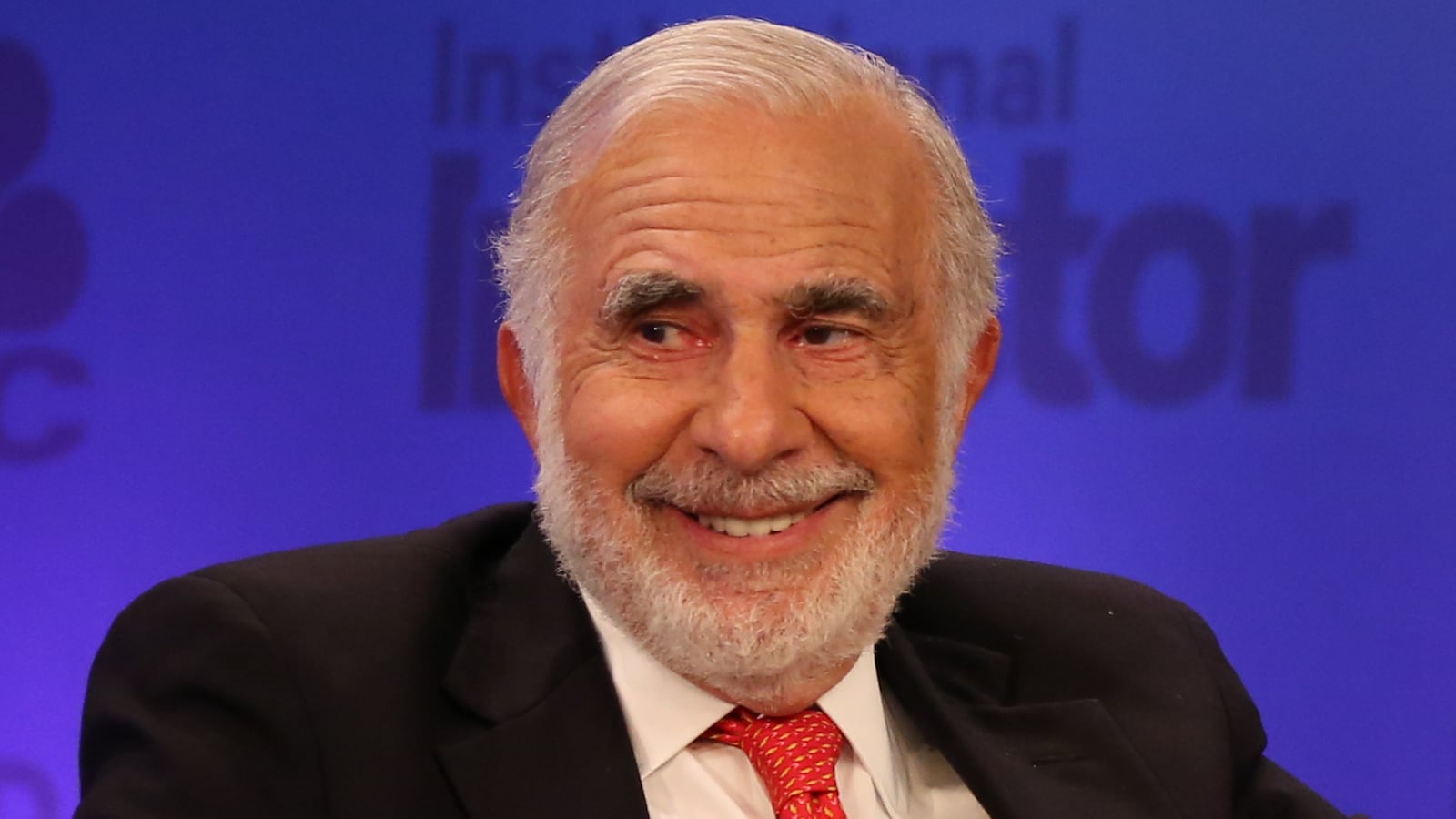

Billionaire corporate raider Carl Icahn has settled charges with the US Securities and Exchange Commission that he failed to disclose he’d used up to 80% of stock in his own company to secure personal loans worth as much as $5 billion. The loans were worth almost as much as his entire net worth, according to the Forbes 400. Not disclosing them is a breach of securities laws. Both he and Icahn Enterprises will now pay the agency a total of $2 million, without admitting any wrongdoing, CNBC reports. Icahn, now 88, rose to fame as a “corporate raider” in the 1980s, first for his hostile takeover of Trans-World Airlines. He threw his weight behind his friend Donald Trump in 2016 and was at one time a prospective nominee for Secretary of the Treasury. Though he was eventually passed over for Steven Mnuchin, he spent a brief stint advising the Trump administration on financial regulatory reform.

Read it at CNBC