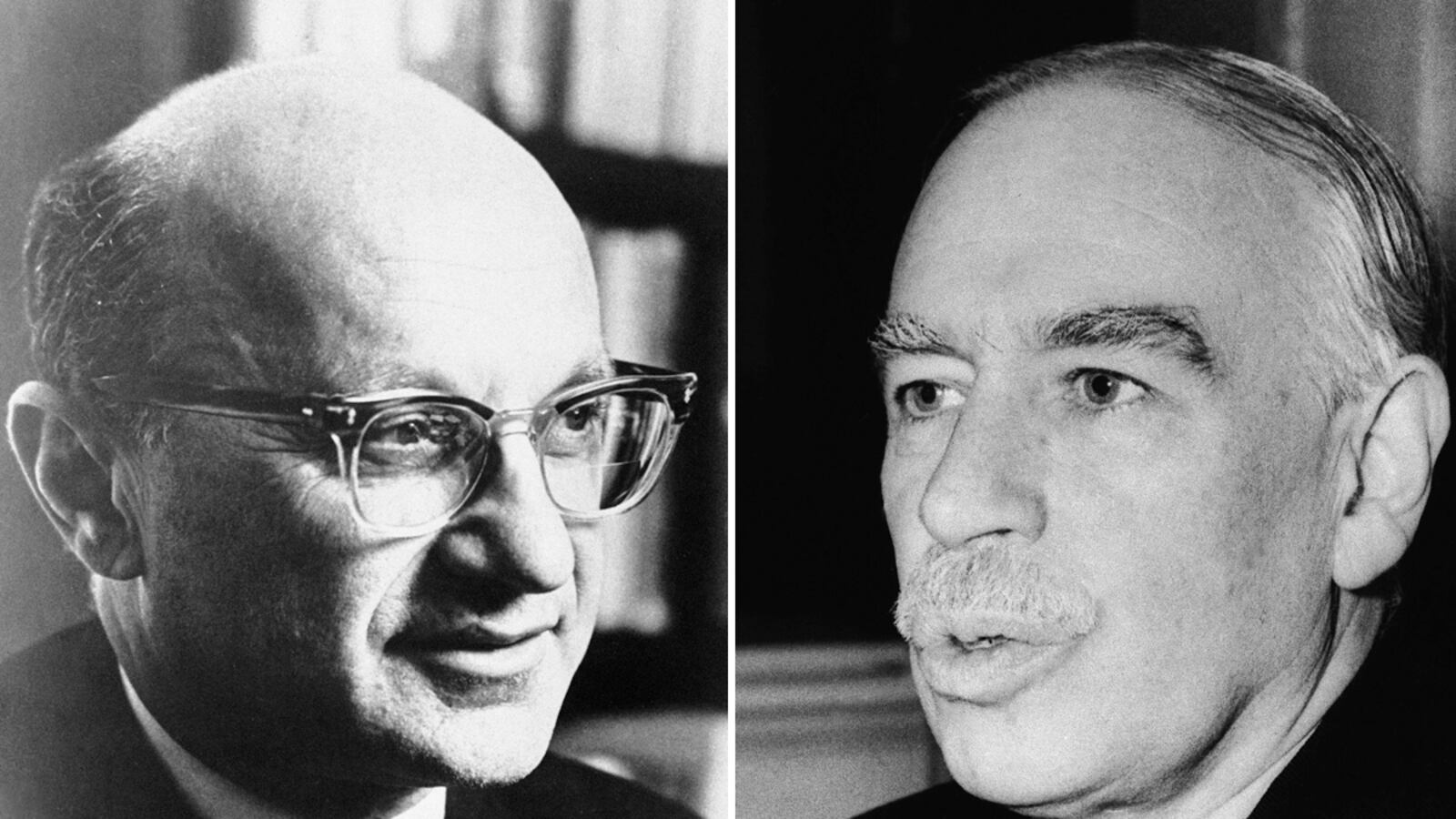

July 31 marks the centenary of the birth of the high priest of monetarism, Milton Friedman. Conservatives will be rejoicing at his many achievements, notably his most famous triumph in the mid-1970s, when he almost single-handedly turned back the tide of 30 years of big-government Keynesian economics.

Yet Friedman’s contemporary supporters no less than his critics will be surprised to learn that he was in fact an enormous admirer of John Maynard Keynes—the patron saint of the New Deal—and not at all the absolute opponent of big government he is usually presumed to be.

A key lost document in the story of modern economics is Friedman’s only essay to directly address the legacy of Keynes, written for a German publisher in 1988 as the introduction to a new edition of Keynes’s revolutionary book The General Theory of Employment, Interest, and Money, originally published in 1936. The essay was circulated in English in the obscure quarterly of the Federal Reserve Bank of Richmond. Most monetarists do not know of its existence, and even fewer have read it.

The essay is a revelation. While Friedman spent most of his life insisting that Keynesian measures had led governments to grow too large, in this devastating critique of the American system of government he concedes not only that Keynesianism can work but that big government is not evil so long as it is honestly administered.

Friedman was a warm-hearted and likable man who in the 1950s spent a great deal of time in Cambridge, England, where he enjoyed the company of Keynes’s disciples and debated with them the value of Keynes’s legacy. It is this generosity of spirit—long gone from the poisonous left-right, Keynes-Hayek debate over economics today—that allowed Friedman to praise Keynes as “a great economist” and “a public-spirited and largely disinterested participant in the political process.”

Having started out life as a socialist working as an economist for Franklin Roosevelt, Friedman, a chirpy, impish Brooklynite, had became an economist at the University of Chicago, surrounded by distinguished conservatives. Friedman’s research into the causes of the 1929 stock-market crash and the ensuing Great Depression led to a rewriting of history. Instead of the Crash being caused by too much money in an inflated market, Friedman argued that the Federal Reserve had tightened the money supply so severely that it choked the national economy nearly to death.

Friedman leveraged this discovery in the late '70s into a cure for stagflation, which combined persistently high price inflation with low economic growth. He turned the tables on the 1929 crash and suggested that stagflation was caused by too much money in the system. If too much cash chasing too few goods led to inflation, then the trick was to tighten the supply of money until there was no inflation. It was the theory that led Fed chairman Paul Volcker to purge stagflation from the system.

Friedman became the talk of the town and launched a successful franchise on the back of his triumph. At Newsweek he dueled with his economic nemesis, Paul Samuelson, the amanuensis of the Keynesian revolution. He fronted a popular television series, Free to Choose, which trumpeted the virtues of free enterprise. When Friedman first met Queen Elizabeth II, she said her husband, Prince Philip, watched the program avidly and agreed with every word.

Over the years, Friedman attacked big government at every turn. “I am in favor of cutting taxes under any circumstances and for any excuse, for any reason, whenever it’s possible,” he declared in a 2003 interview. “The only effective way I think to hold [public spending] down is to hold down the amount of income the government has. The way to do that is to cut taxes.”

Yet in his buried essay on Keynes, Friedman expressed a more complicated view. Abruptly dismissing Hayek’s notion that big government tends to curb the rights of individuals, Friedman reports that in Britain, where government was administered with integrity and honesty, governments have grown large without endangering the public good.

From his time in England, Friedman learned that “Britain retains an aristocratic structure, one in which noblesse oblige was more than a meaningless catchword. Britain’s nineteenth-century laissez-faire policy produced a largely incorruptible civil service, with limited scope for action, but with great powers of decision within those limits. It also produced a law-obedient citizenry that was responsive to the actions of the elected officials operating in turn under the influence of the civil service.”

While big government in Britain did not tend to be tyrannical, it was “very different in the United States,” which “has no tradition of an incorruptible or able civil service. Quite the contrary. The spoils system formed public attitudes far more than a supposedly non-political civil service.”

The lost essay shows Friedman at his most clearheaded, unhindered by domestic political considerations, and it calls into question whether those today who rail against the size of the state are blaming the system when they should be rooting out corrupt politicians and public officials instead.