HONG KONG — On Tuesday, the People’s Bank of China devalued the nation’s currency, the renmenbi (or yuan), by 2 percent. The cumulative fall since the beginning of the week is 3.5 percent, the steepest two-day slide against the U.S. dollar in decades.

The joke online is that the paid Internet trolls of the Chinese Communist Party known as wu mao, or the 50 Cent Party, because they get half a yuan per social media post, should now be called si mao, the 40 Cent Party.

But the troubles in China’s economy can’t be masked by jokes or, for that matter, propagandizing trolls. Growth in manufacturing output, retail sales, and investment did not meet official expectations in July. In particular, Chinese exports shrank 8.3 percent last month.

China’s stock market slump in June massacred the portfolios of retail investors. The steepest single-day drop in the Shanghai Composite in 10 years triggered quiet hysteria across the nation. Even Alibaba, China’s web commerce juggernaut and occasional darling of Wall Street, has been hit, with its share price plunging roughly 35 percent from its November 10 peak.

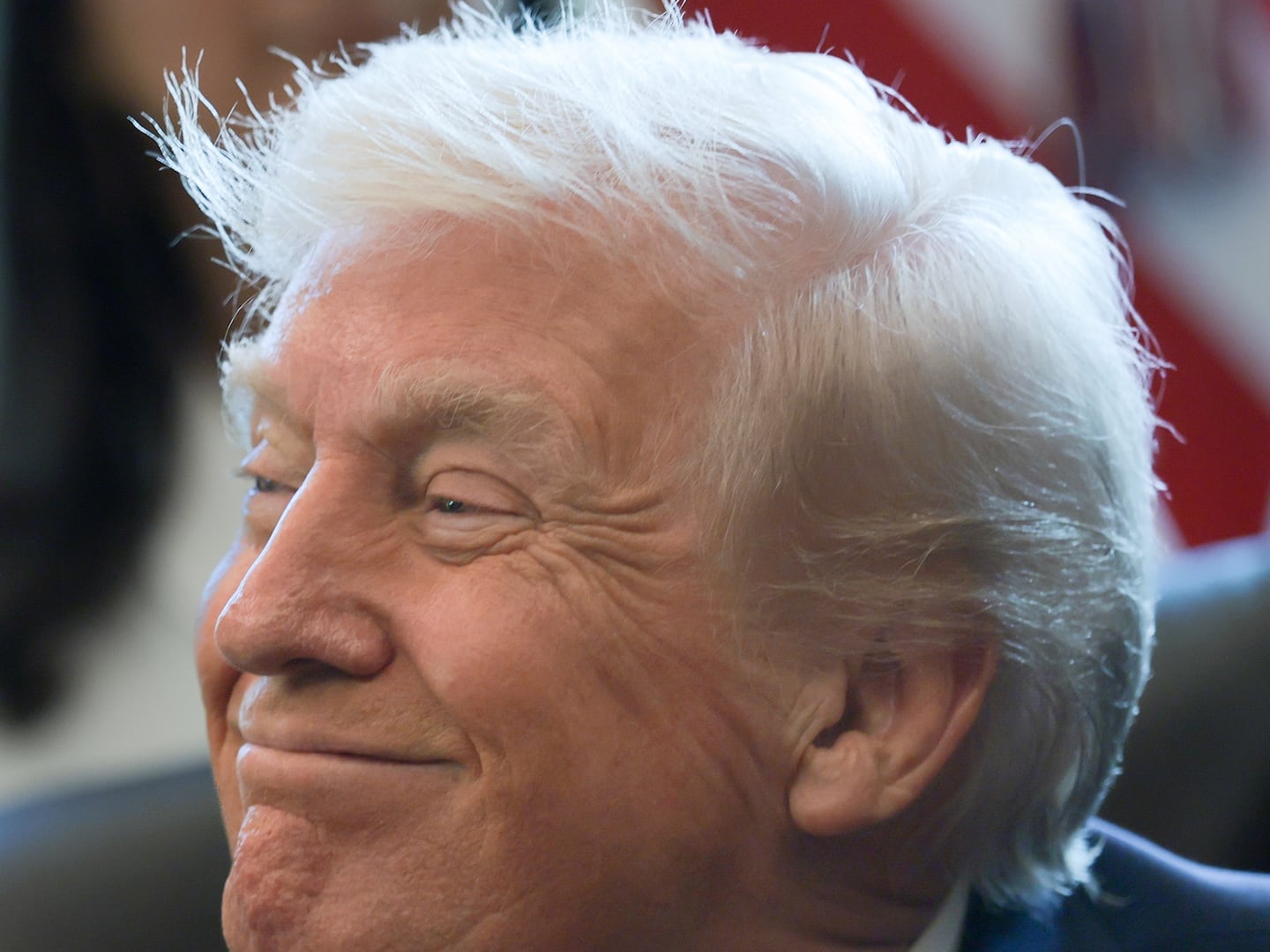

Many in the United States, who have complained for years that the Chinese keep their currency artificially weak, see this latest move as part of a conspiracy. Reality television bully and Republican presidential candidate Donald Trump says Chinese leaders are “sharp and cunning,” and the devalued yuan, which will encourage the import of more Chinese goods, will “suck the blood out” of the United States.

Trump’s language is more colorful than most, but he is not alone when he talks about international economic jousting. Stephen Roach, a senior fellow at Yale University who was a non-executive chairman for Morgan Stanley in Asia, told Bloomberg that what the People’s Bank of China did “raises the distinct possibility of a new and increasingly destabilizing skirmish in the ever-widening global currency war.”

The common idea that China wants to make its exports cheaper, so that its production sector may have an edge over foreign competition again, may be overblown. “Made in China” no longer means what it once did. As the manufacturing sector evolves and modernizes, jobs are leaving, and a devaluation is not likely to bring them back.

A good number of assembly lines that used cheap labor to make cheap goods have been relocated to Southeast Asia or Africa. The operations that have remained in China are increasingly shifting toward the use of robots in their production lines, even if they haven’t reached the point of true lights-out manufacturing yet. A 2 percent difference in the yuan’s value hardly justifies bringing back the plants that have gone overseas to Vietnam or Bangladesh or Ethiopia, where local labor churns out items that stock fast-fashion chains or low-cost electronics brands.

(Trump’s words also ring hollow when you realize that some of his branded merchandise is actually made in China.)

The devaluation also runs against a long-held Chinese objective. Beijing wants the renminbi to be a trusted currency, internationalized, a dependable mark like the U.S. dollar that can be used in international transactions. This hasn’t happened yet, although there have been a series of renminbi bilateral swaps since 2008 with various Asian, European, and African nations. Renminbi hubs dot the globe, and the (former) stability of the yuan made it an attractive currency for the rest of Asia. Surprises like Tuesday’s devaluation are exactly what prevents the yuan from becoming fully integrated into the global economy.

The People’s Bank of China released a statement on Tuesday saying that its move was a one-shot adjustment to ensure exchange rates were aligned with free-market practices, not a move to spur exports. On Wednesday, the PBOC said that the exchange rate will be kept “basically stable,” and that there was “no basis” to believe the yuan would “persistently depreciate.”

If this is true, and Beijing’s control over the rate is softened, then the devaluation actually matches what American officials have wanted for years—a more market-oriented exchange rate.

But things get a little messy if we look at the International Monetary Fund conclusion in May that the price of a yuan already was about where it should be: “While undervaluation of the Renminbi was a major factor causing the large imbalances in the past, our assessment now is that the substantial real effective appreciation over the past year has brought the exchange rate to a level that is no longer undervalued.”

What does all this mean for the average Chinese citizen with money in the bank? For most, right off the bat, it means they can buy fewer foreign goods (and far fewer luxury products) and take fewer foreign trips.

When the yuan was stronger, Mainland Chinese tourists turned their sights from Hong Kong and Macau and went further abroad. Their vacations landed them in Taiwan, South Korea, Japan, Thailand, France, and Italy. Hotels, retailers, and restaurateurs in these places adjusted their business models and welcomed a new set of clientele. Tuesday’s turn of events likely means global profit from Chinese tourists will dip slightly while they spend more at home.

For Chinese businesses, any entity that depends on imported goods, like oil, will see pressure from the rising price of petroleum and gas denominated in dollars. Overall, demand for crude may decline.

So perhaps there is an upside. At least the Chinese forced to stay home in droves may be seeing slightly bluer skies.