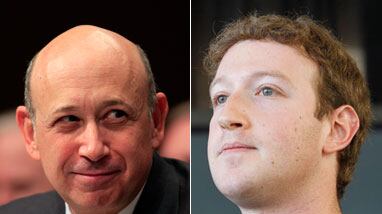

Monday’s eye-popping announcement that Goldman Sachs was investing $450 million in Facebook, now with a $50 billion valuation, has reinvigorated the attention of a Facebook-obsessed world.

I think the deal is being widely misinterpreted. The article that broke the news in The New York Times suggests that the deal may increase pressure on Facebook for an IPO. Its impact could in fact be quite the opposite. That would well suit CEO Mark Zuckerberg.

Why do companies go public? Generally for two reasons: to raise capital to expand operations and to offer liquidity to hardworking employees who have been compensated in part with stock options. Yet both of those goals will be achieved for the time being, with the deal Goldman has arranged for Facebook. Not only is Goldman investing, but Russia’s Digital Sky Technology is also putting in an additional $50 million, on top of the roughly $700 million it has already invested over the past two years, for about 9 percent of Facebook.

In addition, the Times reports that Goldman is arranging for its clients to purchase as much as an additional $1.5 billion in Facebook stock over time. This will be through an investment vehicle that enables sophisticated investors to buy units rather than shares. (They will be required to invest a minimum of $2 million, according to an update in the Times DealBook article.) Some of those sales are likely going to come from employees, who will thus get liquidity.

Facebook is restricted by SEC regulations from having more than 499 shareholders; otherwise, it must begin publishing its financial data as if it were public. At that point most companies just decide to do an IPO. But new investment vehicles like the one Goldman is creating enable Facebook technically to add only one shareholder, though many individuals gain indirect ownership. Recently the SEC has announced it is investigating trading in shares of Facebook and other private technology companies, including LinkedIn, Zynga, Groupon, and Twitter. There appear to be many reasons for the SEC’s concern, but it is sure to take a close look at these new multi-investor vehicles that are treated as a single shareholder.

Goldman has good lawyers, and its funds could very likely withstand this legal test. If it does, it could help Facebook delay its IPO.

Zuckerberg views taking the company public about the same way most of us view getting a root canal: It might sometime be necessary but should be avoided or delayed as long as possible.

With the Goldman and DST money, along with the additional funds being raised by Goldman, Facebook will gain up to $2 billion in additional capital for expansion, hiring, acquisition, or whatever other strategic challenges emerge as the once-upstart increasingly goes toe-to-toe with the biggest Internet and tech companies, like Google and Apple.

In my many conversations with Zuckerberg and his colleagues while reporting my book The Facebook Effect: The Inside Story of the Company That Is Connecting the World, it has been clear that he views taking the company public about the same way most of us view getting a root canal: It might sometime be necessary but should be avoided or delayed as long as possible.

There are good reasons to delay, Zuckerberg believes. He now has complete unilateral personal voting control of the company—he controls three of five board seats—and has been able to achieve its spectacular growth so far by taking the actions he felt were best for the service’s users. He is religious about maintaining that attitude. He fears, rightly, that to have public Wall Street shareholders breathing down his neck after an IPO would almost certainly inhibit his ability to move quickly to counter the innovations of others and to continue growing Facebook.

And he fears for the company if it becomes too easy too soon for employees to get rich rich rich. Facebook’s culture from the beginning has been one of hackers pounding away at the conventions and rigidity of society. How much money do you have to have before you no longer think like a hacker? Zuckerberg would prefer to wait as long as possible to find out.

And his long-term motivation remains far more focused on giving access to Facebook to more people than in making financial gains for himself. He presumes wealth will come eventually, but far more important to him is continuing to expand Facebook’s user base beyond the roughly 600 million people it has today. He looks at a world of 7 billion people and aspires to give as many of them as possible access to this new form of communication he so deeply believes in.

As for Goldman, many say the company did the deal in part to gain favor as the potential underwriter of an eventual IPO. Maybe so, but there are plenty of other ways to profit from a deal like this one. And there’s no question that the Goldman pedigree, even in today’s chastened atmosphere, will reassure many that Facebook’s financial prognosis is inarguably positive. After all, the hard-asses at Goldman took a close look and liked what they saw!

Zuckerberg has had an amazing run so far of soaring growth while facing surprisingly few major obstacles. That won’t remain the case as the company’s scale and global footprint attract more and more attention from competitors, governments, regulators, and advocates for Internet privacy, security, and openness. Money, which Facebook keeps finding ways to acquire without treading the rocky path of a public offering, can make all the difference.

David Kirkpatrick writes about technology for The Daily Beast. A former Fortune reporter, he is the author of The Facebook Effect: The Inside Story of the Company That Is Connecting the World.