimate that close to 1,200 public corporations would be liable for the tax and that “it would raise $1.05 trillion on public companies alone over the ten- year budget window 2019-2028.”

The introduction of this proposal comes the day after Warren’s campaign revealed that she had raised more than $6 million in the first quarter, a number that has been reached even while she has eschewed high-dollar fundraisers.

It provided some evidence that the policy-centric campaign has found an audience with voters, despite the appearance of an operation in need of cash.

Since launching her candidacy, Warren has introduced plans to break up large tech and agriculture monopolies, get to universal child care coverage, a housing initiative to pay for the construction of more homes to eliminate housing shortages and an ultra-millionaire tax among other plans.