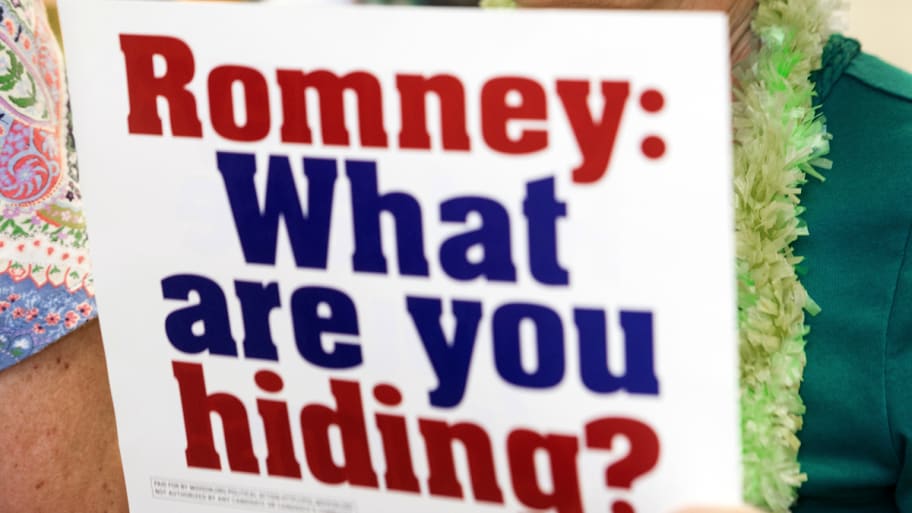

Paul J. Richards, AFP / Getty Images

The people asked for details on Romney’s taxes, and he gave them answers ... sort of. When Mitt’s camp released his 2011 tax returns several weeks ago, we learned the candidate paid $1.9 million in taxes in 2011 on $13.7 million in mostly investment income, with an effective tax rate of 14.1 percent. But we still don’t know how much he made or paid in taxes before 2010—an “important distinction,” according to Daniel Shaviro, a tax law professor at New York University. When the economy collapsed in 2008 and investors lost all their dough, Romney could have used those losses to reduce his adjusted gross income in 2009, Shaviro told ProPublica. We also don’t know why his IRA is worth a whopping $101.6 million or how many of his IRA investments are based offshore, aside from one account in the Cayman islands that he valued somewhere between $5 million and $25 million.