It has been a summer of scrutiny for the ultra-rich—and now the billionaires are fighting amongst themselves.

The culprit: a so-called “Billionaire Income Tax” that Democrats in Congress are reportedly mulling to help finance Biden’s agenda. The proposal would only target several hundred of the wealthiest Americans by taxing the rising values of certain assets, like stocks, even before they are sold.

“I doubt it’s legal, and it’s stupid,” the billionaire investor Leon Cooperman complained to The Daily Beast. “What made America great was the people who started with nothing like me making a lot of money and giving it back. A relentless attack on wealthy people makes no sense.”

Another billionaire, the grocery chain magnate John Catsimatidis, shared his comrade’s ire. “These people are just nuts. They're trying to change our way of life, and it’s not going to happen,” he said. “If they don't like the United States the way it is, I'm buying them a one-way ticket to Venezuela.”

Other billionaires were less aggrieved, including the real estate developer John Sobrato and restaurant entrepreneur Jimmy John Liatuaud, founder of his namesake sandwich chain.

“I know a lot of people that… have accumulated massive, massive wealth, and then they take loans against that to live on. And that's tax free. And I think it’s bullshit,” Liautaud said.

“[With] Warren Buffett or Bill Gates, every year this shit’s compounding,” he added, referring to stock investments that are typically not taxed until they are sold. “I paid more tax than Warren Buffett. And I'm worth 2 billion fucking dollars.”

The debate follows a series of explosive media reports on the low tax rates enjoyed by the ultra-rich.

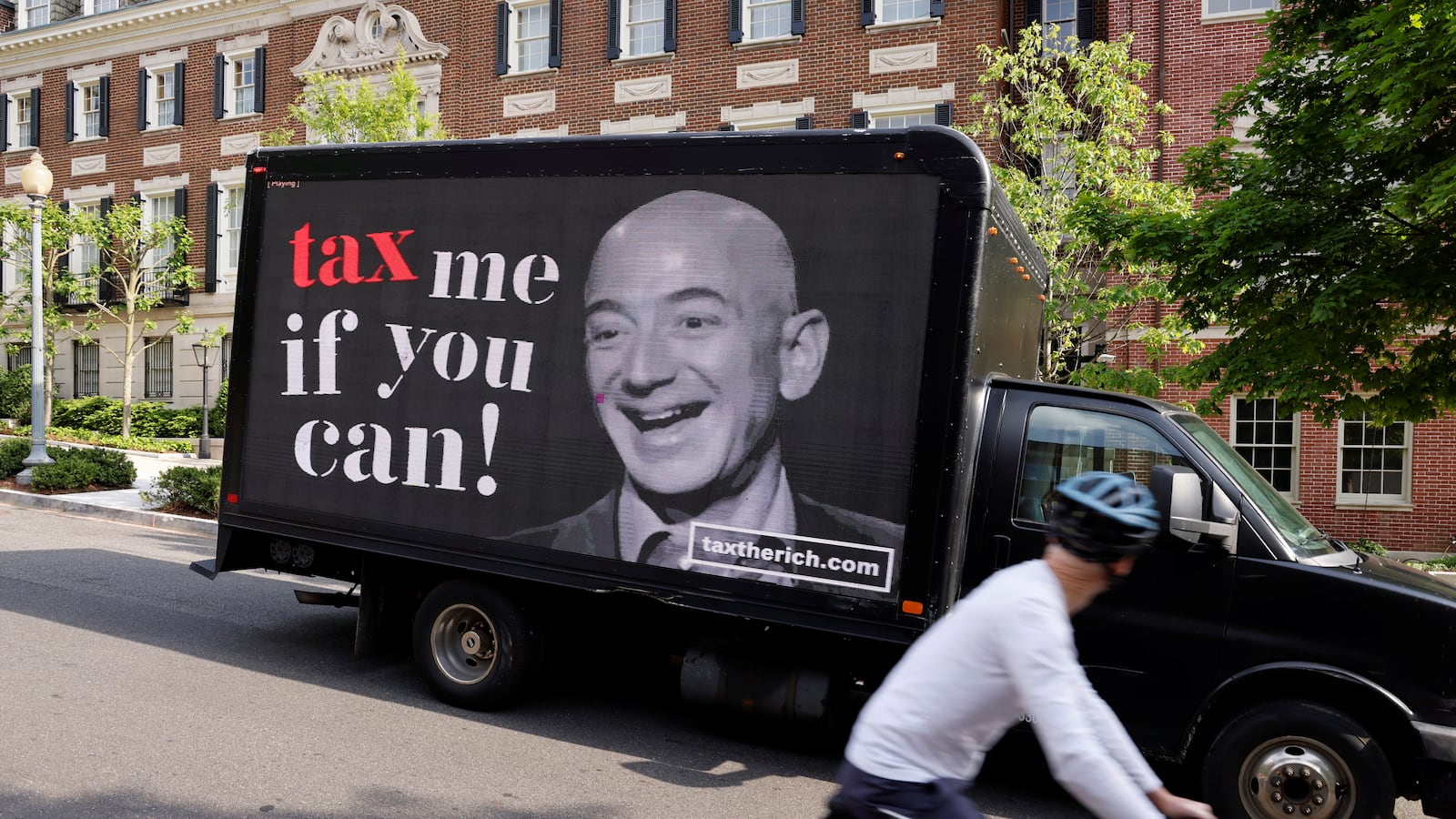

In June, ProPublica published an investigation which found that a number of billionaires, including Jeff Bezos, Elon Musk, Carl Icahn, and Goerge Soros, paid no federal income taxes in certain years.

The report also used an invented term, “true tax rate,” to depict the percentage of a billionaire’s wealth they had paid in taxes during the four years ending in 2018. Warren Buffett’s “true” rate, for instance, stood at just 0.1 percent, while Musk’s stood at a comparatively high 3.27 percent.

Any person who holds appreciating assets—billionaire or not— would likely have a lower “true” tax rate than the percentage of income they pay in federal and state taxes. But the numbers were nonetheless striking.

In September, The White House added to the uproar with a report asserting that the wealthiest 400 billionaires in the U.S. paid an average of 8.2 percent of their income in federal taxes between 2010 and 2018, though it also lumped in assets that aren’t traditionally taxable.

“Biden is fanning the flames of resentment,” fumed Cooperman, who argued that the administration’s methodology was distortive.

He also assailed the viability of a “Billionaire Income Tax,” which could theoretically force wealthy stockholders to sell shares in order to meet tax obligations. “Is Bill Gates gonna have to sell his Microsoft Holdings, is Jeff Bezos gonna have to sell his Amazon holdings?” Cooperman said.

He also pointed out the challenge of taxing individuals on the value of a high-priced stock, since its value could later drop. The 78-year-old investor said he favors other revenue generating measures, like eliminating the “carried-interest” tax loophole for private equity tycoons, and regulating 1031 exchanges, which allow investors to roll over gains indefinitely.

Cooperman said that he pays an effective tax rate of roughly 34 percent and would support a minimum tax on the ultra-rich as high as 50 percent.

It’s unclear if Democrats will be able to find the votes to move forward with a “Billionaire Income Tax.”.

Catsimatidis is skeptical. “Everybody knows it’s never going to happen. I think they’re just trying to make everybody feel like, ‘We're going to go after those people.’”

But it’s not just left-wing activists who are assailing the 0.1 percent. Liautaud took aim at billionaires with publicly traded companies, who are able to take out cheap loans backed by their stock, thereby preventing them from ever needing to sell a significant portion of their shares.

He offered the example of a hypothetical billionaire who wanted to buy a $1 billion yacht. One option would be to sell roughly $1.5 billion in shares, which would incur a massive tax obligation. The other option, Liautaud said, is “he takes a loan against [his shares], buys his yacht, pays no tax whatsoever, and spends one or 2 percent on interest... instead of paying a $400 or $500 million tax bill.”

Liautaud, who donated to Donald Trump’s reelection campaign, outlined what he described as a middle-of-the-road approach. “I don't want to disincentivize the guys that are creating this wealth for you and I,” he said. “But we shouldn't wait 70 years for Warren Buffett to pay.”