Always read the footnotes.

That’s where former federal judge Barbara Jones, the court-appointed special monitor in Donald Trump’s New York business fraud case, just planted a financial bombshell that legal experts say suggests Trump lied knowingly and repeatedly on his federal financial disclosures about a major loan that never existed—and may have evaded taxes on $48 million in income.

The detail came in a letter Jones filed on Friday to update New York Judge Arthur F. Engoron, first reported by The Messenger, on her efforts to get a full and clear accounting of the Trump Organization’s assets. The letter claims, yet again, that Trump and his company have filed statements containing inconsistencies and errors, but have been “cooperative” in the review process.

But Jones tucked a major revelation into footnote 6, writing that a massive chunk of debt Trump has claimed to owe one of his own companies for years apparently does not exist, and never did.

“When I inquired about this loan, I was informed that there are no loan agreements that memorialize the loan, but that it was a loan that was believed to be between Donald J. Trump, individually, and Chicago Unit Acquisition for $48 million,” Jones wrote, referencing the name of Trump’s LLC that held his debt.

Trump International Hotel & Tower Chicago, 401 N. Wabash Ave., Oct. 4, 2022.

Terrence Antonio James/Chicago Tribune/Tribune News Service via Getty Images“However, in recent discussions with the Trump Organization, it indicated that it has determined that this loan never existed—and thus that it would be removed from any upcoming forms submitted to the Office of Government Ethics (OGE) and would also be removed from subsequent versions of [corporate financial statements],” Jones wrote.

If true, that would essentially be an admission from the Trump Organization that all the financial disclosures Trump has filed with the federal government listed an entirely fictional debt worth tens of millions of dollars, which Trump claimed he personally owed to one of his own companies.

Asked to comment on Jones’ letter, Alan Garten, chief legal counsel for the Trump Organization, told The Daily Beast that her claim—that the company confessed to the loan never existing—was inaccurate and the loan did in fact exist.

“That’s one of many inaccuracies contained in the monitor’s letter, which we will be addressing with the court,” Garten said in a phone interview.

Moreover—in contradiction to the ex-president’s own statements about the mystery loan—Garten repeatedly insisted that the LLC actually owed the money to Trump. Asked to confirm the loan, Garten replied, “Yes, the loan existed,” specifying that it was “an internal loan” where Trump “lent money to the entity that he owns.”

Yet all of Trump’s financial disclosures, including his most recent amended version approved by the OGE last October, clearly state that it was Trump who owed Chicago Unit Acquisition LLC. He’s consistently listed his debt as more than $50 million, in the form of what’s known as “springing loan”—a loan with unfavorable terms to the borrower.

In fact, Trump confirmed this arrangement himself. In a 2016 interview with The New York Times, Trump claimed that he bought back this loan from “a group of banks several years ago.” Trump said that he’d chosen to keep the debt on his books, the Times reported, claiming that he pays interest on it to himself—despite the LLC’s “practically worthless” valuation.

“We don’t assess any value to it because we don’t care,” Trump said in the interview. “I have the mortgage. That is all there is. Very simple. I am the bank.”

The Daily Beast sent Jones an email asking if she would like to respond to Garten’s claims, but she did not immediately reply.

Jordan Libowitz, communications director at Citizens for Responsibility and Ethics in Washington, said that, assuming the court filing is accurate, Trump would appear to have intentionally and repeatedly broken the law.

“When you fill out your personal financial disclosures, you attest under penalty of the law that the information is true,” Libowitz told The Daily Beast. “Trump had to know that his Chicago business never gave him a loan of more than $50 million, as he claimed, repeatedly.”

Kedric Payne, general counsel for ethics at watchdog Campaign Legal Center, agreed, telling The Daily Beast that, given the personal nature of the loan and the repeated filings, authorities likely wouldn’t just write this off as an unintentional oversight.

“Financial disclosure laws require accurate reporting of debt. It seems clear that Trump inaccurately reported this loan, and it’s unlikely that he will get the benefit of the doubt that it was a simple mistake,” Payne said. “It defeats the purpose of the disclosure laws if the public does not have complete and accurate financial information for their elected officials.”

Trump had many opportunities to correct this claim, including over the last year while Jones had been inquiring about this loan specifically. As of his latest amended disclosure, filed in October, he never did.

“While the reasons behind claiming this fake loan are still unknown, at the very least he misled the government for years about his finances,” Libowitz said. “It appears that Trump knowingly and intentionally broke the law. The only question is how many laws.”

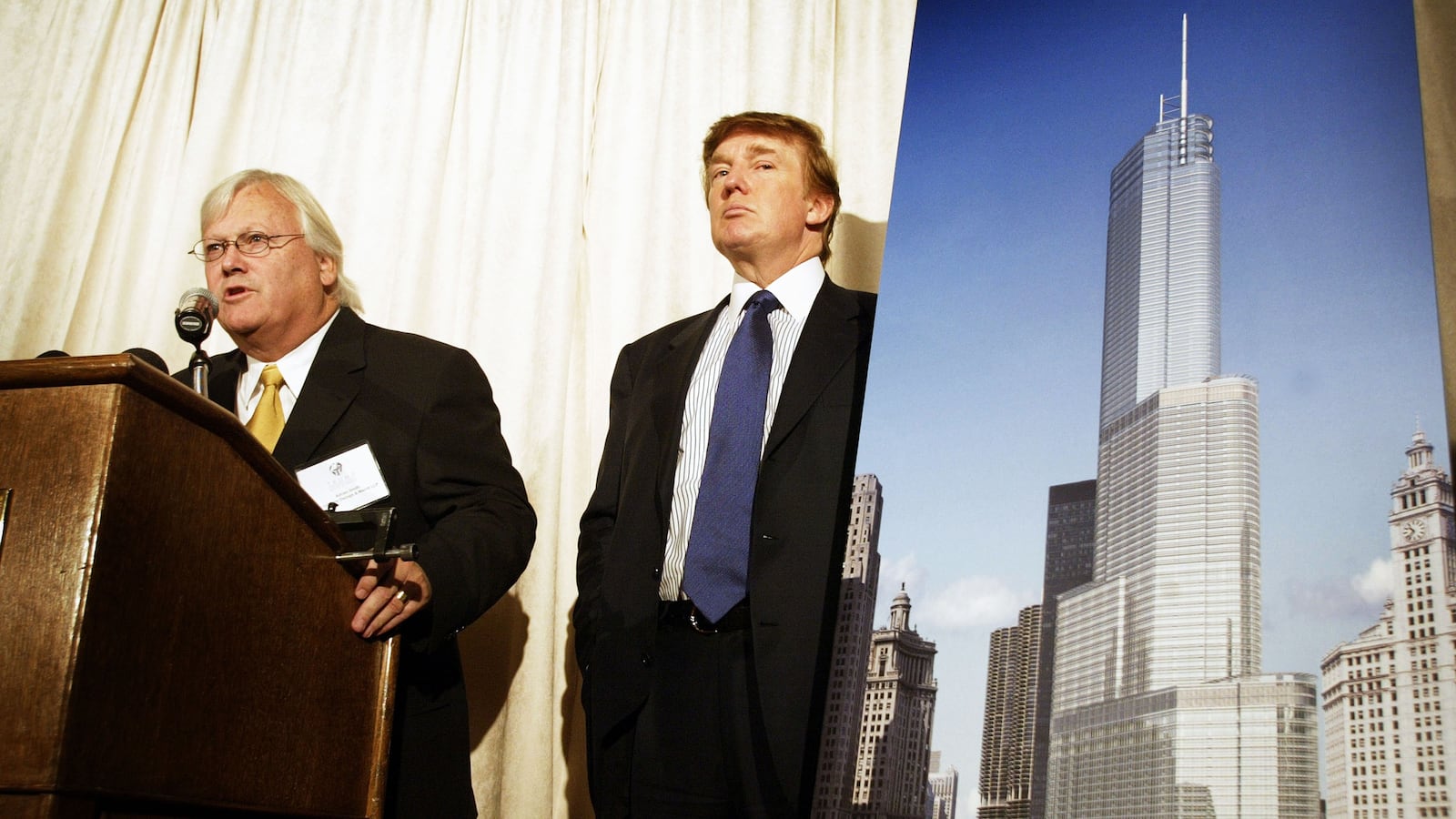

Donald Trump and his children Eric, Ivanka, and Donald Jr. at a press conference at the Trump International Hotel and Tower in Chicago on Sept. 24, 2008.

Amanda Rivkin/AFP via Getty ImagesThe OGE warns filers that the Justice Department may bring civil or criminal action against any individual who “knowingly and willfully” falsifies or omits any required information on their disclosures. The Trump Organization’s promise to remove the debt from upcoming OGE filings would indicate that all of Trump’s prior filings—dating to the 2015 fiscal year—contained a staggering inaccuracy.

This mysterious chunk of debt has long been a white whale for Trumpworld financial reporters. It has always seemed odd that Trump owed $50 million or more to a company that he fully owns. Odder still, Trump also reports that this company—Chicago Unit Acquisition LLC—doesn’t make money or have any value at all. It would seem logical, reports point out, that a company with a $50 million credit on its books would have a value of at least that amount. This LLC, however, is reported as having no value.

“There should be an offsetting entry somewhere,” Harvard real estate professor Richard Peiser told Forbes in 2020. “I can’t explain that.”

The Daily Beast consulted multiple tax experts to analyze the new revelation, and the general opinion was that Trump may have created a fake loan to avoid income taxes.

That’s because Jones’ letter appears to match a 2019 analysis from Mother Jones’ Russ Choma—which concluded that Trump may have committed tax fraud by fabricating the loan, making it look like his LLC still owned a debt that had in reality been fully forgiven. That would have allowed Trump to duck taxes on $48 million of canceled debt, a rate which could run up to 39 percent.

Jones’ letter, citing the Trump Organization itself, backs up what would be the centerpiece to that theory: That the loan does not exist.

As Mother Jones and other outlets have reported, the loan supposedly stemmed from a complex emergency financial restructuring that Trump scrambled to throw together amid the 2008 real estate crash, when he was loaded down with $800 million in debt from his faltering Chicago Hotel and Tower and his empire faced a very real risk of collapse.

(While many real estate investors and developers ate crow in the 2008 crash, Trump managed to dodge the worst of it—thanks, in part, to Russian oligarch and fertilizer king Dmitry Rybolovlev, who bought a Palm Beach mansion from Trump for $95 million that July. Trump had paid $41 million for the place four years earlier, and netted $54 million in the deal.)

During his maneuvering, Trump convinced one of the entities funding that project—a financial firm called Fortress—to cut him a deal on the slightly less than $100 million they’d loaned him for the project. As prior reports show, Fortress eventually agreed to cancel half that original amount in 2012, forgiving Trump a total of $48 million.

Normally, tax experts told The Daily Beast, that would qualify as $48 million in reportable, taxable income. But instead, these experts said—as experts previously told Mother Jones—it now looks like Trump may have made it look like the debt wasn’t canceled, but that he instead bought it from Fortress. His 2016 statements to The New York Times—that he had in fact bought this specific loan back from a group of banks—further supports this theory.

Martin Lobel, a prominent Washington, D.C., tax lawyer who also spoke to Mother Jones for the 2019 report, said that the new information appears to confirm the tax fraud hypothesis.

“It would appear, assuming Judge Jones’ letter is accurate, that this amounts to tax evasion,” Lobel told The Daily Beast.

Donald Trump poses across the street from the site of the Trump International Hotel and Tower Chicago after a news conference in Chicago, May 10, 2006.

Getty“This explains why the Republicans have been so intent on cutting the IRS’s budget,” he said, “because they don’t want it to be able to audit transactions like this.”

Martin Sheil, former special criminal investigative agent for the Internal Revenue Service, also told The Daily Beast that the letter suggests a tax dodge.

“I would characterize the whole matter as ‘shady’ and the so-called ‘springing loan’ as ‘funky,’” Sheil said. “The fact that Jones, as a court appointed monitor, officially references the transaction as a $48 million loan that never existed, should raise eyebrows.”

“That there exists no loan agreements or other indicia of an actual loan certainly suggests the existence of an alternate possible characterization of the large money transfer as income,” Sheil noted, adding that even if the original transfer was intended as a loan, “forgiveness of the ‘debt’ would trigger a taxable event.”

To pull this off, Trump would have fabricated the “loan” that he claimed to owe Chicago Unit Acquisition LLC. This would make it appear on paper as if Trump had used the LLC to buy his debt from Fortress. Now—as Mother Jones reported, and as tax experts told The Daily Beast—instead of owing Fortress $48 million, Trump was saying that the debt simply got transferred and he now owed his LLC $48 million.

In reality, however, according to the reports, Fortress had canceled that debt. It did not exist.

Sometimes borrowers will perform a maneuver like this, “parking” their debt in a related entity and then paying it down later, tax experts told The Daily Beast. It isn’t all that uncommon with major borrowers, the experts said, but the issue becomes potentially criminal if you park your debt with no intention of ever paying it off.

But it appears even worse in Trump’s case: He apparently never bought the debt to begin with. If so, the experts said, Trump would have essentially pocketed the $48 million that had been canceled, and then simply invented a new loan to cover it up or misdirect financial scrutiny.

Sounds far-fetched. But that’s exactly why it’s so notable that Barbara Jones’ footnote happens to fit this bizarre, seemingly outlandish scenario.

Also note that both Joneses—Barbara and Mother—cite the actual loan amount as $48 million, not the $50 million or higher that Trump had stated on his disclosures. Mother Jones got that number in 2019 from a source with direct knowledge. Barbara Jones got it from the Trump Organization itself.

Trump continually listed this massive amount of mystery debt year after year on his income taxes, as well as on the sworn financial statements he was required to file annually as president, so that his constituents could have an understanding of his finances. It’s unclear why the debt is listed in the “more than $50 million” category on those statements when, according to the Jones letter, it was really $48 million, which would have fallen in the “$25 million-$50 million” range.

It’s also entirely unclear why it took so long for Trump and his team to “figure out” that this colossal debt he thought he’d owed for years didn’t actually exist, and never had.

But another unusual thing happened last year: Trump paid his taxes. A lot of them—$29 million, in fact, according to a previous status letter from Barbara Jones. If Trump were hit with the 39 percent capital gains tax on that $48 million, that would come out to a little more than $18 million.

It’s unclear from the letters exactly why Trump started paying taxes this year. But in that previous letter, filed at the end of November, Jones also alluded to the mysterious Chicago loan.

“I have also reviewed information regarding the existence of an intercompany loan related to the [Chicago] property. Defendants are continuing to investigate this issue and any reporting requirements or documentation that may be required,” Jones wrote.

Sheil, who also bemoaned the GOP’s “defund the IRS” movement, said that criminal action against Trump was far from guaranteed.

“When it comes to financial fraud, the Trumpster always points his fingers at someone else with regard to responsibility,” Sheil said, noting that Trump has previously blamed his accounting firm Mazars for missteps. “He will blame his accountants or his lawyers or anyone but himself with regard to financial irregularities.”

Sheil said that an investigation would have to establish intent, and that might mean getting witnesses to cooperate.

“Documents don’t lie but people do,” he said.