The congressional stock trading scandal of 2020 claimed its share of political victims, but one member’s curiously well-timed trades that year flew under the radar—because he appears to have broken the law about disclosing them.

In August 2020, Rep. Mike Garcia (R-CA) sold up to $50,000 in shares of aerospace giant Boeing, weeks before his committee released the damning results of its investigation into deadly crashes involving the company’s 737 Max airliner.

But while other incumbent campaigns were dogged by blockbuster stock scandals that year, the Garcia campaign never had to answer for this trade. That’s because Garcia blew the mandated deadline to report the transaction, only filing the paperwork on Nov. 23—more than two months after the 45-day reporting window had closed. When he finally did disclose the sale, it was two weeks after the 2020 general election votes were cast, and three days after Garcia declared victory. He won by 333 votes.

Legal experts called the delay an “egregious” ethics violation, and they said the circumstances of the stock sale raise concerns about whether Garcia was using his government position to trade on privileged inside information.

Delaney Marsco, senior counsel for ethics at nonpartisan watchdog Campaign Legal Center, called Garcia’s reporting “just a blatant violation” of congressional ethics rules.

“You can’t file transaction reports after that period,” Delaney told The Daily Beast. “When members file late, this is the cost—it deprives voters of the information to assess it themselves.”

Jordan Libowitz, communications director for Citizens for Responsibility and Ethics in Washington, noted that Garcia did not report the trade “at a time when people would have been asking questions about it.”

“There’s a chance he’s in Congress today because he hid this,” he said. “And it raises the question of whether he’s looking out for his constituents or is he just trying to enrich himself.”

As a member of the House Committee on Transportation and Infrastructure, Garcia was privy to a long-running congressional investigation into Boeing’s role in the 737 Max crashes. In September 2020, one month after Garcia’s trade, the committee produced its findings—an unsparing critique of the company, just ahead of regulatory recertification.

But experts said that it’s difficult to know whether Garcia was actually engaging in insider trading. That criminal allegation hangs on a precise technical definition—access to “material non-public information”—which can be notoriously difficult to prove. And Garcia, like many Americans at the time, was aware of just how difficult that could be.

In the months before the Boeing sale, Congress had been rocked by a trading scandal after a number of lawmakers engaged in well-timed transactions just ahead of the COVID pandemic. The audacity of those trades generated national outrage, prompting warnings from federal regulators and sparking widespread calls for a congressional trading ban and criminal investigations.

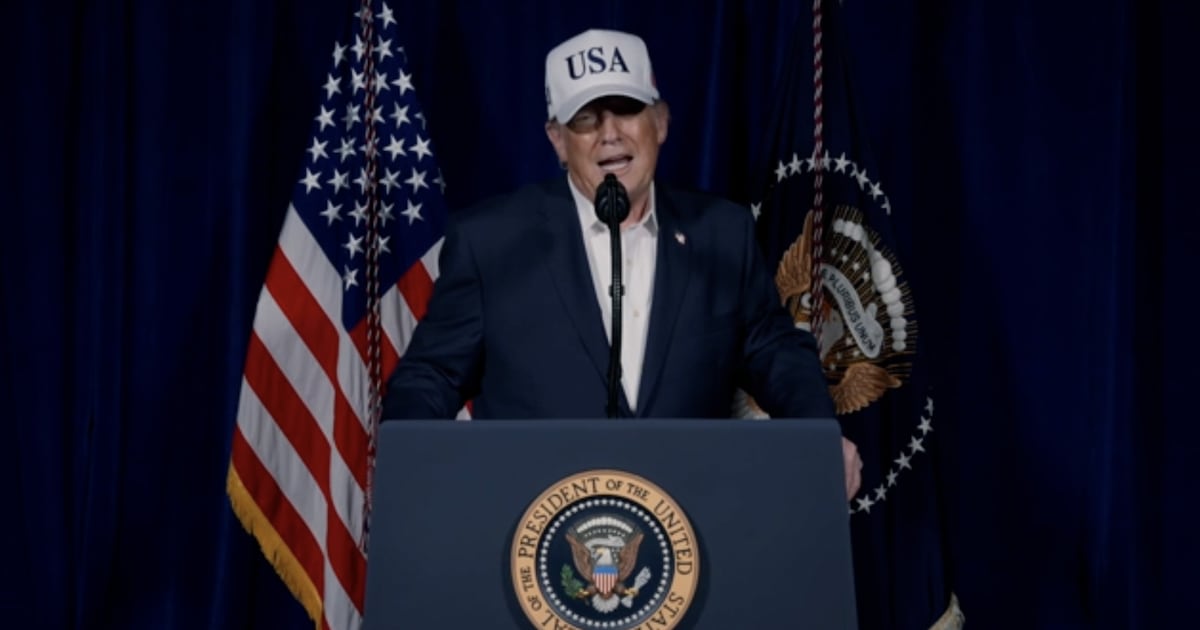

Rep. Mike Garcia (R-CA) speaks after House Republicans met at the Longworth House Office Building

Photo by Matt McClain/The Washington Post via Getty ImagesThe Justice Department opened probes into several senators, including Richard Burr (R-NC), Kelly Loeffler (R-GA), David Perdue (R-GA), Jim Inhofe (R-OK), and Dianne Feinstein (D-CA), who had all carried out trades in proximity to private COVID briefings.

But the DOJ had shuttered most of those probes by the summer, and none of the senators ever faced charges. The Securities and Exchange Commission also closed its parallel investigations without publicized action. (It’s still unclear what became of the SEC’s inquiry into Loeffler; neither she nor her husband, the chair of the New York Stock Exchange, have commented publicly.)

Even against that backdrop, the legal experts agreed that Garcia’s trade merits further investigation.

“This situation appears to be the exact kind of fear that people talk about where members of Congress are benefiting from their position,” Libowitz speculated. “He knew bad news was coming for Boeing and was in a particular place to know and he made a move on that.”

Ben Edwards, a securities expert at the University of Las Vegas Boyd School of Law, said the fact-pattern suggests that Garcia’s decision to sell his Boeing stock “might have been triggered by knowledge that the committee report was about to come out.”

Edwards floated a few possible explanations for Garcia’s delay. It could be evidence of “consciousness of guilt” about potential insider trading, he said, or perhaps a political calculation—appreciating that “this is information that might negatively impact him in a close race, so he decided to withhold it.”

A third option, he said, is that Garcia “had a lot of distractions and didn’t make this a priority,” though Edwards noted that Garcia wasn’t too busy to plan the trade in the first place.

The Boeing trade disclosure was also not Garcia’s only ethics violation. In the same report, Garcia was late to disclose two other transactions—a Sept. 4 purchase of Tesla shares valued between $15,000-$50,000, and an American Airlines buy in the same price range on July 9, disclosed more than three months past the deadline. (The next day, American Airlines pushed back against Boeing, threatening to cancel orders for the 737 Max.)

But the Boeing sale stands apart from Garcia’s trading history. His transaction reports reveal a cluster pattern, trading multiple stocks either on the same day or within a few days of each other. The August Boeing sale, however, was isolated, with no other transactions for a month on either side.

“That eliminates a portfolio-wide sale as an excuse,” Edwards said. “He picked that stock. Why?”

If Garcia believed that the Transportation Committee’s report—an unsparing critique of the company, just ahead of regulatory recertification—would move the needle on Wall Street, he may have been overly optimistic about his own impact. After the report came out, the company’s stock—already sluggish from the COVID pandemic and bad press about the crashes—did not take a hit.

“If I were defending this guy, well yeah, everybody knew that Boeing was getting a lot of heat,” said Edwards. But he pointed out that not all insider trades are winners, saying that even if the deal didn’t break Garcia’s way, “it could still be insider trading—it would just be dumb insider trading.”

Garcia’s office did not respond to The Daily Beast’s detailed questions for this article.

There’s also the fact that Garcia would be hard-pressed to claim that he did not understand the disclosure rules.

At the time, Garcia was a newbie. He had been sworn into Congress in May 2020 after winning a special election in a purple district north of Los Angeles. He replaced Democrat Katie Hill, who had resigned from Congress after admitting to an inappropriate relationship with a 22-year-old staffer, a scandal which itself had been the subject of an ethics investigation.

But while a newly elected member could be forgiven for not knowing the filing requirements, Garcia had already demonstrated his familiarity with the rules. Not only were congressional trades in headlines, Garcia had already filed a stock trading disclosure—called a “Periodic Transaction Report” (PTR)—which he submitted two months before the August Boeing sale.

That PTR, filed on June 17, listed a number of transactions. They also included sales of Boeing—at a curious time.

Garcia reported that he dumped between $15,000 and $50,000 of Boeing shares on June 3, and between $1,000 and $15,000 on June 5. (Congressional disclosures only provide ranges of value, not exact amounts.) A few days after that trade, Boeing announced slumping sales data, featuring a number of cancellations for the 737 Max.

But it’s unclear how Garcia was selling those stocks in the first place. That’s because neither of his annual reports—one as a candidate in 2019 and the other as a member in June 2020—listed any individual stocks at all, which Marsco and Libowitz cited as another apparent violation.

As a result, voters who carried Garcia to victory in the special election in May would have had the impression that Garcia didn’t own any stocks. The public could only have learned that Garcia actually held stakes in Apple, Boeing, Starbucks, Tesla, Uber, UBS, and VanEck Vectors Oil Services from PTRs that Garcia filed later in 2020, which reported sales of those holdings. And Garcia appears to have withheld some of that crucial information until after the election.

Both Marsco and Libowitz said Garcia was exploiting a weak congressional ethics system, backed by an even weaker enforcement mechanism that rarely carries substantial consequences for violators.

“We don’t have a good way of policing insider trading-adjacent trades. ‘Not insider trading’ is such a low standard for Congress—the most powerful people in the world—and we should expect more,” Marsco said, calling it “shameful” that the existing laws and enforcement haven’t curbed violations.

“The only thing the voters can have confidence in is to check these reports—that’s the only thing we have—and when they file late we don’t have that,” she said, noting that the Ethics Committee’s steepest penalty for a missed deadline is a $200 late fee.

Notably, a number of the companies Garcia was trading fell within the scope of his two areas of oversight, on Transportation as well as the Science, Space and Technology Committee. This meant that when Garcia executed the Boeing sale, Marsco said, he certainly had knowledge and information that “most people don’t have access to”—serving on the committee that was preparing to release the damning findings of its 18 month-long Boeing investigation.

Garcia came into Congress steeped in aerospace experience, as a well-connected executive in the defense industry. On the campaign trail, Garcia had trumpeted his career at Raytheon, a prominent defense contractor and major employer in his Southern California district. A former fighter pilot himself, Garcia worked his way up at Raytheon for a decade, eventually rising to vice president of business development, where he managed the F-15EX program, equipping the fighter jet with new radar systems.

As Garcia gassed up his congressional campaign, Raytheon showed itself to be an accommodating employer. The firm granted Garcia a one-year leave of absence—Garcia’s VP gig had commanded a $475,000 salary, his disclosures show—and then paid him his 2019 bonus in March 2020, three months before the special election. (His disclosure shows he earned $175,000 in 2020.)

That same month, Garcia’s Raytheon stock options matured, according to his financial statements, but it’s unclear what happened to them. Garcia has never reported shares of Raytheon among his assets. However, if Garcia did in fact sell the stock, he never disclosed that income, as required, depriving the public of a full accounting of exactly how much money his federal contractor employer paid him just before he joined Congress.

When Garcia decided to run for Congress, in June 2019, Raytheon was at the center of Donald Trump’s budding scandal in Ukraine. The weapons manufacturer’s Javelin anti-tank missiles had long been on Kyiv’s wishlist—Ukrainian President Volodymyr Zelensky had specifically requested Javelins in the infamous July 2019 call that sparked Trump’s first impeachment—but Trump had been holding up that aid since at least June, unless Ukrainian officials helped him smear Joe Biden.

Trump’s special envoy to Ukraine in that matter, Kurt Volker, had been a Raytheon lobbyist. In 2020, Raytheon’s corporate PAC contributed $20,000 to Garcia’s campaign, $15,000 of it while he was still an employee running in the special election.

Libowitz said that Garcia’s apparent failure to disclose his full earnings from Raytheon not only may have been another ethics violation, it also kept important information from voters.

“You’re of course allowed to pay your employee, but this is a company with significant interests in front of the federal government, paying the candidate an unknown amount of money weeks before he joins Congress. This is information that the public should know,” he said. “The cover-up might not necessarily be a crime, but you’re covering up what voters know about you, and what your opponent knows.”

Shortly after he was seated, Garcia received his committee assignments. At the time, the Transportation Committee was knee-deep into an investigation of Boeing, after hardware and software deficiencies caused two 737 Max planes to crash in 2018 and 2019, killing 346 people.

The committee held five public hearings on the 737 Max in 2019. In July 2020, when Garcia was on the panel, the investigation was still active, with leadership questioning Federal Aviation Administration chief Steve Dickson about the agency’s safety culture survey.

Garcia dumped his Boeing stock on Aug. 10, a little over one month before the committee published its findings. When it came, the 238-page report blasted Boeing and the FAA for the crashes, blaming Boeing specifically for a “culture of concealment” that withheld “crucial information” from its customers, the FAA, and even its own pilots. (Boeing eventually reached a $2.5 billion settlement with the Justice Department over conspiracy to defraud the FAA in 2021.)

Had Garcia followed the rules, he would have had to report the Boeing sale by the end of September—the disclosure deadline fell exactly one week after the report was released. Instead, Garcia reaped more money from Boeing. On Sept. 29, Boeing’s corporate PAC made its first contribution to Garcia, giving his campaign $1,000, Federal Election Commission filings show.

The PAC made a second, $2,000 contribution on Election Day.

It’s impossible to say whether the Boeing sale, had Garcia reported it on time, would have generated enough political fallout to tank his campaign. But the race was so close that even a small impact could have changed the outcome.

Garcia’s initial special election victory in May 2020—flipping a Democratic seat in Los Angeles, with Donald Trump’s endorsement—was seen as a “surprising upset.” Heading into the general election, forecasters at the Cook Political Report and FiveThirtyEight both labeled the race a “toss-up,” with FiveThirtyEight calling Garcia “the most at-risk Republican incumbent” in the 2020 midterms. He eked out victory by just a few hundred votes.

That paper-thin margin has made Garcia one of the top target’s of the Democratic Party’s campaign arm in 2024. And while he is no longer on the Transportation Committee, Garcia is still deeply enmeshed in the defense lobbying complex, sitting on the defense subpanels of the Intelligence Committee and powerful Appropriations Committee, and he has held onto his position on the Science, Space, and Technology Committee. Garcia has taken an active role in defense funding, including Boeing packages; in August he provided a quote for a Boeing press release touting a NASA collaboration.

Garcia often cites his Raytheon experience as preparing him for his congressional role, specifically as it relates to procurement. This February, he told Roll Call that his career provided insight into “the challenges” facing both the Pentagon and private companies.

In that interview, Garcia said he had developed “a good understanding of where all the choke points are” in funding disputes—“where all the barriers to going faster lie, where all the inefficiencies lie, and where the entire complex sort of fails in many cases.”

“Trust me, as a former contractor, I’m not trying to protect those guys,” he said. “There are a lot of areas they can do better, but they do invest in these programs, and they don’t recognize the highest profit margins.”