Today we inaugurate a new feature that will appear from time to time on this blog, a Q & A with an interesting public person--an author of a new book, a newsmaker or expert of some sort, someone who's saying something that I want to do my part to promote.

We begin in pretty classy fashion, with the political philosopher Michael Sandel, one of the leading (and one of my favorite) political thinkers of our time. You should, I hope, be roughly familiar with Sandel's biography. His most famous book is probably Liberalism and the Limits of Justice from 1982, in which he critiqued John Rawls's powerfully influential "veil of ignorance" argument. As I mentioned just last week, I come down largely on Sandel's side of this argument, and I think and have written that his vision of liberalism imbued with a civic-republican spirit is really the way we need to go.

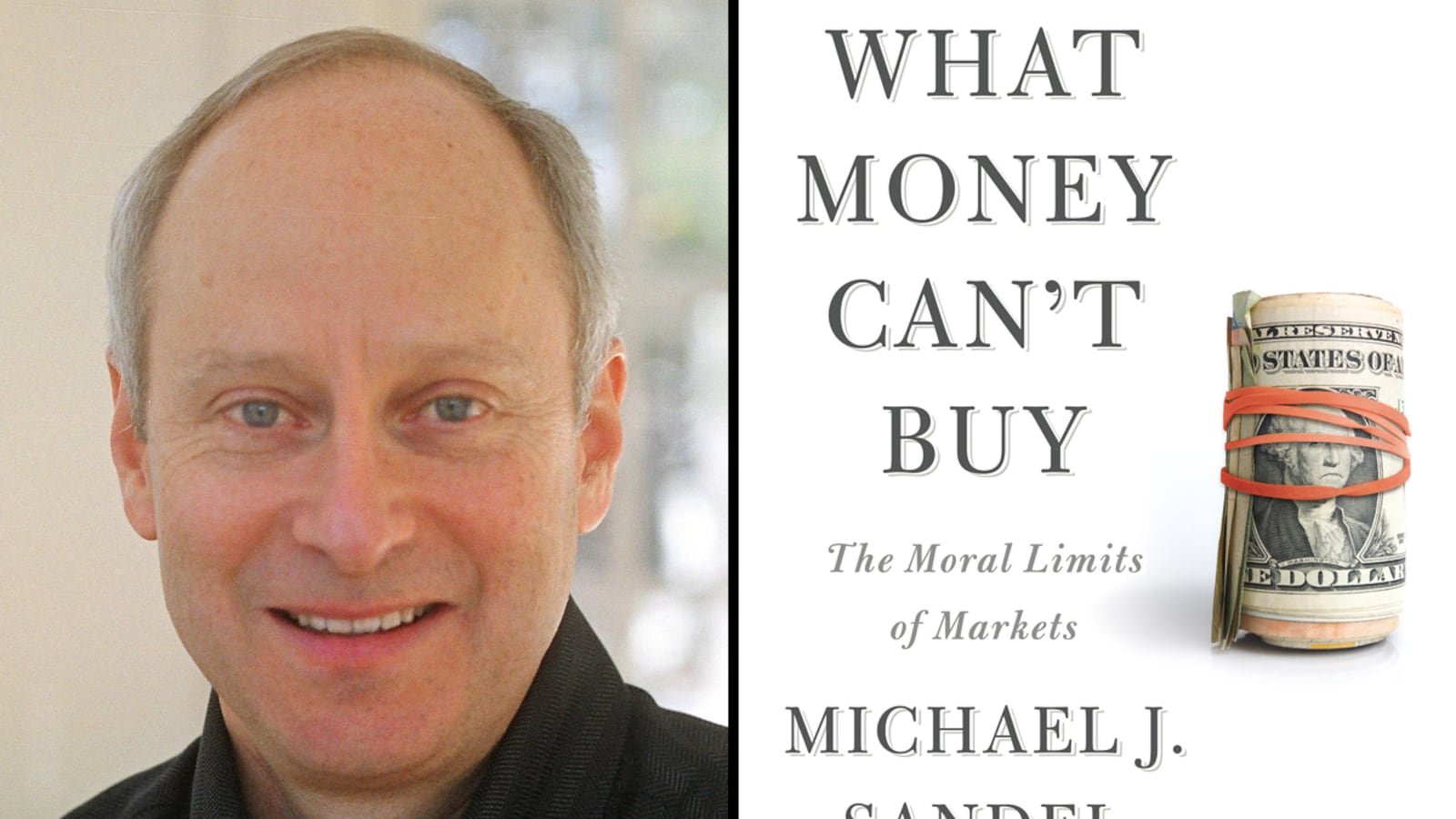

Sandel's new book is What Money Can't Buy: The Moral Limits of Markets, and I recommend it highly. It's a powerful indictment of the market society we've become, where virtually everything has a price. We need desperately, he writes, "to rethink the role and reach of markets in our social practices, human relationships, and everyday lives."

Our short Q & A follows the jump. And please, buy the book here (it's available traditionally and electronically).

What’s the book’s thesis in a nutshell?

Today, there are very few things that money can’t buy. Markets, and market values, have reached into spheres of life previously governed by non-market values. Over the past three decades, we have drifted from having a market economy to becoming a market society. The difference is this: a market economy is a tool--a valuable tool--for organizing productive activity. But a market society is a place where almost everything is up for sale. We need to ask whether this is the kind of society we want.

What do you hope its publication accomplishes?

I hope the book will encourage a public debate about where markets serve the public good, and where they don’t belong. The financial crisis of 2008 arose after three decades of “market triumphalism”--a widespread faith that markets, and market mechanisms, are the primary instruments for achieving the public good. Many assumed that the financial crisis would prompt a reconsideration of this faith, that we would step back and ask big questions about the moral limits of markets. But this hasn’t happened. We’ve had some discussion of regulatory reform. But we have not had a serious public debate about the role that markets, and market reasoning, should play in our society and civic life.

How did this happen; how did everything become a commodity?

The market triumphalist faith, and the tendency to turn everything into a commodity, has been gathering force since the late 1970s and early 1980s. The arrival of Margaret Thatcher and Ronald Reagan signaled a growing faith in markets. After they passed from the political scene, their successors—parties and political leaders of the center-left—moderated but consolidated this faith. The underlying assumption—that market mechanisms are the primary instruments for achieving the public good—was never really challenged. The end of the Cold War reinforced this tendency. Capitalism seemed the only system left standing; many assumed that there is only one version of capitalism, and that it applies universally, in all places and circumstances. This was a misreading of the end of the Cold War. But it reinforced the notion that markets should govern the whole of life.

Who else is responsible?

Responsibility is shared across the political spectrum. Neither Democrats nor Republicans have raised serious questions about the moral limits of markets and market reasoning. In some ways, the tendency to marketize every aspect of life—from personal relations to procreation, health, education, national security, criminal justice, the environment, civic life, campaigns and elections—also reflects a change in the way economists understand their subject. Today, many economists maintain that economics is not only the study of such things as inflation and unemployment, productivity and economic growth, savings and investment, interest rates and foreign trade—but a science of choice that can explain all human behavior.

The book has many examples of a price being put on things that didn’t have a price in the past. What are the most striking couple of examples to you, and why; what categorical point or point of principle do they demonstrate?

Here is one: In Washington, DC, a new cottage industry has arisen: line-standing companies. When lobbyists want to make sure of getting a seat in a Congressional committee hearing, they hire these companies to pay people to wait in line for them. The line-standing companies, in turn, hire homeless people and others to stand in line, sometimes overnight. The lobbyists show up just before the hearing begins, take their place in the queue, and file into the hearing room. The line-standing companies will also get you a seat to hear an oral argument at the U.S. Supreme Court.

Although the transaction is voluntary, and consistent with economic efficiency (both parties to the deal are better off), two objections can be raised against it: It makes access to representative government depend on the ability to pay, and it demeans Congress (and the Supreme Court) by auctioning seats to the highest bidder. The first objection is about inequality; the second is about degradation—in this case, valuing representative government in the wrong way. These two kinds of objections arise whenever we worry about putting this or that good up for sale.

Leave my readers with a hopeful thought.

The book argues that we need a morally robust debate about the role of money and markets in our society. Such a debate will not be easy. It will require us to debate, in public, the moral meaning of goods and social practices, ranging from procreation and child-rearing to education, health, the environment, military service. Since we often disagree about how to value such goods, we often shrink from debating these questions in public. But this has left our public discourse empty and unsatisfying. A morally engaged public debate about the role of markets will not only enable us to keep markets in their place; it will also help elevate and invigorate our public life.

MT here: Again, buy the book.