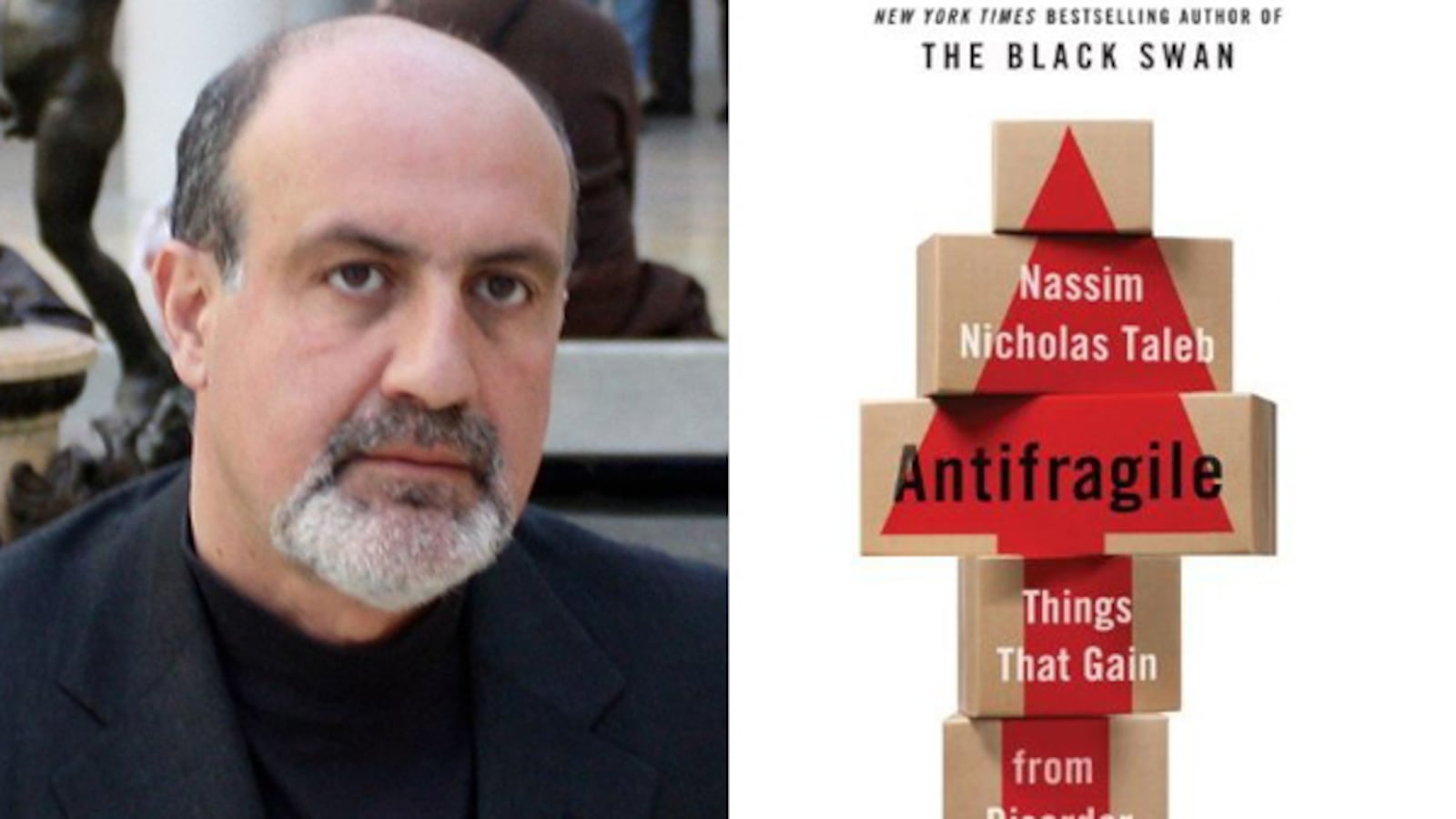

Nassim Nicholas Taleb has little tolerance for, well, a lot of things. But, as his latest book demonstrates, he holds a particular grievance against the mediocre, the safe middle ground, and most forms of moderation.

True to form, Antifragile: Things that Gain From Disorder, is a work of non-fiction that trades in extremes—a book that, in complete earnestness, offers thoughts on everything from the philosophy of Seneca and the structure of the Swiss government to the value of procrastination and the limits of academic research. He is just as likely to bring in Ben Bernanke and Ralph Nader as Hammurabi and Cato the Elder.

Taleb meanders between these and many other far-flung topics in the service of an impressively straightforward point: some things like volatility and some things hate it.

More specifically, his aim is to introduce a new concept he believes has been absent from our discussions of nearly all human endeavor, one called antifragility. Fragile things—a crystal champagne flute, for instance, or a house of cards—are hurt by stress, randomness, and uncertainty. Antifragile things, meanwhile, are strengthened by it—just as Hydra grows stronger and more multiheaded with every decapitation.

Taleb maintains that living things and complex systems are all antifragile to some degree. Our bodies, for the most part, thrive as a result of regular interaction with stressors in the environment just as “firms become weak during long periods of steady prosperity devoid of setbacks” and “[s]mall forest fires periodically cleanse the system of the most flammable material, so these do not have the opportunity to accumulate.” The process of biological evolution, technological progress, and economic growth all rely on some sort of messy, undirected trial-and-error process that is fueled by regular exposure to uncertainty. We insulate ourselves from such natural volatility at our own peril.

By adopting practices that makes our lives and institutions more antifragile, Taleb argues that we can better negotiate a world that is in so many ways inherently unpredictable. It’s an undeniably rich insight, so much so that even though Taleb seems to restate it in one form or another on every page, he continues to illuminate surprising dimensions and implications of the concept as the book unfolds. It seems antifragility doesn’t just shed light on how to structure our portfolio but also how to choose a lunch partner or decide what books to read.

Early versions of this idea were developed in his previous books Fooled by Randomness and The Black Swan. But this latest volume is intended as the most complete articulation of Taleb’s approach to grappling with uncertainty. It is, he tells us, his “central work.”

And like many attempts to lay the foundation for a new philosophical system, it offers its own vocabulary and a platter of new concepts. Hubristic wielders of rationality are dubbed “fragilistas” (Alan Greenspan, at one point, is labeled an “uberfragilista”). Those who practice “naïve interventionism” by recklessly meddling in complex systems often give rise to “iatrogenics,” or “harm done by the healer, as when a doctor’s interventions do more harm then good.” The many who believe that human knowledge begins in the academy are guilty of the fallacy of “lecturing birds on how to fly.” There are so many neologisms and repurposed turns of phrase, in fact, that a back-of-the-book glossary is provided for easy reference.

Taleb seems to have taken pains to is meticulously organize Antifragile into individual books, sections and subsections, with such largely unhelpful titles as “The Philosopher’s Stone and Its Inverse,” and “Plus or Minus Bad Teeth.” And while it rewards sequential reading, once the major ideas are understood, Antifragile can also be harvested for discrete aphorisms, ingestible in isolation.

As one goes: “We humans lack imagination, to the point of not even knowing what tomorrow’s important things will look like. We use randomness to spoon feed us with discoveries—which is why antifragility is necessary.” Another such self-contained nugget has it that: “Expert problems (in which the expert knows a lot but less than he thinks he does) often bring fragilities, and acceptance of ignorance the reverse.” Yet another tells us, “In the United States large corporations control some members of Congress. All this does is delay the corporation’s funeral at our expense.”

Taleb also provides a variety of practical ways to embrace antifragility. One can, for instance, rely more on trial-and-error processes and less on the assessments of experts when it comes to acquiring knowledge. Those calling the shots at the highest levels of an organization, or offering consequential opinions, Taleb advises, should have “skin in the game” and be held accountable if they get it wrong. We should also cultivate a greater reverence for failed entrepreneurs, as the personal risks they assume leave the entire economic system better off.

One of the book’s most distinctive—and, admittedly, entertaining—features is Taleb’s tendency to unapologetically skewer various establishment figures and archetypes. “[P]eople employed in financial institutions” he tells us “are rarely interesting and even more rarely likable.” He characterizes Nobel laureate Joseph Stiglitz as “an academic economist of the so-called ‘intelligent’ variety.” And recounts a visit to Davos where he became nauseated—actually nauseated!—upon making eye contact with New York Times columnist Thomas Friedman, whom he considers “vile and harmful.”

Among other things, such merciless critiques of the well regarded suggest that the ideas Taleb offers aren’t just intellectual Tinker Toys, but have real moral weight for him. Those that ignore these insights, he makes clear, deserve his derision, and ours, too.

More than anything else, the book’s sheer scope, as well as its capacity to move with great confidence between the macro and micro while attempting to uncover seemingly universal principles harks back to the writings of classical antiquity. This is a conscious choice by Taleb, who regularly evokes the ancients, and who suggests throughout that he is taking his cue more from the likes of Seneca and Aristotle than any regular of the Aspen Ideas Festival.

This is displayed most brazenly in a passage envisioning a dialogue between Socrates and one of Taleb’s own rhetorical creations, Fat Tony—a corpulent, independently wealthy Italian gentlemen from New Jersey. As an embodiment of antifragility Fat Tony pays little heed to books or the opinions of experts, and instead cares only about his own bottom line, sizing up the world in terms of suckers and non-suckers, risks and rewards. In his dialogue with Socrates, Fat Tony takes over for Euthyphro, besting the philosopher where Euthyphro famously fell short, and displaying the limits of definition-based forms of knowledge in the process. “The problem, my poor old Greek,” Fat Tony tells Socrates, “is that you are killing the things we can know but not express … You are taking the joy of ignorance out of the things we don’t understand. And you have no answer.”

Tangling with the ancients in this way takes a certain Herculean arrogance. And it would be easy to write off the entire book as precisely the kind of cocksure theorizing that Taleb himself so adamantly condemns. This would be a mistake.

For all of Taleb’s obvious self-assuredness, Antifragile is, in part, an exploration of how little we understand, and how much suffering arises from overestimating the firmness with which we grasp the universe we inhabit. “There are secrets to our world,” he writes, “that only practice can reveal, and no opinion or analysis will ever capture in full.” It might be more appropriate, then, to see Antifragile as a paean to intellectual modesty—a characteristic that, strangely enough, nobody is likely to ascribe to Taleb anytime soon.

Editor's note: An earlier version of this article confused the monster Hydra with Medusa.