As spotlights flared in Asbury Park, New Jersey, earlier this month, Tyler Winklevoss clasped a microphone, closed his eyes, and bleated the lyrics to Don’t Stop Believin’—standing, as always, next to his identical brother, Cameron. It was a fitting song for two of the principal mascots of crypto, a movement reliant on epic sums of blind faith.

But as the crypto market melts down, the brothers appear to have lost some of their interest in the industry and their beleaguered startup Gemini, instead leaning into their “hard-hitting rock band,” Mars Junction. They have embarked on a 10-stop cross-country tour and launched a line of accompanying NFTs.

Gemini employees, meanwhile, are polishing their résumés.

Just days before the Asbury Park concert, on June 2, the Winklevii—a nickname that became famous via their depiction in the 2010 Facebook drama The Social Network—announced in a public statement that they were axing dozens of workers to make the cryptocurrency exchange “better over the long run.”

Based on interviews with nine current and former employees, that sequence of events isn’t going over well.

“They laid off 10 percent of their staff,” said one aggrieved former staffer, “and then they went on tour with their rock band.”

Another recently departed employee said Gemini employees were blindsided by the layoffs. More than a dozen have reached out to him, looking for advice or a job referral. “They’re like, ‘Yeah, I made it through, but I’m really nervous now,’” he said. “‘Like, I’m really scared.’”

For years, the Winklevosses have been held up as crypto heroes, traveling the globe as evangelists and pledging not to sell their holdings. “Bitcoin isn’t just an asset. And it’s not just a technology. It’s a movement that offers the blueprint to dismantle traditional power structures,” Cameron tweeted in May. (The 40-year-old former Olympic rowers are familiar with traditional power structures, as alums of a Greenwich, Connecticut, prep school, Harvard, and Oxford.)

Last fall, Gemini—which declined to comment for this story— raised $400 million from its first outside investment, and the company said it was weeks away from profitability. Forbes pegs the twins’ net worth at $3.2 billion apiece.

Yet even those numbers weren’t enough to prevent layoffs.

Said one recent worker of the founders: “Wow, you guys really talk about holding and holding and holding, but you don’t hold your own employees.”

Gemini’s problems aren’t just internal. The same day it announced the layoffs, the company was hit by a suit from the U.S. Commodity Futures Trading Commission claiming its leadership misled the FTC about a bitcoin futures contract and its efforts to prevent manipulation. The agency said it was seeking civil penalties and the forfeiture of any “ill-gotten gains.” (A Gemini spokesperson said in a statement that the company had an eight-year record of “asking for permission, not forgiveness, and always doing the right thing,” and that it “look[ed] forward to definitively proving this in court.”)

Four days later, the company was sued again—this time by one of its trading partners, the crypto retirement provider IRA Financial Trust. The company claimed Gemini’s insufficient security protocols were to blame for a $37 million security breach of many IRA Financial customers’ accounts on Feb. 8. Gemini rejected the allegations in the lawsuit, saying its security standards were “among the highest in the industry.” The company is currently trying to force the suit into arbitration.

Whatever becomes of the legal entanglements, there is clear reason to believe Tyler and Cameron are distracted. In recent weeks, they removed references to bitcoin from their Twitter bios, and they swapped out a link to Gemini’s website with one advertising their Mars Junction tour.

And the brothers, who used to tweet about Gemini multiple times per month, haven’t posted about the company since May 22—except to respond to news of the FTC suit. (“I might respond to this nonsense when I have some free time,” Cameron tweeted of the suit. “But I dunno, maybe not, we’ll see.”) Over the same time period, they have tweeted about Mars Junction a combined 35 times.

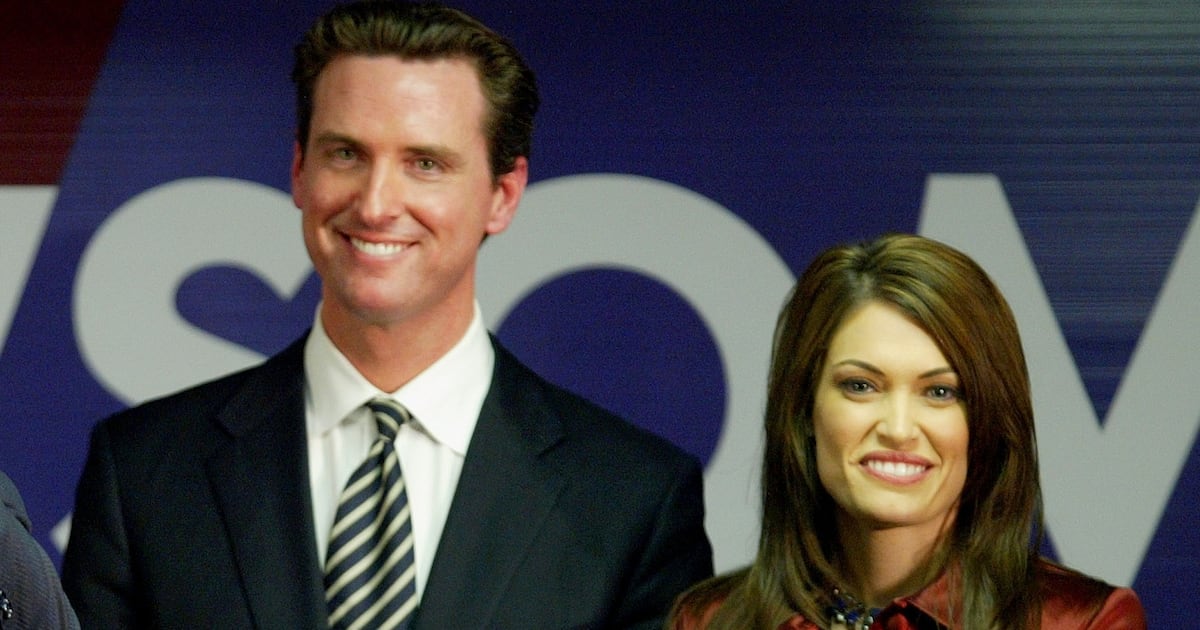

Cameron Winklevoss and Tyler Winklevoss pose at a Los Angeles holiday party in 2012.

Todd Oren/GettyThe brothers started Gemini in 2014, six years after receiving a $65 million payout from Facebook over claims that Mark Zuckerberg had stolen the idea for the social media site from them. At the time, bitcoin was worth only a few hundred dollars, and they were among the few public figures throwing their full support behind crypto.

The volatility of the crypto markets made for an excitable workplace. “You could definitely tell that people’s moods there were determined [by] the price of bitcoin,” said Harrison Leggio, a software engineer who left Gemini in 2021 and liked working there. “We had screens around the office with graphs of prices and stuff. When bitcoin was booming, people were super hype.”

The founders also cultivated an atmosphere of secrecy. As at other tech firms, employees signed non-disclosure agreements, multiple people familiar with the matter said, and workers grew fearful about openly critiquing the business.

One former staffer, who declined to speak on the record for that reason, said he began to worry about Gemini’s aggressive efforts to grow revenue and felt that the company “did not improve our customer’s lives, their financial well-being, or [serve] the public.” But he found few avenues to raise his concerns within the startup. “I would have panic attacks,” he said.

Starting in 2020, as the price of bitcoin recovered from a major price collapse, known as a “crypto winter,” Gemini accelerated its hiring plans, former employees said.

Nick Fuhrmann, who departed Gemini in late 2020 and had an overall positive view of the business, said there was industry-wide pressure to grow, which led to “lots of overhiring.”

Another former employee, who left the company late last year, complained that in the rush to hire, Gemini onboarded people who “really didn’t know what they were doing.” The startup’s leadership didn’t seem fully prepared for the volatility of the crypto market, either.

“I think the management was very young, [with a] kind of a finance-bro kind of mentality,” the former employee said. “I think leadership really was just kind of walking around like a bunch of chickens with their heads cut off.”

Cameron and Tyler Winklevoss leave the U.S. Court of Appeals on January 11, 2011, as they seek to void a 2008 agreement with Facebook.

Justin Sullivan/GettyStill, the recent layoffs came as a shock to the rank-and-file, who believed that Gemini’s leadership had prepared for a market downturn. Evidently not so.

The company gutted the bulk of its quality assurance team, according to a person familiar with the matter, creating concerns that future product launches will have bugs.

Current employees have vented their frustration on Blind, a social app that allows employees to anonymously review their companies.

“The company is barely afloat, it’s a sinking ship,” one verified employee wrote late last month. “The management/leadership in all divisions are trash. Most had like a year of work experience and [were] nobodies before they joined Gemini.”

It certainly hasn’t helped optics that, amid the meltdown, the twins have decided to go on tour. After the Asbury Park debacle, which went viral, Tyler attempted to blunt the criticism through a lengthy, emotional Medium piece.

He explained that the brothers were using the band to honor their sister, Amanda, an accomplished high school thespian who died at age 23 in 2002. “As much as I tell myself this is about challenging myself in a new way, which it is, I am coming to terms with the fact that this is very much a way for me to feel closer to my big sister,” Tyler wrote. “And even if I can’t hold a candle to her on the stage, I can at least be with her.”

The essay was moving but it did little to refute a legitimate point of criticism: that two billionaires were off playing cover songs while their employees were growing panicked.

The Winklevosses, after all, seem to place little stock in the opinions of critics.

“I think that what we identify with is this idea that you’re crazy,” Cameron said last year, invoking the ubiquitous “First they ignore you” quote frequently misattributed to Mahatma Gandhi and infamously paraphrased by Theranos founder Elizabeth Holmes.

“And quite frankly,” he added, “we’ve been crazy a lot.”