Americans have always prided themselves on being a nation of the self-made, where class and the accident of birth did not determine success. Yet increasingly we are changing into a society where lineage does matter—and likely this process has just started, threatening not only our future prosperity but the very nature of our society.

In some ways the emerging age of inheritance stems from the success Americans enjoyed over the past half century. Think not only of the wealthy entrepreneurs, but the vast middle class that purchased their homes, often for what in hindsight look like very low sums, and which now can be sold at massively higher prices. In part this reflects the reality that previous generations simply had an easier time accumulating real estate and other assets at low prices. As a friend once told me, “A chimpanzee could have made money in L.A. real estate—and many did.”

The oldsters have also have benefited more from the asset-led economic recovery, according to a St. Louis Federal Reserve study, in part because they tended to buy their homes earlier and tend to have larger stock holdings. By 2017, according to Nielsen (PDF), Americans over 50 will control some 70 percent of the nation’s disposable income.

And the boomers—at least those in the more affluent classes—are about to get yet another windfall. As the members of World War II’s “Greatest Generation” die off, they are set to pass on between $8.4 trillion and $11.6 trillion to their Baby Boomer descendants, according to a study by MetLife.

In the coming decades this tsunami of inherited money will likely accelerate class divisions, as those in the current top decile (in terms of income) gather in more than a million in parental bequests, while those in the lower class will at best count their inheritances in the thousands. Among boomers who will receive an inheritance, the top 10 percent will receive more than every other decile combined.

This is just the beginning of the process. The well-born members of the millennial generation are set for an even greater inheritance, which will distort the economy even more. The Social Welfare Research Institute at Boston College estimated that a minimum of $41 trillion would pass between generations from 1998 to 2052. This huge transfer, the researchers believe, will usher in what they call “a golden age of philanthropy.” Even as most younger Americans struggle to obtain decent jobs and secure property, the Welfare Institute concluded, America is moving toward an “inheritance-based economy” where access to the last generation’s wealth could prove a critical determinant of both influence and power.

These trends will affect everything from geography to culture and politics. For one thing, we are likely to see people settling in areas depending on their class status. For example, an examination of income data by Mark Schill of the Praxis Strategy Group finds that, with the exception of retirement communities, the areas with the greatest dependence on rents, dividends, and interest are concentrated in the expensive “luxury cities” New York, Boston, and the San Francisco Bay Area (and their surrounding pricey suburbs).

With some areas, the differences are stark in terms of where this windfall lands. Manhattan, for example, was among the leaders of the nation’s core cities in asset-based wealth while the Bronx, just across the Harlem River, ranked at the absolute bottom. This inherited wealth is increasingly diffused among multiple cities as the expanding ranks of the ultra-rich purchase apartments in favored locations.

In contrast, it’s still hard to find concentrations of inherited wealth in historically poorer regions such as the South, even in booming growth regions such as Houston, Dallas-Ft. Worth, and Atlanta. These are places that you don’t have to use family money—or parental co-signers—to afford a decent home, as is often the case in places like San Francisco, Manhattan, or Brownstone Brooklyn—all places where, as the Financial Times’ Simon Kuper has noted, you no longer go to be someone; you only live there once you are already successful or living on inherited largess. They are, as Kuper puts it, “the vast gated communities where the one percent reproduces itself.”

In the coming decades, these trends could grow, particularly as economic and population growth slow. Of course, there have always been rich people, and wealthy enclaves, but the impact of inherited wealth on politics and culture—like that on real estate—may be more profound in the future. One key difference is education, which increasingly determines social status and wealth.

Historically, education was one way the middle and working classes, and even the poor, ascended the class ladder. But we may be seeing the end of this trend, given what some see as the “death of meritocracy,” particularly if you also count the enormous advantage in education that comes from going to an elite private school or a well-placed suburban public school. Over the past two generations, notes former Treasury Secretary Larry Summers, the gap in educational achievement between the children of the rich and the children of the poor has doubled. While the college enrollment rate for children from the lowest quarter of income distribution has increased from 6 percent to 8 percent, the enrollment rate for children from the highest quarter has risen from 40 percent to 73 percent.

So we have a graduate of Choate or Beverly Hills High who attends Wharton, and goes to work for, say, Goldman Sachs. And yes, this individual may work hard. But whether he or she works hard or not, the chances of success are much greater than those of an equally talented, equally diligent person who has to pay off college loans and whose choices about where to live—outside of places like New York or San Francisco—are driven as much by cost as they are by opportunity.

This represents a sea change from the past, where the inheritors earned their “gentlemen’s Cs” while the aspiring class busted for As. After all, who needs good grades to simply engage in traditional charity work—like feeding the poor or supporting their churches? But now many of the rich feel compelled to “make a difference.” No longer satisfied to suck gin and tonics at the country club, they want to find fulfillment, and impress their friends with their cleverness and social worth.

One place we can see this is in the cultural sphere. Hollywood, in particular, has always had a weakness for helping its own. Dorothy Parker once noted that “the only ‘ism’ Hollywood cares about is plagiarism.” But increasingly there is another “ism”—nepotism. And the trend can be seen across the the entertainment industry in such families as the Paltrows, Fondas, Douglases, and Smiths. You can see the wheels turning when someone like Jay Z puts his newborn baby’s cries—no doubt a budding rapper—on his songs.

But some of the most obvious places where dynastic power can be seen are on the executive side of the business. In the early years, the big powers were often rough, self-made men such as Jack Warner or Louis B. Mayer. People like David Geffen who worked their way up from the mailroom are increasingly rare. Today the hottest new producers tend to come from the richest classes, such as William Pohlad, son and heir of a Minnesota billionaire; Gigi Pritzker, an heir to the Pritzker fortune; and Megan Ellison, daughter of Oracle Founder Larry Ellison, one of the world’s 10 richest men.

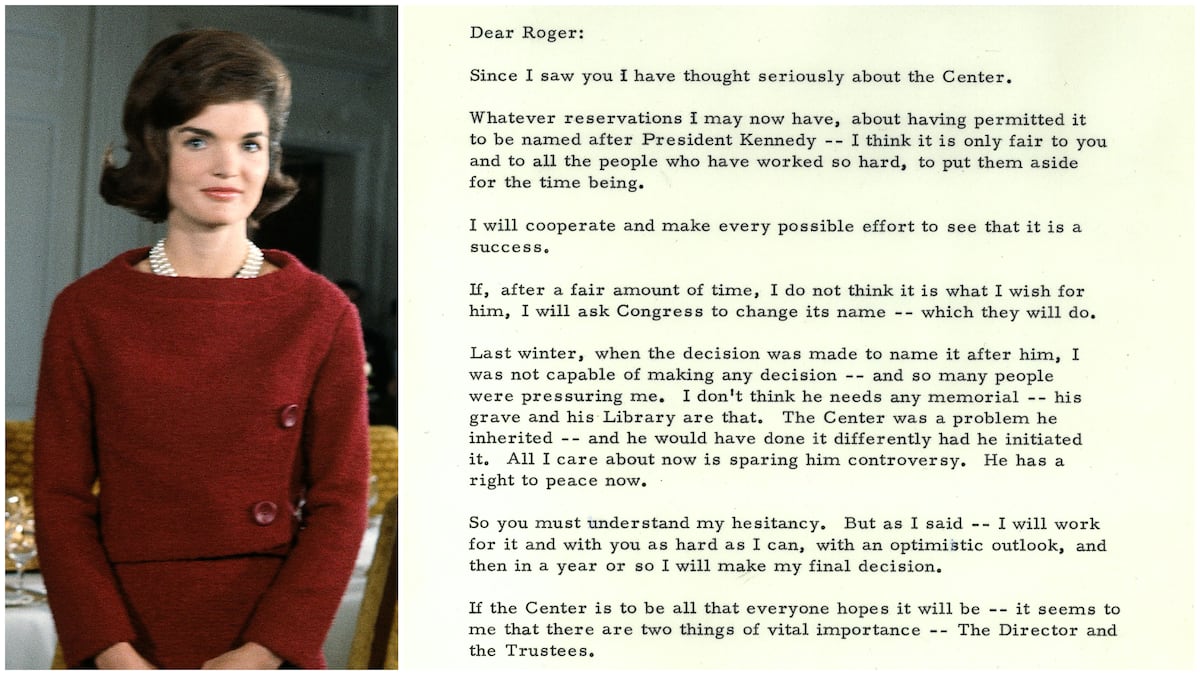

At the same time, the media itself, particularly in its most visible manifestations, is increasingly populated by the children of prominent politicians and by those who come from the ranks of the plutocracy. Middle-class parents may have to grind their teeth and empty their wallets as their kids work in unpaid internships in pricey Gotham, but this is not the fate of the offspring of the Reagans, Bushes, Clintons, McCains, Pelosis, or Kennedys, all of whom have ascended to levels of media power that mere mortals take years to achieve, if ever. If you need a show for millennials, why not hand it over to Ronan Farrow, the offspring of celebrity parents. In my time, generally speaking, the icons of a generation were likely to be outsiders; the “screwed generation” of millennials get to have theirs defined by whose birthright landed them on third base.

But perhaps the biggest long-term impact may come from the nonprofit institutions that the wealthy fund. Nonprofit foundations have been growing rapidly in size and influence since the late ’20s, paralleling the expansion of other parts of the clerisy like the universities and government. Between 2001 and 2011, the number of nonprofits increased 25 percent to more than 1.5 million. Their total employment has also soared: By 2010, 10.7 million people were employed by nonprofits—more than the number of people working in the construction and finance sectors combined—and the category has expanded far more rapidly than the rest of the economy, adding two million jobs since 2002. By 2010, nonprofits accounted for an economy of roughly $780 billion and paid upwards of 9 percent of wages and 10 percent of jobs in the overall economy.

Nonprofits, due to their accumulated wealth, are able to thrive even in tough times, adding jobs even in the worst years of the Great Recession.

In the past these organizations might have tended to be conservative, as inherited wealth followed the old notions of noblesse oblige and supported traditional aid to the poor, such as scholarships and food banks. But the new rich, particularly the young, tend to be more progressive, or at least gentry liberal. The direction of this rapidly expanding part of the clerisy will be increasingly important in the future, and already many of the largest foundations—Ford, Rockefeller, Carnegie, and MacArthur—veer far toward a left social-action agenda.This is particularly ironic since their founders were conservative, or even reactionary, and generally held strong, sometimes fundamentalist, religious beliefs.

Much of this shift reflects the social phenomena of inheritors in general. Not involved with making their fortunes, and sometimes even embarrassed by how those fortunes were made, the new generation of “trust-fund progressives” often adopt viewpoints at odds with those of their ancestors. One particularly amusing, and revealing, development has been the recent announcement by the Rockefeller heirs that they would divest themselves of the very fossil fuels that built their vast fortune.

Of course, there remain many conservative foundations, such as those funded by the Koch brothers, who wield their fortunes for highly conservative causes. But roughly 75 percent of the political contributions of nonprofits tend to go in a left, green, or progressive direction.

This trend is likely to accelerate, as millennials—who will inherit the most money and may be the most inheritance-dominated generation in recent American history—enter adulthood. Schooled in political correctness, and not needing to engage in the mundane work of business, this large cadre of heirs to great fortunes will almost surely seek to shape what we think, how we live, and how we vote. They may consider themselves progressives, but they may more likely help shape a future that looks ever less like the egalitarian American of our imaginings, and ever more like a less elegant version of Downton Abbey.