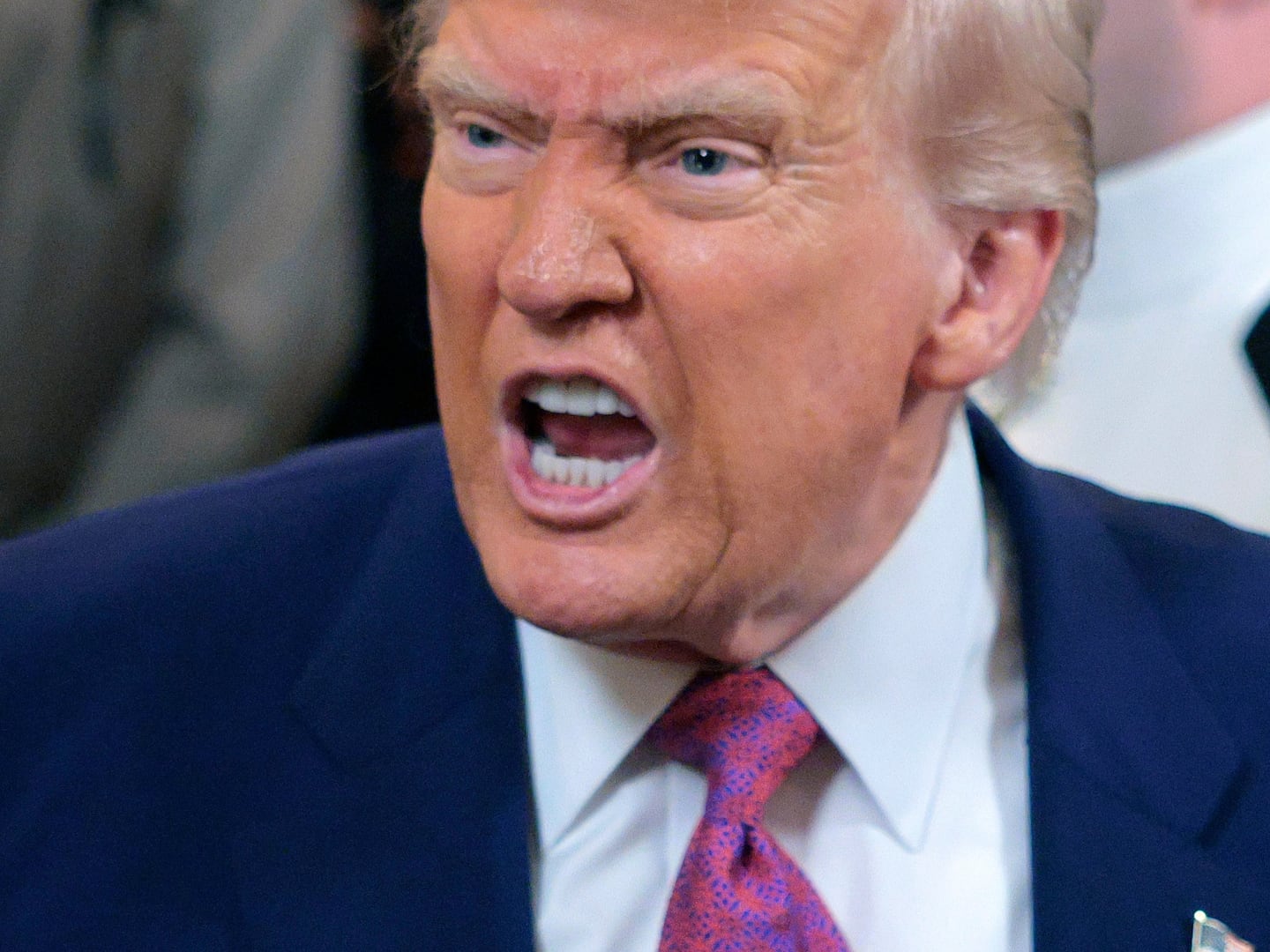

Tee up the next big political fight for congressional oversight of President Donald Trump: The Justice Department has announced that the IRS does not have to give his tax returns to Congress.

The announcement came in the form of an opinion from the DOJ’s Office of Legal Counsel (OLC) late on Friday afternoon. The opinion, signed by Assistant Attorney General Steve Engel—a Trump appointee—concluded that Congress does not have a legitimate lawmaking purpose for demanding the president’s tax returns, and assessed that lawmakers only wanted the documents so they could make them public. At issue is a long-overlooked provision in federal law that gives the chairman of the House Ways and Means Committee wide latitude to ask for individuals’ tax returns. But according to the OLC opinion, Congress never had the right to give itself the power to demand confidential executive branch material for reasons other than lawmaking.

“Congress could not constitutionally confer upon the Committee the right to compel the Executive Branch to disclose confidential information without a legitimate legislative purpose,” the opinion reads.

Moreover, the Justice Department accused the House Ways and Means Committee of overstepping simply by requesting the tax returns.

Chairman Rep. Richard Neal’s request “that Treasury turn over the President’s tax returns, for the apparent purpose of making them public, amounted to an unprecedented use of the Committee’s authority and raised a serious risk of abuse,” the opinion argued.

It’s an unsurprising setback to congressional efforts to get some of the most-discussed confidential documents in American public life: Trump’s tax returns. The president broke from decades-long precedent in 2016 when he refused to release his tax returns as a candidate. He claimed it was because the IRS was auditing him—an assertion that doesn’t hold water, as any audit wouldn’t have precluded the release of his tax documents.

When Democrats took control of the House in 2018, they promised an oversight onslaught directed at the White House. Top on their list: the tax returns. So on April 3, Ways and Means Chairman Richard Neal asked the IRS to fork over the records. Friday’s OLC opinion is a line in the sand: no tax returns without a legal fight.

And that’s likely to come. Neal will have to consider subpoenaing the IRS to turn over the returns. If and when the IRS fights that subpoena, it will go to court.

This is far from the only hot oversight fight. This past week, Congressional Democrats voted to highlight the power of their committee chairs to ask federal judges to enforce their subpoenas. And Democrats moved to hold Attorney General Bill Barr and Commerce Sec. Wilbur Ross in contempt for refusing to turn over documents related to Republican efforts to add a question to the 2020 census about citizenship. Meanwhile, House Judiciary Committee Republicans touted an agreement with DOJ to view underlying evidence from Special Counsel Robert Mueller’s investigation. But they may have celebrated too soon; senior administration officials say the White House will work with DOJ to decide which specific materials they actually get to view.