CNBC’s senior retail reporter Courtney Reagan delivered a stark analysis of the financial impact of President Donald Trump’s tariffs—and said the true costs are “almost impossible to quantify.”

Wall Street traders have made light of Trump’s erratic and contradictory trade policies in recent weeks, coining the phrase TACO, which stands for “Trump Always Chickens Out” as a way to bet against the president’s unpredictable moves.

But for retailers, the uncertainty is no joke. On CNBC’s Squawk Box, Reagan broke down an exclusive “worst case scenario” model showing the potential price hikes consumers could face if businesses decide to pass the full cost of tariffs along to them.

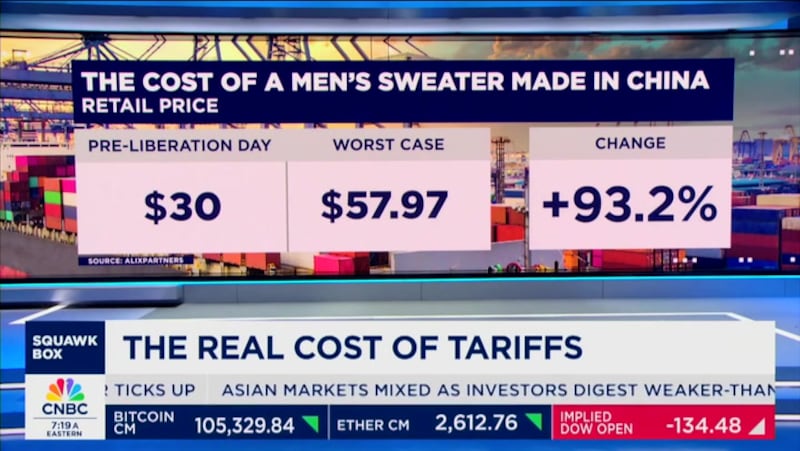

Explaining the model to her co-host Becky Quick, Reagan explained that if retailers couldn’t absorb the added expenses, price jumps would be severe. Using a men’s cotton sweater as an example, she detailed how tariffs could inflate costs.

“So before the April 2nd tariffs, a cotton men’s sweater made in China cost $6.80 to produce,” she explained.

“Pre-liberation day, a 41.5 percent total tariff was already in place for that sweater shipped to the U.S. That equals $2.82. The cost of logistics and sourcing adds another 95 cents. So put together, the total cost of making that sweater is $10.57. At a typical initial markup rate to get to a 65% gross margin, the retail price before liberation day for that sweater would have been 30 bucks.”

But under current tariffs (71.5 percent), she added, the retailer’s cost rises to $12.61, meaning the customer pays $35.80—a 19 percent increase.

“That’s only if you pass the entire cost on,” Quick interjected.

“If you pass the entire cost on, right now, at where we’re sitting today.” Reagan added.

“So let’s look at what happens if the full tariffs announced on April 2nd would be enforced,” she continued.

“At that 41.5 percent pre-April 2nd existing tariff for that sweater, plus the additional 145 percent, the tariff rate is 186.5 percent for the sweater, or a tariff cost of $12.68, making the new cost the retailer pays to make this sweater. $20.43.

“So if you use that same 65 percent markup to maintain the level of profitability, the new price of consumer pays $57.97.

“That is an increase of 92.3 percent, almost double the original retail price.”

Back in April, Amazon boss Jeff Bezos briefly earned the ire of Trump after he announced products would display how much of an item’s cost is derived from tariffs, right next to the original price.

But following a furious phonecall from the president, the billionaire backed off and an Amazon spokesperson released a statement claiming “This was never approved and not going to happen.”

Although most large retailers are working on mitigation strategies, some such as Walmart and Macy’s have admitted that even with mitigation, prices will still increase.