Failure Friday is back. After a lull of a couple weeks, three banks failed on Friday.

Gulf South Private Bank, a four-branch bank based in Destin, Florida, with $159 million in assets, failed and was taken over by SmartBank, based in Pigeon Forge, Tennessee.

First East Side Savings Bank, a one-branch bank based in Tamarac, Florida, with $67 million in assets, failed and was taken over by Stearns Bank National Association, based in St. Cloud, Minnesota.

Excel Bank, a four-branch bank based in Sedalia, Missouri, with $200 million in assets, failed, and was taken over by Simmons First National Bank, based in Pine Bluff, Arkansas.

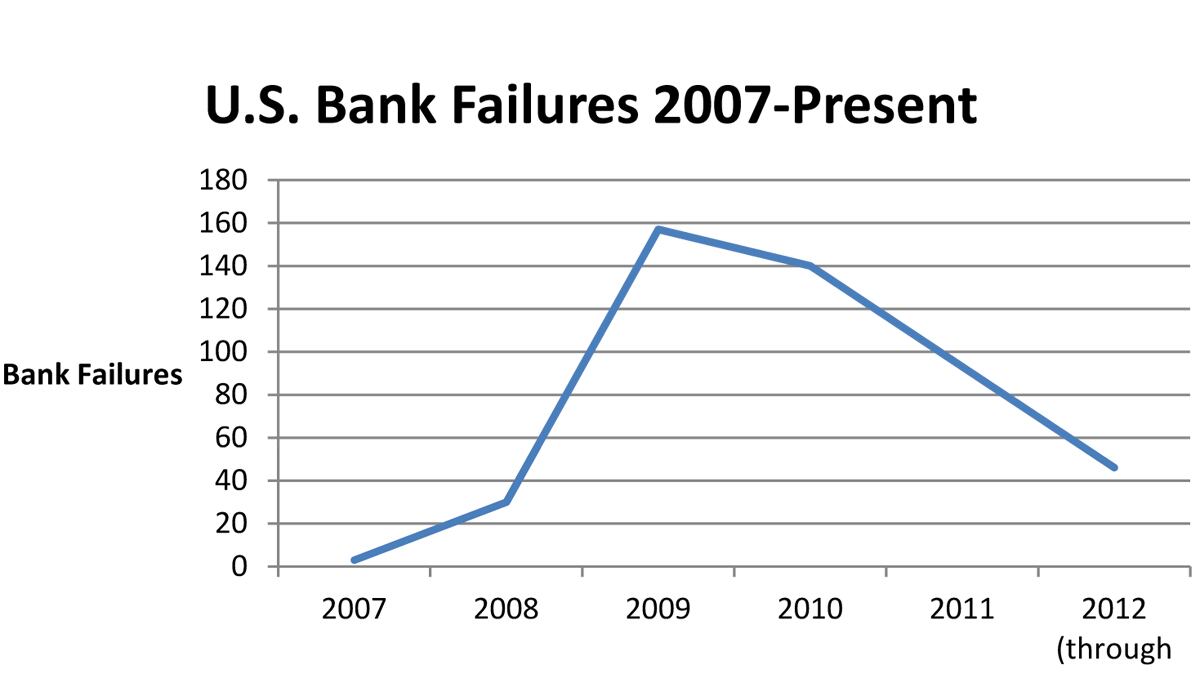

This brings the total to 46 banks failing through the first 42 weeks of 2012. But that’s still progress. As the chart shows, bank failures rose sharply in the wake of the housing bust: 30 in 2008, 140 in 2009, and 157 in 2010. (The FDIC's complete failed bank list can be seen here.)

But the wave of failures has subsided. Bailouts, government guarantees, and the Fed's easy money policies helped buoy banks. Meanwhile, American companies, borrowers, and consumers started to do a much better job keeping up with financial obligations. This is one of the great underreported and underdiscussed features of the current economic expansion. In 2011, 93 banks failed. That's high by historic standards, but it was down 40 percent from 2010. And the size of the banks failing fell, too. All of which meant the systemic implications of bank failures became far less severe in 2011 than they were in 2010.

That trend is continuing through 2012. As noted, through the first 42 weeks of 2012, 46 banks have failed – more than one per week. But in the first 42 weeks of 2011, 86 banks failed. So far through 2012, then, bank failures are down 46 percent from 2011.