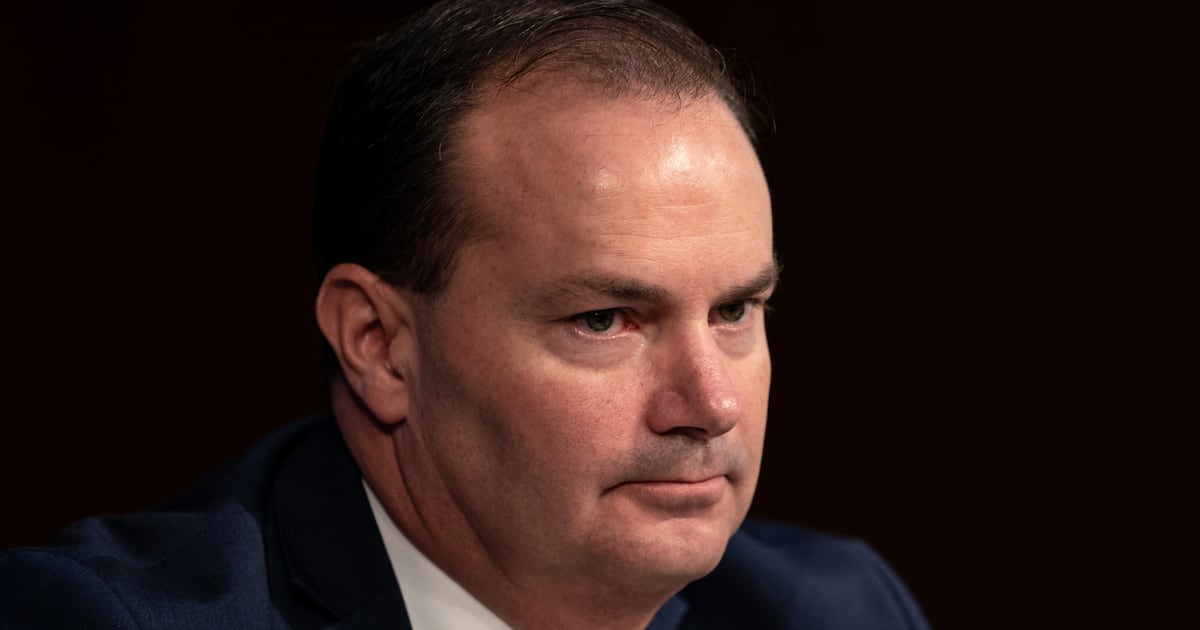

Rep. Chris Collins (R-NY) remains invested in the company at the center of a scandal that led to his indictment, and recently introduced legislation that could help that company.

Collins was charged last week for allegedly giving nonpublic information on Innate Immunotherapeutics, where he was a board member while also serving in Congress, to his son. Collins learned Innate’s lone drug failed its clinical trial and allegedly told his son before the company announced the devastating news. Collins’s son and other family members then dumped Innate stock before it crashed when the news was made public. Collins, his son, and a third defendant have pleaded not guilty. Collins said he would not seek re-election in November.

Collins still holds about 2.6 million shares of Innate, worth some $780,000 as of Monday. As recently as last month, Collins continued to introduce legislation that could help Innate, as he has done for the past several years.

In July, Collins introduced a proposed bill that would remove infusion drugs (administered by needle) from a federal program called 340B that requires the pharmaceutical industry to sell drugs at steep discounts to hospitals serving poor patients. Many infusion drugs are used to treat deadly diseases like cancer and HIV and can costs tens or hundreds of thousands of dollars per year.

Innate said in April it is developing a cancer treatment that could become an infusion drug, according to the company’s U.S. patent application for the treatment.

If the treatment were an infusion drug and if Collins’ bill became law, it would mean millions in additional profits for Innate and other pharmaceutical companies. In 2016, the pharmaceutical industry lost out on $16 million in profits thanks to 340B. Compared to the $450 billion in total 2016 U.S. drug sales, 340B cost the pharmaceutical industry 0.000035% of its revenue that year.

At an Energy and Commerce Committee hearing on July 11, Collins lamented the pharmaceutical industry’s increasing losses thanks to 340B purchases, a program he says is improperly expanding.

“Everyone would like more money,” Collins said of hospitals using savings from 340B purchases to pad their bottom lines. “But to take it off the backs of pharmaceutical companies inappropriately could lead to higher [drug] prices overall.”

Collins’s office did not immediately respond to a request for comment.

Innate’s previous drug was also an infusion drug that would likely have been covered under 340B’s discounts had it not failed its second clinical trial. That failure is what federal prosecutors say led Collins, then an Innate board member, to call his son from the White House lawn, telling him the bad news about the results of the clinical trial before Innate announced it publicly.

The drug’s failure meant about $17 million in lost stock value for Collins, as well as speculation in the pharmaceutical industry that the company was largely finished.

But in April, Innate announced it had acquired another Australian pharmaceutical company, Amplia Therapeutics. Employees of both companies are hopeful that the combination of Innate’s previous work on its failed drug and Amplia’s intellectual property will turn into groundbreaking treatments for a variety of cancers. Innate plans to seek “investigational new drug” status from the Food and Drug Administration, a process Collins has made easier thanks to legislative language he wrote in a 2016 law.

While Collins left Innate’s board of directors in May, he appears to still hold some stock in the company. In March, Collins had 2.8 million shares in Innate, according to its 2018 annual report. On June 20, Collins sold as much as $50,000 worth of Innate stock, or about 178,500 shares, according to a report he filed with the House of Representatives.

His vested interest in the company and work as a lawmaker should prompt questions from the House Ethics Committee, said Virginia Canter, chief ethics counsel for Citizens for Responsibility and Ethics in Washington.

“If you’re a member of Congress you shouldn’t be sitting on the board of publicly traded company, and you shouldn’t be trading stock that could in that company that could benefit from what you’re doing as a lawmaker,” Canter said.

Collins also served on the board of directors of another biotech company, ZeptoMetrix, while he dealt with issues that could have affected the company.

The first bill he sponsored in Congress would have removed Obamacare penalties on small businesses like ZeptoMetrix, The Daily Beast previously reported. In 2016 and 2017, according to The New York Times, he “asked detailed questions about development of a test for the Zika virus, not revealing his connection to ZeptoMetrix, which was selling the virus to laboratories that were developing tests for the disease,” He also failed to disclose his ties to ZeptoMetrix when he questioned an FDA official in 2015 about regulation of laboratory tests. Collins left the board last week, the Times said.

The Ethics Committee has been weighing an investigation into Collins since October 2017, when a probe was recommended by the Office of Congressional Ethics (OCE). The OCE found that Collins had likely violated House ethics rules in his dealings with Innate by telling other lawmakers about the company and asking a scientist at the National Institutes of Health to help the company prepare for a clinical trial. The committee has not commented on what ethics watchdogs say were glaring conflicts of interest, the OCE’s findings did not include three other bills discovered by The Daily Beast that could have helped the company.

While proponents of 340B have been expecting Collins’s infusion bill for more than a year now, it wasn’t until early July that the discussion draft was released on the Energy and Commerce Committee’s website. (Collins and others say 340B has expanded beyond the original scope of the program while its proponents argue hospitals are simply more adept at taking advantage of its discounts.) Less than a week after the discussion draft was published on Energy and Commerce’s website, the committee held a hearing at which Collins discussed his proposed bill and more than a dozen others that will fundamentally change 340B.

The draft bill was the culmination of years of work by Collins and his staff on what he and others call “reform” of 340B. Collins had long sought to remove infusion drugs from 340B by changing the “patient definition” of the program. In February 2017, Collins drafted an outline of his discussion draft. The document, obtained by The Daily Beast in April 2018, begins by stating that Collins’s marquee 340B reform bill should immediately address the patient definition.

“Language starts with a patient definition for hospitals (pg 1),” the outline states.

In a section outlining “exceptions” to 340B coverage, Collins’s draft bill excludes patients whose treatment “consists only of the administration or infusion of a drug or drugs,” among other provisions. Infusion drugs comprise about 70 to 80 percent of the estimated $8 billion in 340B drug discounts annually, a former Health and Human Services official who worked on the program at the agency told The Daily Beast in April.