Donald Trump came out last Friday for a freedom most Americans never imagined they wanted and that only financial predators would embrace: the freedom to be fleeced.

In a memo to the Labor Department, Trump took an initial step to making it easier for financial advisors to rake in more in fees for themselves, leaving clients with less money for old age. He instructed the Secretary of Labor to delay implementation of a new rule that would have extended fiduciary responsibility to all financial advisors handling retirement accounts.

Requiring financial advisors who manage retirement savings to put the interests of their clients first (a principle known as the fiduciary standard that requires “a duty of loyalty”) “may not be consistent with the policies of my administration,” Trump wrote in a Feb. 3 memorandum to the Secretary of Labor.

Putting clients first “may adversely affect the ability of Americans to gain access to retirement information and financial advice,” Trump wrote.

Understanding the Fiduciary Standard

Trump’s memo takes aim at an Obama Administration rule designed to rein in greedy investment advisors handling retirement savings, such as 401(k) accounts. The rule was issued in April 6, 2016, but was not scheduled to be phased in until April 10, 2017, to Jan. 1, 2018 (for details see DOL Fiduciary Rule Explained as of Feb. 3, 2017).

Some financial advisors have always adhered to this standard, getting their income from management fees, rather than commissions. Others, however, have followed the much less stringent suitability standard. Under this rule, an investment only has to be "suitable" for the client (not the best possible choice). This leaves plenty of leeway for advisors to choose investment vehicles that offer healthy commissions to them, even if that means lower earnings for clients.

By one conservative estimate financial advisors raked in $17 billion a year in excess fees before the fiduciary rule was scheduled to take effect.

The new ruling decreed that advisors handling retirement funds must adhere to the stricter standard – though they could still suggest non-retirement investments that didn't meet it. Removing commissions meant that advisors would likely charge some sort of money-management fee, perhaps requiring a certain size of retirement fund, the reason Trump could claim that Americans would lose access to information.

What Advisors Stand to Gain (And Retirees Lose)

This is about big money—money that could and should be yours, but that Trump would instead divert to Wall Street, a place Trump the candidate demonized.

I did a simple calculation to measure how much less you could end up having under this system than your retirement savings earned.

Imagine that, at age 20, you set aside $100 in after-tax earnings for old age in a Roth IRA. No taxes are due when you withdraw the money from a Roth at retirement. Now, imagine your savings earned a 5% annual return because investment advisors had to put your interests first. Imagine a second scenario under Trump’s policy, in which your financial advisor raked off just one percentage point in annual fees, lowering your net return to 4% per year.

At age 70, that one-percentage-point difference in investment return results in $1,147 if you get 5%. If you'd gotten 4%, you'd reap just $711. The other $436 would have enriched your advisor.

Looked at another way, for each dollar Trump’s policy would put in your pocket in old age you could have had $1.64 because a duty of loyalty is required.

The Freedom to Make Safe—not Bad—Choices

Imagine for a moment if we ran our licensing systems for doctors or pilots along the lines that Trump proposes, were government to adopt the Trump view that you should be free to make bad choices.

That would mean you should be free to consult a doctor who does unnecessary surgery to collect more fees, perhaps to support a bigger sailboat required larger monthly payments. In addition to the risks you run whenever you go under the knife, everyone in your health insurance pool would share in the cost of that unnecessary surgery.

If we followed the Trump theory of absolute freedom to choose, you could fly on an airline that skimps on aircraft maintenance and pilot training and flies through storm systems instead of around them. And if you die: Well, you exercised your freedom to choose. As for those on the ground when the plane fell—too bad for them, but at least their right to choose an unsafe airline was protected by our federal government.

If Trump’s policy, as explained here, sounds crazy that’s because it is. It is illustrative of something I keep saying: Donald Trump doesn’t know anything. It’s all bluster to make up for his appalling ignorance of economics, geopolitics, diplomacy, war and much else. If you ran into him in a bar and had never heard of him you’d quickly conclude he was a blowhard.

Trump’s directive is part of his promise to eliminate two regulations for each new one. That premise is moronic.

The Right Role for Regulations

First, we need to understand that everything is regulated and in civilized society always has been. Lending and investing money were regulated under Hammurabi's code, nearly 4000 years ago in what we today call Iraq. The pharaohs, the Israelites, the ancient Athenians and the Romans all had rules regulating loans and investments. Major League baseball even regulates how many stitches are on the ball.

Second, without specialists in everything from surgery to piloting planes to managing money we would all be a lot poorer. Adam Smith taught this in "The Wealth of Nations" with his story of how the cost of pins dropped from dear to almost nothing once the manufacturing tasks were broken into specialized operations.

Third, because none of us has the skill to judge the competence of every other occupation—airline pilot, surgeon, stockbroker—we need regulations so we can trust in the competency of those who hold in their hands our lives and our fortunes.

If people knew what was best about investments there would be no need for financial advisors. Because most people don’t understand investments we need advisors and that means we need to regulate them for the benefit of investors.

This is not an argument for more regulation. All regulations should be written with an eye toward the least interference and the most economic, environmental, financial or social benefit. As I taught my students at Syracuse University College of Law, the best regulations are self-reinforcing of virtuous behavior while the worst enable vicious behavior.

Trump’s directive is a classic of replacing a self-reinforcing virtuous regulation with a vicious policy.

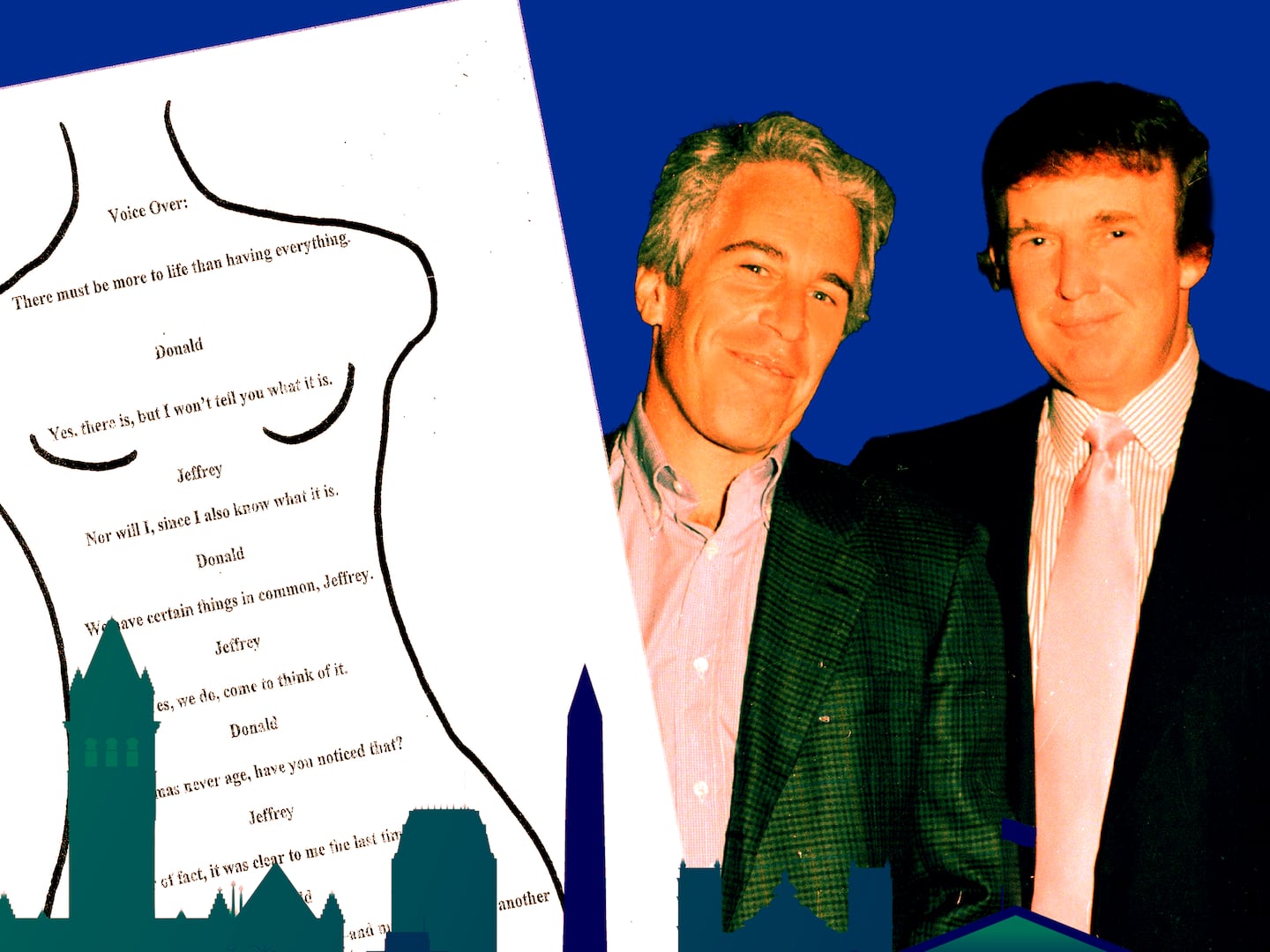

That’s not surprising given Trump’s decades long—and thoroughly documented—history of cheating workers and vendors, as well as swindling investors. What his memo reveals is that the candidate who ran as the champion of Joe Sixpack, as the man who would take on those greedy Wall Street bankers, is at one with Wall Street.

The question Trump’s memo raises is how long will it take the Joe Sixpacks to realize they’ve been conned? Will it be soon enough to keep their retirement savings from ending up on Wall Street instead of in their own pockets? Or will we all face huge future tax costs to provide welfare for the elderly who saved, but did not reap the rewards?