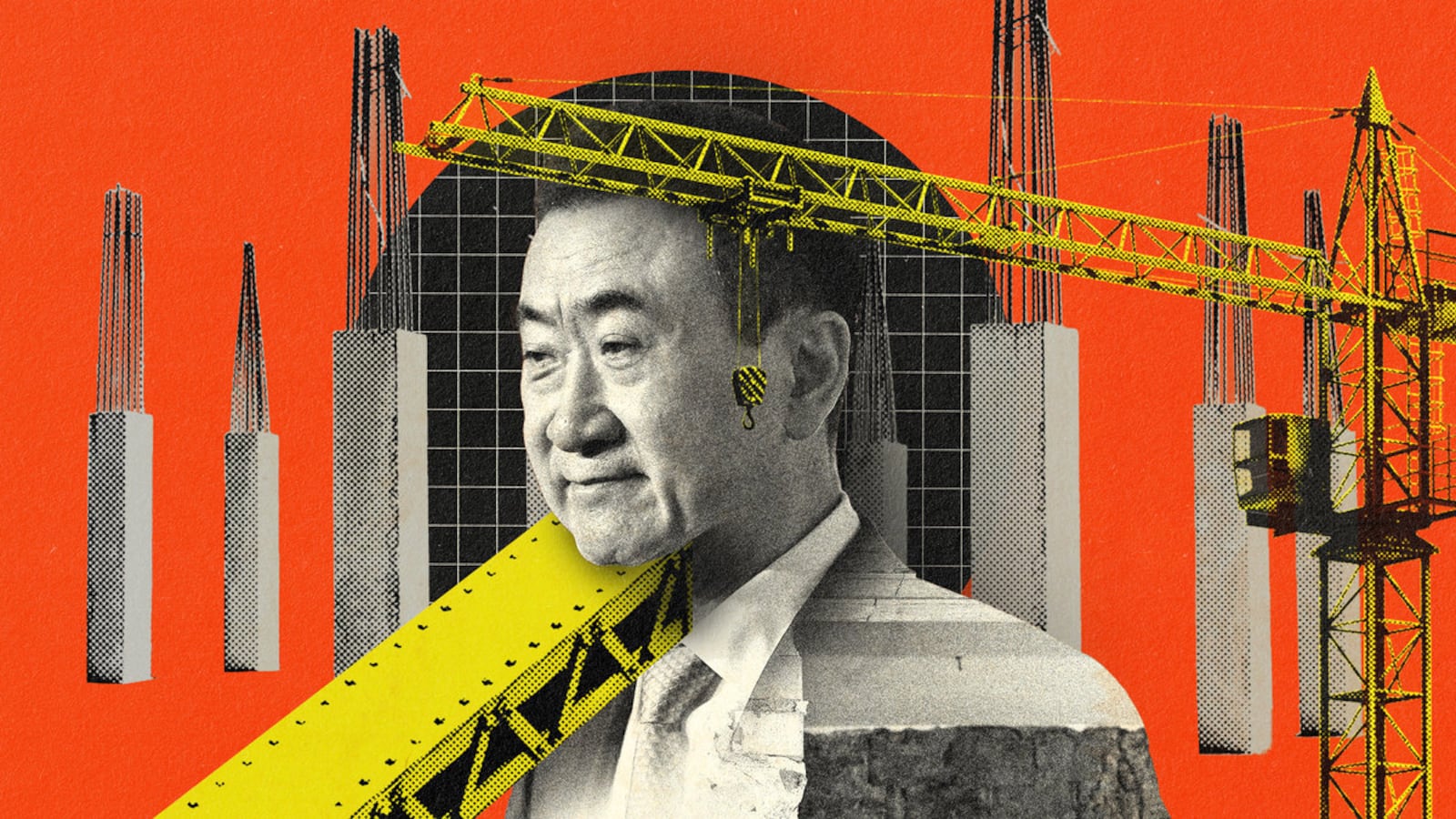

In September 2013, a cadre of Western A-listers followed the money to Qingdao, China, where billionaire Wang Jianlin was breaking ground on a mini-rival to Hollywood that would feature a theme park, a yacht club, and 20 film studios. Leonardo DiCaprio zoomed down the red carpet signing autographs; John Travolta blew the crowd a two-handed kiss; Catherine Zeta-Jones gushed about the arrival of “this dream and this vision;” Nicole Kidman shyly lamented, “I only know how to say ni hao.”

Wang’s firm had paid the celebrities and several others roughly $50 million to attend, according to a Wall Street Journal report published that month. For Wang, that was a rounding error. Just a month prior, he had been crowned China’s richest man, with a net worth of $14.2 billion. By 2015, that fortune would more than triple.

What a difference a decade makes. Since June 2015, Wang’s estimated net worth has plummeted nearly $40 billion, thanks in part to a mountain of debt saddling his empire of malls, theaters, and real estate. The pandemic dealt him another crippling blow, as the Chinese government imposed severe restrictions on public gatherings.

“It was just a double whammy on top of the already precarious position,” Christopher Balding, an economist and founder of a China-focused think tank, told The Daily Beast. And he added that the bleeding is likely to continue: “If he walks away with much of anything, he'll be very lucky.”

Wang’s firm, Dalian Wanda Group, did not respond to a request for comment.

Leonardo DiCaprio waves to fans during a red carpet event promoting Wanda Group's Oriental Movie Metropolis project in Qingdao.

Jason Lee/ReutersBorn in 1954 in Sichuan, China—a central province northeast of Myanmar—Wang grew up in the wake of the Chinese Communist Revolution, which spawned the creation of the People’s Republic of China and ended the country’s brutal civil war. His father had “fought for Mao Zedong’s Red Army during the Long March campaign in the 1930s, and later against the Japanese in World War II,” according to Bloomberg, and Wang became a military man himself, serving in the army between 1970 and 1986.

Wang left the armed forces still in his early 30s and began working in district government in Dalian, a port city in Southern China. He became chairman of Dalian Wanda two years later, in 1988.

Under Wang’s leadership, the company pushed into shopping malls, theaters, and hotels. As China’s economy developed, his fortune rapidly multiplied, and so too did his ambitions.

Wang Jianlin strikes a gong during the debut of Wanda at the Hong Kong Stock Exchange in 2014.

Tyrone Siu/ReutersIn 2012, Wanda Group made a major splash in the American market, with a $2.6 billion deal to buy cinema giant AMC Entertainment. When combined with Wang’s Chinese assets, the acquisition made him the biggest theater owner in the world, the company claimed at the time.

Wang sought additional favor in the U.S. by donating $20 million in 2013 to the Academy of Motion Picture Arts and Sciences—which presents the Oscars—to help create a museum dedicated to the history of film; in exchange, the academy promised to name a gallery after Wanda Group.

Wang’s 2013 bash in Qingdao marked an even larger bet. In all, his company pledged to spend $8 billion on the movie metropolis, with plans to churn out dozens of films on site. (It finally opened in 2018.)

Meanwhile, he poured some of his billions into trophy assets, scooping up Picasso’s Claude et Paloma at Christie’s for $28.2 million in 2013 and a Monet piece from Sotheby’s for $20.4 million in 2015. That year, ArtNews named Wang to its list of the top 200 global art collectors. Eventually, he and his company amassed a collection worth a reported $1.5 billion. Also in 2015, Wanda Group spent $52 million for a stake in Atlético Madrid, becoming “the first Chinese company to invest in a top European football club.”

Wang’s son, Wang Sicong, splashed out as well. The young scion generated outrage by showering his dog with lavish gifts, then posting the photos on social media. In one picture, the Alaskan malamute named Coco was shown wearing two gilded Apple Watches on her forepaws; each retailed for upwards of $10,000. Other posts showed Coco donning a luxury handbag, lazing in a pile of eight iPhones, and resting with her head on a pile of cash.

Wang Sicong at the 15th China Digital Entertainment Expo on July 27, 2017 in Shanghai, China.

VCG via GettyBut Wang’s good fortune soon began shifting. As his company racked up debt, the billionaire was forced to pare back his ambitions. During the summer of 2017, Wanda Group offloaded more than $9 billion worth of hotels, theme parks and other tourism-related holdings; it sold the rest of its theme parks in China the next year. It also jettisoned most of its stake in Atlético Madrid. Still, the company’s debt load remained oppressive, and the Chinese government— alarmed about its financial condition—restricted the company’s ability to borrow more cash.

“A lot of what he was doing when he was [China's] richest man was basically leverage and taking out all of this debt,” said Stanley Rosen, professor of political science at the University of Southern California. “So his days were really numbered.”

Ker Gibbs, executive in residence at the University of San Francisco’s China Business Studies Initiative, offered a softer take. “Is his business at risk of collapse? I don't think so, certainly [no] more so than all the other real estate businesses that are carrying huge debt in China,” Gibbs said. “True, there are systemic problems in the market today, the provinces are carrying huge debt from zero covid, and unemployment is a major issue. [But] China's government technocracy actually has a pretty good track record for managing out of situations, even though they've never faced this unique set of issues.”

Wanda Cultural Tourism City opens in 2017 in the city of Harbin in northeastern China.

Simon Song/GettyCOVID undoubtedly made Wang’s problems much worse. “If you aren't putting butts in movie theaters… and people are avoiding shopping malls, that's absolutely going to hit you very, very hard,” Balding said.

Wanda continued ditching assets, exiting AMC in 2021, a decision Forbes called a “dramatic retreat” from its plan to conquer Hollywood. To generate more cash, the company has tried to take public one of its business units, Zhuhai Wanda, but so far has been unable to pull off the deal.

Wang Sicong has attracted more negative attention, as well. This winter, he was reportedly arrested after he and three men allegedly broke the nose of a man who was trying to take their picture.

The elder Wang’s precarious position is a far cry from the growth he once forecast for his company. A decade ago, awash in glamor in Qingdao, he told a journalist that he planned to grow Wanda’s revenues by $10 billion per year. “We will have more than $50 billion in revenue two years from now,” he declared. “In 2020, we will have at least $100 billion, even by conservative estimates.”

In reality, revenue has declined in multiple years since then, and as of 2019, the company wasn’t even halfway toward that goal.