U.S. stocks took a steep dive on Monday after China let its currency weaken against the U.S. dollar, escalating an ongoing trade war between the two countries. The Dow Jones Industrial Average fell 767.27 points in Wall Street’s worst day of 2019. Hours later, the U.S. designated China as a currency manipulator—something President Trump campaigned on doing. The formal designation is a historic move that hasn’t been used since the Clinton administration. “As a result of this determination, Secretary Mnuchin will engage with the International Monetary Fund to eliminate the unfair competitive advantage created by China’s latest actions,” the Treasury Department said in a press release. Currency manipulation requires that a country spent two percent of its GDP on the alleged manipulation over a 12-month period, something China has not done.

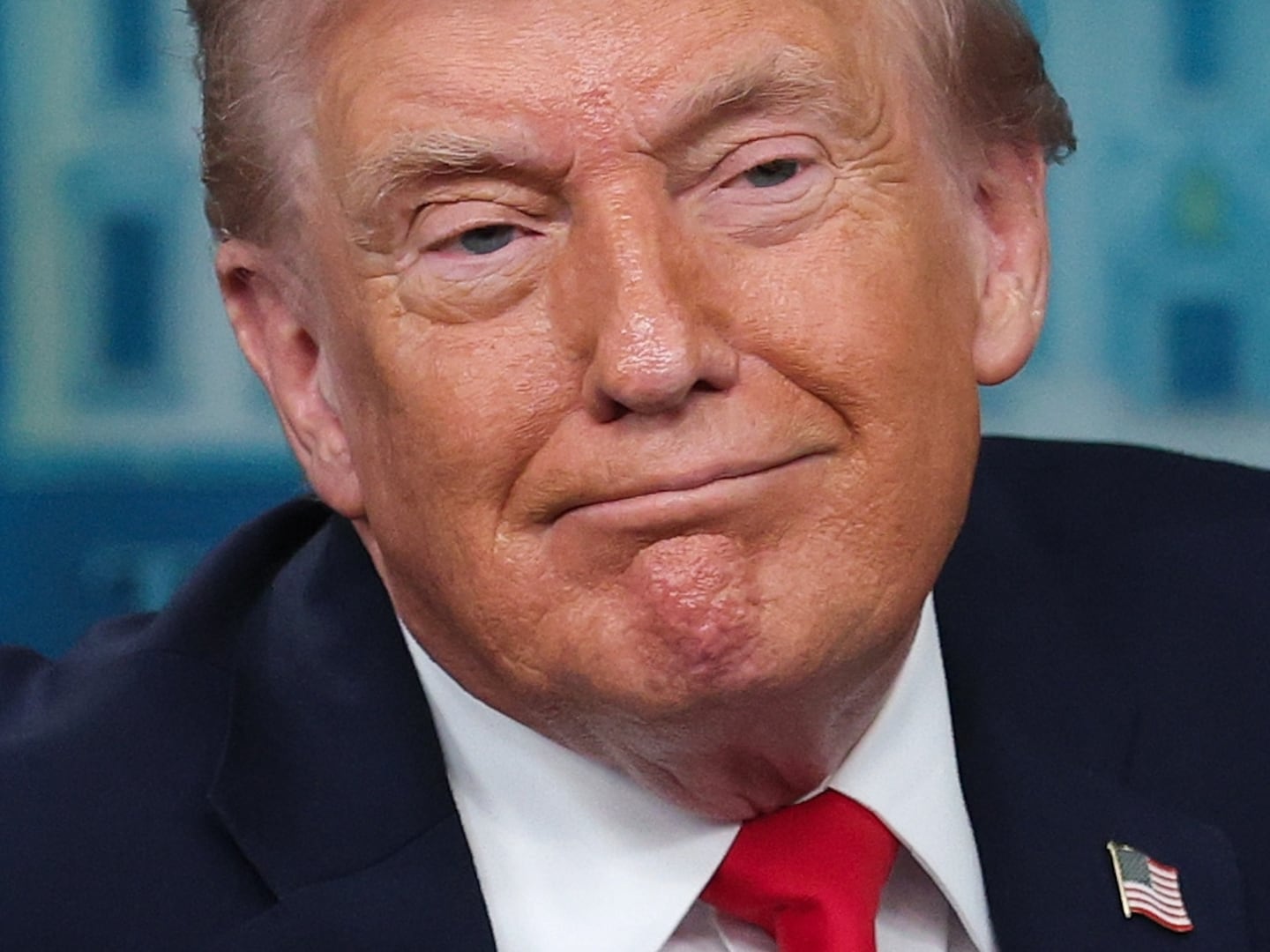

The Chinese government devalued the yuan for the first time in 10 years, allowing it to fall below its 7-to-1 ratio with the U.S. dollar. Weakening the U.S. dollar could soften the blow of Trump’s extensive new tariffs against China, but the move adds to fears of a burgeoning currency war. China on Monday also announced its companies would no longer purchase American agricultural goods. There were concerns that Trump would retaliate by devaluing American currency, which could further weaken U.S. purchasing power and the global economy. Trump said on Monday that the devaluation of the yuan was a “major violation.”