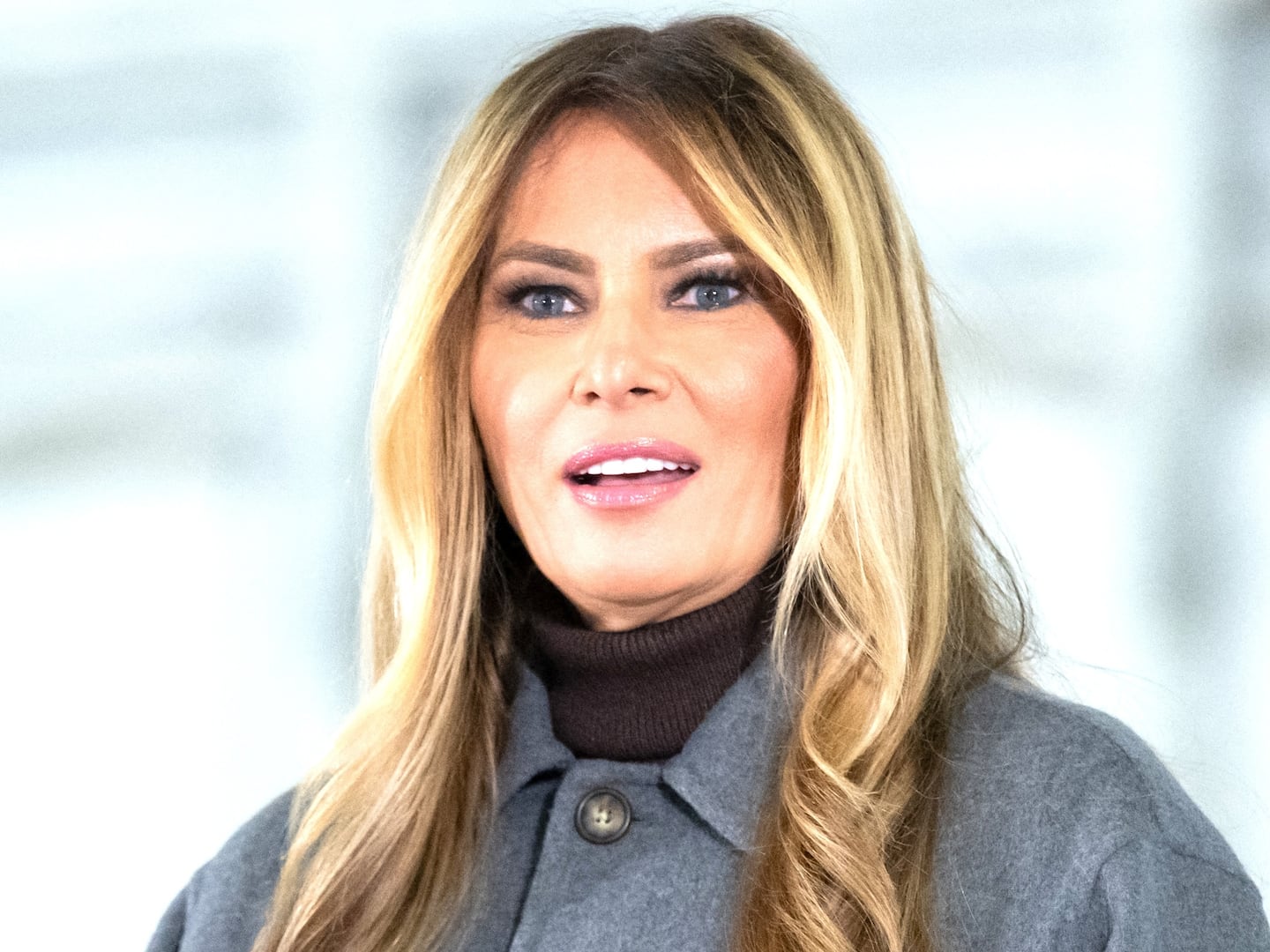

When German chancellor Angela Merkel arrived in Athens on Tuesday, she was met with a 7,000-strong police escort. But it wasn’t out of respect—it was to protect her from being physically attacked by more than 50,000 angry Greeks who took to the streets to protest her brief six-hour state visit. Police used tear gas and pepper spray to keep the rowdy mob at bay, but the chaos was not lost on the German leader, although she is quite accustomed to animosity by now. Merkel is the common target of most euro-frustration because she is the de facto leader of Europe, thanks to her country’s immense wealth and prosperity while the rest of the 17 members on the single currency teeters on the edge of financial ruin. “I am convinced that the path, which is a difficult path, will lead to success,” she said in a joint press conference with the country’s new prime minister, Antonis Samaras. In the gilded stateroom, Merkel was greeted by civility—but in the streets, banners written in red proclaimed “Frau Merkel Get Out” and “You’re not welcome here” in Germany, Greek, and English.

Merkel’s visit comes on the heels of an important inspection by the International Monetary Fund, European Central Bank, and European Union, the so-called “troika” of financial creditors who hold Greece’s future in their hands. They are expected to issue a make-or-break report card in late October or early November that will succinctly recommend whether Greece has done enough to get its next €31.5 billion bailout check. Samaras says Greek coffers will be empty by mid-November, and the country has already instituted hiring and pay freezes for many of the country’s civil servants. If Greece doesn’t get the much-needed cash, the country will default on its debt and then spiral into an economic abyss—and it still needs to implement 89 remaining “actions” before an Oct. 19, when European financial leaders are scheduled to meet and make their recommendation to the troika. The sizable “ to-do” list is aimed at shrinking the country’s burgeoning public debt, which is expected to be 182 percent of the country’s GDP in 2013—and that figure is after belt-tightening measures are in place. “Clearly there is progress on the ground,” IMF director Christine Lagarde said ahead of Merkel’s visit. “But more needs to be done.”

Greek leaders have asked for a two-year extension to help deaden the pain, but it is unclear whether European leaders will be lenient with the deadlines—especially given the growing problems elsewhere in the economically challenged euro zone. On Tuesday, Cyprus lurched one step closer to defaulting on its debt loans, in part because of their tight connection to the Greek catastrophe. Portugal, also teetering dangerously close to default, barely scraped by on its financial obligations to satisfy requirements for their own much-needed €43 billion installment payment from a €78 billion euro bailout.

Greece may ultimately weaken the euro if leaders can’t make the necessary cuts, but no one is discounting Spain as the real threat to the future of the currency. Despite a banking catastrophe last summer that prompted the EU to pony up €100 billion to bail out its worst-hit banks, the Spanish government has so far resisted officially requesting a bail-out for the rest of its limping economy. Unemployment in Spain now tops 25 percent and prospects for growth are increasingly dim as the country tries to self-heal its own sick economy through austerity measures without becoming beholden to the EU or ECB like Greece and Portugal. And don’t forget about Italy: Europe’s third-largest economy has managed to stave off a total economic meltdown for now, thanks to tough love from its technocratic leader, Mario Monti, who has made reining in tax evasion and corruption his priority to great success. But the IMF still expects the Italian economy to contract by 2.3 percent in 2012, which will make growth even more challenging and likely mean higher unemployment and even more cuts to public services. “Some things have improved in the last few months, but the road ahead is still long and uphill,” European Central Bank chief Mario Draghi told the European Parliament ahead of Merkel’s visit to Greece. “But what’s the alternative?”

At the end of her visit to troubled Greece, Merkel’s closing remarks easily reflected the greater sentiment of gloom and doom across the euro zone. Noting that seven of the 17 states on the single currency are facing increasing financial difficulties, she urged the struggling nations to resist and carry on. “We are dealing with problems that have arisen in part over decades, and these problems can’t be solved with one bang, with one measure,” she said at the joint press conference with Samaras. “It will be a long path but I believe that we will see light at the end of the tunnel.”