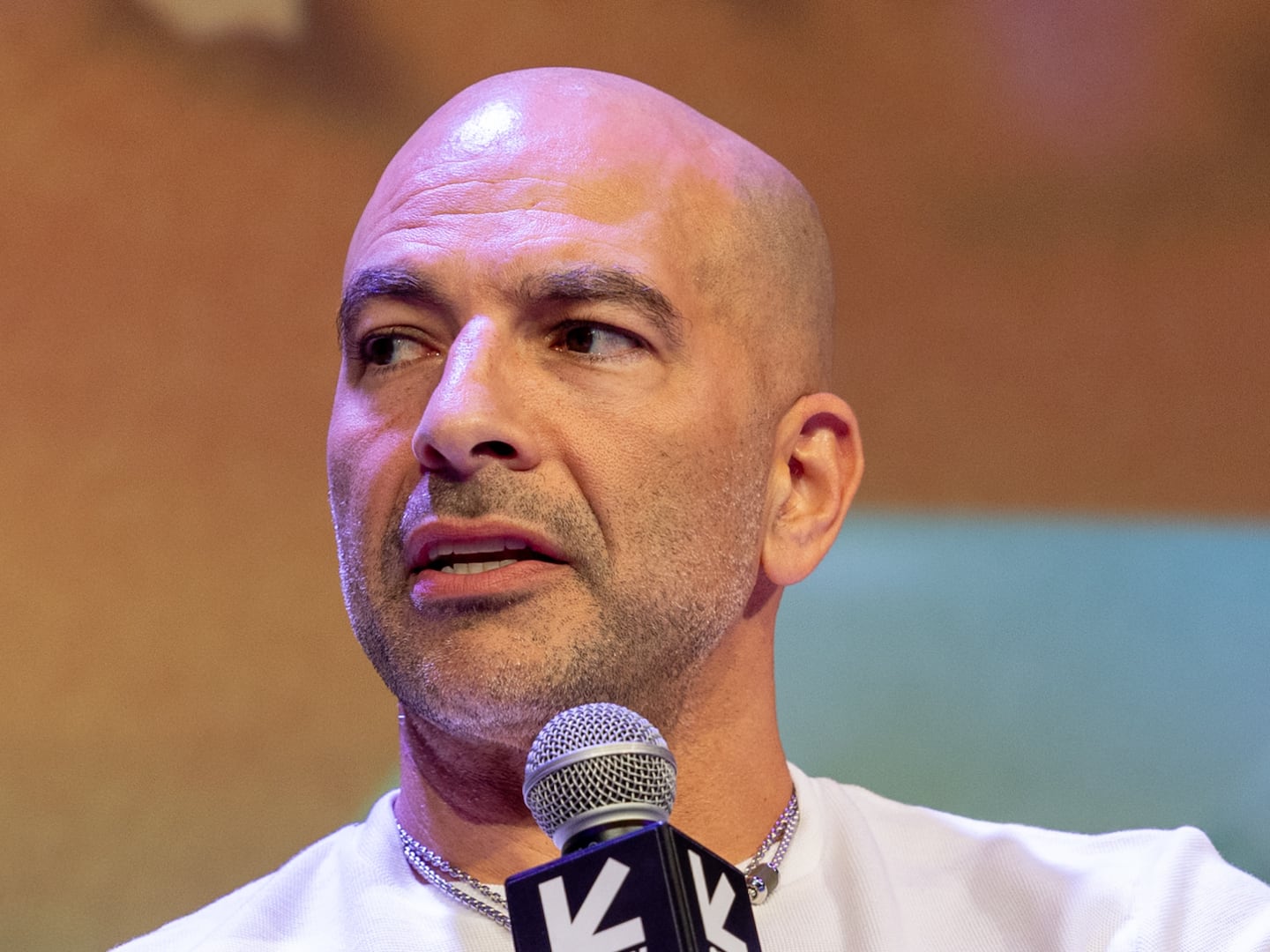

In April of this year, Do Kwon was on top of the world. The cryptocurrency he created, Luna, was worth billions of dollars; its novel algorithm was the talk of the tech world. Kwon racked up hundreds of thousands of followers on Twitter, where his fans referred to themselves as “Lunatics.” Kwon was so besotted with the technology he named his daughter Luna.

On Sunday, the crypto world’s golden boy was added to Interpol’s most wanted list.

The story of how Kwon went from a high-powered startup founder to international fugitive starts in 2018, when he founded his doomed company, TerraForm Labs. Kwon, a South Korea native and Stanford graduate, worked as a software engineer at Microsoft and Apple before founding the company, which he claimed would be “the largest decentralized money in crypto, period.”

The company’s chief products were a standard cryptocurrency, Luna, and a so-called stablecoin, Terra. Stablecoins are a kind of cryptocurrency meant to maintain a steady value—pegged to something like the U.S. dollar— to help facilitate trades between other coins. Terra maintained its value by playing off of Luna, in a complicated algorithm the founder claimed would keep the coin incredibly stable.

Investors loved it. The company raised more than $200 million in venture capital in its first three years, including from major investment firms like Arrington Capital. Kwon was named to Forbes’ 30 Under 30 and CoinDesk’s list of most influential people in crypto. By April of this year, the price of a single Luna coin reached over $100; the value of all the coins combined was more than $40 billion. Mike Novogratz, the CEO of the crypto-focused investment management company Galaxy Digital, got a full-color tattoo of a wolf howling at the moon, next to a banner reading “Luna.”

“I’m officially a Lunatic!!” he tweeted.

Kwon’s startup had its detractors. Kevin Zhou, the founder of a prominent cryptocurrency hedge fund, claimed even at the height of Luna's ascent that it would inevitably crash. Charles Cascarilla, the founder of another stable coin, referred to Luna as an “unstable coin” in an interview with The Wall Street Journal. Multiple economics experts said the entire ecosystem was susceptible to a “death spiral,” in which doubt about either coin would plunge both of their values to zero. Kwon dismissed his detractors as simply “poor.”

But in May, the wheels began to come off. Instability in the crypto market led investors to start selling off Terra, leading the stablecoin to lose its crucial peg to the U.S. dollar. Panic over the change led to more sell-offs, bringing the value of Luna down with it. In a matter of days, Luna dropped to nearly nothing. Kwon’s $60 billion empire was essentially worthless. The death spiral was complete.

In the weeks following, investors—some of whom claimed they had quit their jobs and mortgaged their homes to invest deeper in the cryptocurrency—started to question whether they had been misled. (Kwon has denied the company was a Ponzi scheme.) In July, a stockholder rights law firm filed a class-action lawsuit on behalf of Luna’s investors, claiming it was sold at artificially inflated prices. Earlier this month, prosecutors in South Korea announced they had filed charges against Kwon and five other people in connection with the crash.

The only problem? He was nowhere to be found.

When prosecutors issued their arrest warrant for Kwon on Sept. 14, they believed he was in Singapore, where TerraForm maintains a base. But law enforcement in the country quickly reported that he was not in their jurisdiction. Kwon took to Twitter to claim he was in “full cooperation” with the investigation and “not on the run,” but investigators said otherwise.

“[Kwon] is obviously on the run,” a South Korean prosecutor said, according to local media, adding that lawyers for the founder had told them he had no intention of appearing for questioning. The office was in the process of asking for his passport to be revoked.

Interpol issued a red notice for Kwon on Sunday night, according to South Korean prosecutors, asking law enforcement around the world to locate and arrest him. The founder has not commented further on his whereabouts. Kwon and TerraForm did not immediately respond to an email seeking comment.

In his first interview after the crash, Kwon promised to take responsibility for what happened with the coins.

“I bet big and I think I lost,” he said in the interview. “I’ve never thought about what could happen to me if this fails.”