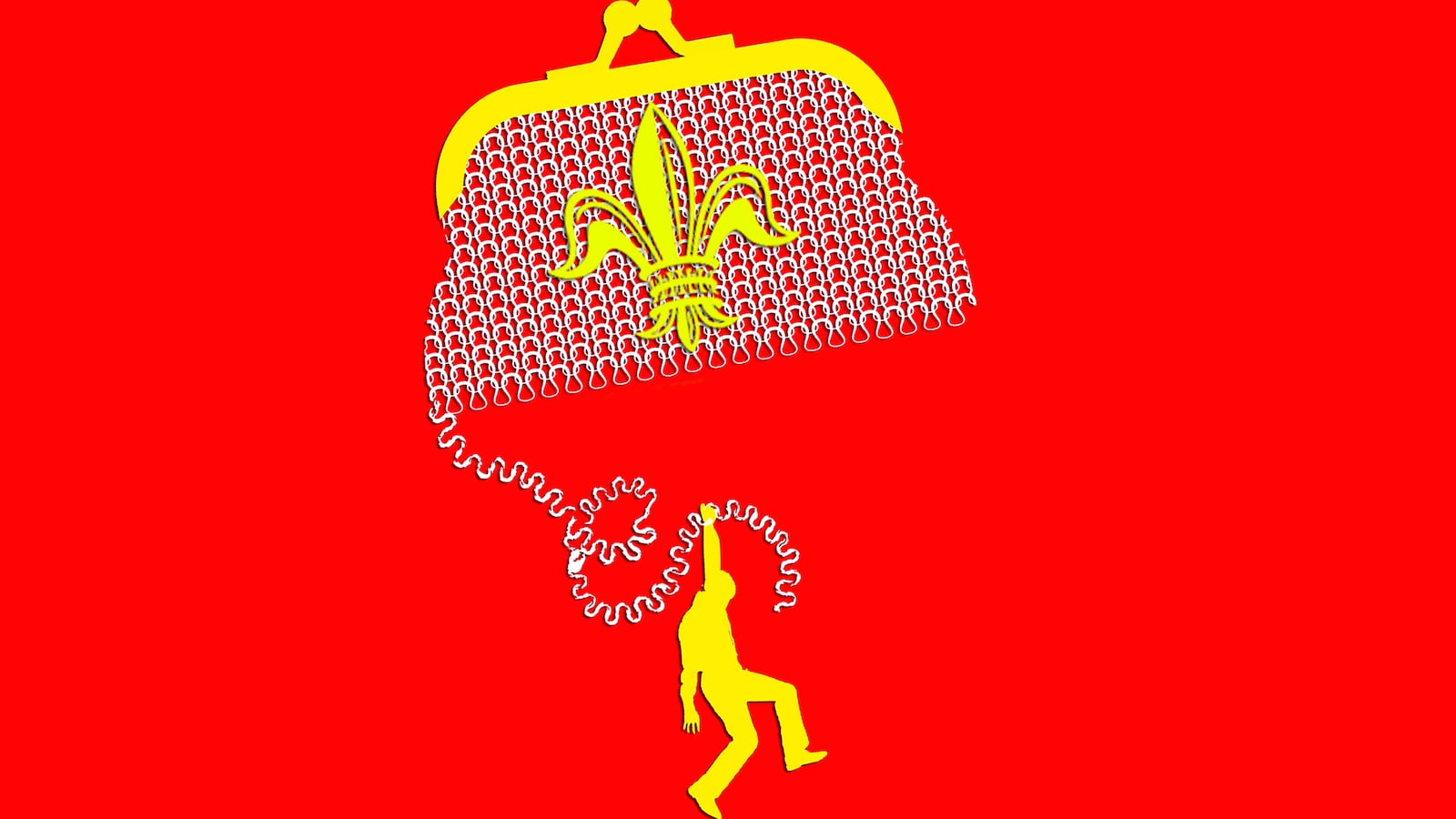

In 2012, New Orleans judges charged indigent locals a combined $9,841 for court transcript fees. Then the system changed, and those fees were redirected to an expense fund for judges. The next year, judges charged $271,581 in transcript fees.

It’s a symptom of what some New Orleans residents describe as a “modern debtors’ prison.” When a New Orleans judge assigns court fees, they are required to consider a person’s ability to pay those fees. Instead, a federal judge ruled last week, those New Orleans judges were demanding impossible fees from the city’s poorest and arresting them if they failed to pay. The judges upped those fees in 2013, after the money was redirected to a fund that judges have been accused of abusing to buy more than $800,000 in redundant insurance policies.

Meanwhile, the already poor found themselves in a cycle of debt and imprisonment while they tried to pay their court-ordered fees.

The ruling, handed down in the U.S. District Court for the Eastern District of Louisiana on Wednesday, stems from a 2015 lawsuit by poor New Orleans residents who claimed to have been extorted by the city’s judicial system.

“The Defendants use their unconstitutional scheme of arresting and jailing people for their inability to pay and keeping them in jail until they come up with money to fund themselves off the backs of New Orleans’ poorest,” the 2015 lawsuit reads.

One of the plaintiffs, Ashton Brown, was 21 when the suit was filed. Brown was out of work at the time, impoverished and struggling to keep up with court debts and probation officer fees, which had carried over from a misdemeanor theft conviction two years earlier.

Brown had asked the courts for more time on his payments. When considering court fees, New Orleans judges are legally required to determine a person’s ability to pay those fees. But despite being penniless, Brown got no mercy from the courts, he claims in the lawsuit. He was arrested for failure to pay and informed that he would not be released until he made his next payment. He spent weeks in jail before family members pooled just enough to free him.

But not enough to clear his debt. Upon release from jail, the still jobless Brown was warned that he’d be locked up again if he was late on another payment.

New Orleans is not the only jurisdiction with officials accused of profiteering off court debts. In Oklahoma last month, debtors sued every sheriff’s department in the state, accusing them of getting kickbacks from a private debt collection agency. In both cases, local courts or law enforcement are accused of jailing poor people indefinitely, until friends or family come up with the money to free them.

The alleged scheme is in New Orleans judges’ financial interest. In 2012, New Orleans courts redirected indigent locals’ court fees to the Judicial Expense Fund, which makes payouts to the city’s criminal court judges.

New Orleans criminal court judges can’t use the Judicial Expense Fund to supplement their own salaries. Not officially, at least. But those judges have a spotty record with the fund. A 2012 audit (conducted before the judges got access to debtors’ fees) found that the criminal court judges had signed up for and expensed over $800,000 in “excessive and unnecessary” insurance plans, including pricey life insurance plans, in addition to the insurance already provided through their jobs.

In 2010, the court’s 13 judges held a combined 249 supplemental insurance policies, all fully paid through the Judicial Expense Fund, the audit found.

“These are redundant policies, but because it wasn’t their money, it didn’t really matter how much it cost,” Rafael Goyeneche, president of the audit’s commissioning body, told the New Orleans Times-Picayune in 2012.

The audit also said the judges omitted key details from their travel expense reports and expensed “excessive amounts” for alleged business trips. State law prohibits judges from receiving more than $130,000 in compensation outside their salaries.

With the indigent court fees now paying into their expense fund, New Orleans judges “sought ways to increase collections from criminal defendants,” the federal ruling handed down Wednesday found. “At a City Council hearing in July 2014, a judge explained that the Judges were sharing ideas ‘in an effort to increase [their] collection’ of fines and fees.”

Among those apparent efforts was a steep increase in indigent court fees. From 2012 to 2013, the first year all fees went to the judges’ expense fund, those judges awarded more than $2,750 more in court transcript fees for penniless defendants. Instead of ruling the defendants unable to pay, the judges were ratcheting up their fines.

That system, with judges prescribing and profiting from court fees, is a clear conflict of interest, the federal court ruled.

“The judges therefore have an institutional incentive to find that criminal defendants are able to pay fines and fees,” the federal ruling reads. “The judges’ practice of failing to inquire into ability to pay is itself indicative of their conflict of interest.”

In another City Council hearing, cited in the ruling, a New Orleans judge claimed the court was not extorting money from the city’s poor, as it would be an unreliable source of income for the court.

Noting that 95 percent of the court’s criminal defendants were too poor to afford a lawyer, the judge told City Council that “if they can’t afford an attorney, just imagine how difficult it’s going to be for us to have to chase them around the block to try to get money from them.”

Defendants like Ashton Brown know the answer: Getting the money was as easy as jailing a broke 21-year-old for two weeks until his family made the next payment.