Donald Trump’s Social Security chief is under fire for spreading propaganda and fueling confusion after his agency said the president had ended taxation on Social Security for millions of Americans.

Trump and the White House have repeatedly touted that Republicans’ “Big, Beautiful” bill ended taxes on Social Security—a promise the president made on the campaign trail—but the reality is much more complex.

Many seniors will get a tax break, but rather than eliminating taxes on Social Security, the relief would come in the form of a tax deduction.

However, the Social Security Administration sent out an email to Social Security recipients in July stating that the law would “eliminate federal income taxes on Social Security benefits for most beneficiaries” and that the bill “ensures that nearly 90 percent of Social Security beneficiaries will no longer pay federal income taxes on their benefits.”

What the bill actually does is create a temporary $6,000 deduction for those over 65.

“It doesn’t directly address the income that’s in question here, the Social Security benefits, it just simply does not involve that,” said Tax Foundation chief economist Will McBride.

The deduction phases out for seniors with higher incomes and does not apply to Social Security beneficiaries under 65. At the same time, it is set to expire at the end of Trump’s second term.

“It’s basically introduced a brand new political football, as if we didn’t already have enough, that will come into play four years from now,” said McBride.

Tax Policy Center senior fellow Howard Gleckman agreed the email from the administration was misleading. He also found only about half of Social Security recipients would benefit from the deduction.

“Many Social Security recipients would get no benefit because they already make too little income to pay federal income tax,” he noted. “Others get no benefit because the senior deduction phases out at high incomes.”

Democratic lawmakers claimed they’ve been flooded with questions from confused constituents. Members of the Ways & Means Committee sent a letter to Commissioner Frank Bisignano demanding the agency issue a correction.

“We write with alarm about the unprecedented, factually incorrect email you recently sent to tens of millions of current and future Social Security beneficiaries,” they wrote. “We urge you to immediately contact those who received this misinformation to correct the record.”

The lawmakers warned the incorrect statements made in the email about the bill could negatively affect the personal financial planning of seniors “in support of a partisan, controversial political agenda.”

“We know you are aware that your original email was false, because you subsequently quietly updated the most blatantly erroneous claim in a press release posted to your website,” the lawmakers wrote. “However, you have not issued a correction to the tens of millions of individuals with mySSA online accounts who received your email.”

The Social Security Administration did not immediately respond to a request for comment.

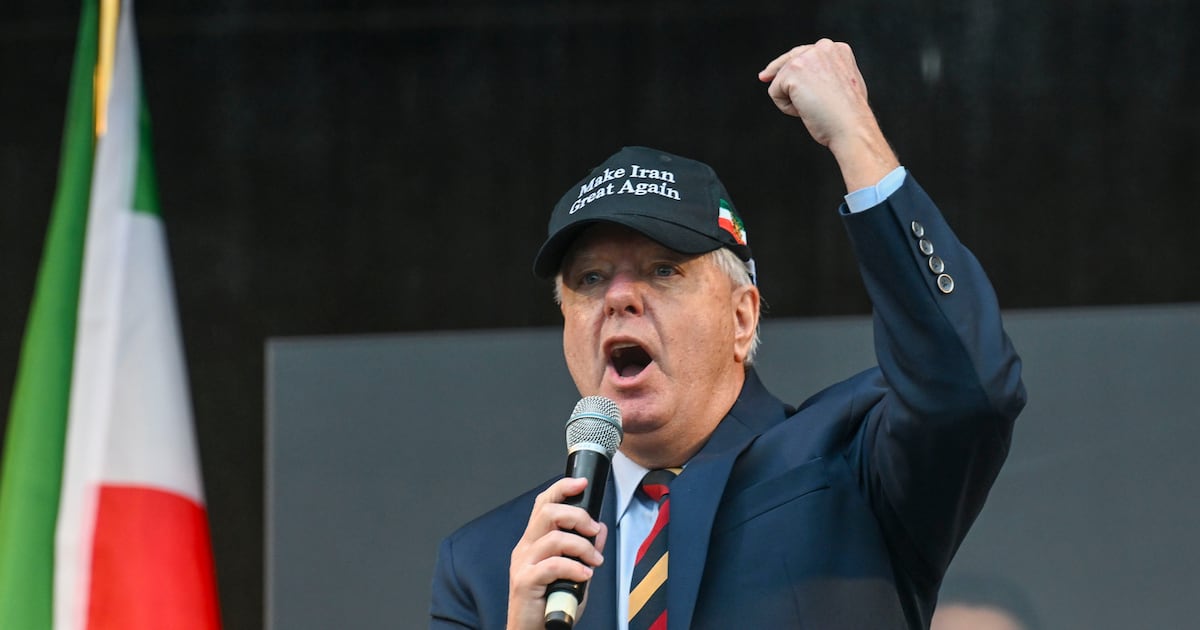

Bisignano, a former Wall Street executive, was tapped to lead the agency tasked with administering benefits to more than 74 million people. At his first meeting after taking office in May, he even admitted he had to Google the position when it was offered to him, according to ABC News.

House Democrats are not the only ones who have raised concerns this week. Democratic senators led by Senate Finance Committee Ranking Member Ron Wyden sent their own letter to Bisignano in which they accused the agency of spreading political propaganda and false information.

“We are appalled that the agency distributed misleading and blatantly inaccurate information regarding tax changes affecting older Americans, transforming the agency into a partisan megaphone for Donald Trump while sowing confusion and distrust in SSA among Americans,” they wrote.

They noted that about half of those receiving benefits will still owe some income tax on the benefits. The bill also does not change tax filing requirements for the people who receive them.

The dispute comes as the agency is already struggling to meet demands with long wait times for those seeking information. The challenges existed during the Biden administration and carried over into the Trump administration, which sparked further concerns as it looked to further reduce the federal workforce.