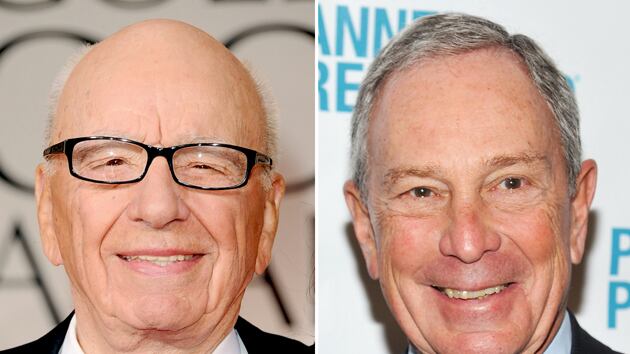

As Rupert Murdoch splits up News Corp, many say he’s aiming to separate the wheat from the chaff, to free the lucrative entertainment group from the lagging, scandalized newspapers, and keep the Street happy.

But behind the News Corp. shakeup, Murdoch appears to be embarking on a new strategy to revamp at least one of his media properties. According to former and current Dow Jones executives, as well as industry analysts, the company is taking a page from rival Bloomberg and launching a data-driven expansion of Dow Jones, the jewel in Murdoch’s American crown.

The new CEO of Dow Jones, Lex Fenwick, previously ran Bloomberg Ventures, that company’s three-year-old venture-capital unit. Fenwick, in turn, has hired three deputies from Bloomberg. He has started a new division, Data Strategy, which according to a Dow Jones internal memo will funnel data to business and institutional customers. According to one executive, Fenwick has even started “tearing the doors off offices,” creating the kind of open workspace environment Bloomberg is known for.

Ashley Huston, Dow Jones’s vice president for communications, declined to comment on the Dow Jones leadership transition or News Corp.’s strategy.

Murdoch is widely known to have newspapers in his DNA, and analysts have speculated he was forced to split the company by anxious investors. But if the publishing division has any hope for survival on its own, Murdoch might be forced to take the bitter pill of reinventing that side of the business to compete better with his data-focused competitors. In 2011, Bloomberg controlled 30.44 percent of the $16 billion financial-data market, according to Burton-Taylor. Thomson Reuters took a close second, at 30.05 percent, and Dow Jones, a distant third, with 1.6 percent.

The newspapers, meanwhile, have been hurting. News Corp. bought Dow Jones in 2007 for $5 billion. Goldman Sachs recently valued Murdoch’s new, postsplit publishing arm at $5.35 billion, including Dow Jones, HarperCollins, and all foreign newspaper properties. In contrast, when Michael Bloomberg bought back a 20 percent share of his company in 2008, Merrill Lynch valued the whole company at $22.5 billion.

Not that Dow Jones is going into the terminal business, say analysts. Bloomberg has that market wrapped up. But, says Lazard’s Barton Crockett, “it makes a lot of sense for Dow Jones to put more into data subscriptions,” which can be hugely profitable. Crockett says Dow Jones appears to be thinking “about creeping down the road towards Bloomberg.”

One recent move that could signal a shift in strategy was the executive shakeup that saw the departure of President Todd Larsen. One former executive described Larsen as “a numbers guy” who “kept the trains running on time” after News Corp. bought Dow Jones and who had lobbied hard for the CEO job. But according to one current executive, Murdoch was looking for someone willing to roll heads. “I don’t know if Todd was that person,” says the executive. Lex Fenwick, who got the CEO job over Larsen, “[is] more aggressive, more of an extrovert, more hands on … The type to do a death check or a walk-around.”

Neither Larsen nor Fenwick responded to requests for comment.

Last week, Fenwick announced the resignation of three Dow Jones executives and the hiring of three former Bloomberg colleagues—two of them, Tracy David and Victoria Chin, were his former deputies at Bloomberg Ventures. Dan Hayter, also formerly of Bloomberg, was brought on to head up institutional sales, as well as the business-to-business Factiva product. The same week, Fenwick announced that he would close the print version of SmartMoney magazine. An internal memo said that the newly online property will report to the head of the Wall Street Journal Digital Network. SmartMoney.com joins a stable that includes WSJ Deutschland, Dow Jones’s all-digital, data-driven German service launched earlier this year.

Fenwick will oversee Data Strategy, which will create a cross-company research juggernaut to pipe data directly into “institutional products and enterprise customers,” according to an internal memo. Fenwick said it was a structure “that will allow us to better integrate and align our assets.”

As Lazard analyst Crockett puts it, “everyone’s used to getting quotes, data, and charts online. Dow Jones wants to make sure you get that stuff better in the Journal”—or in video, or on an iPhone.

Says Wunderlich media analyst Matthew Harrigan, “If the walls between print and digital become arbitrary over time, they’re going to be in an amazing position to grow the company.”

Other analysts say the split could just as easily be a fatal blow to Dow Jones, The Wall Street Journal, and the rest of Murdoch’s publishing empire. “We and others believe the business is in decline,” says BTIG’s Rich Greenfield. “We’re not assuming there’s a growth opportunity in the spinoff.”

Maybe. But as Fenwick and Murdoch tease out their “just-approved expansion plans,” as the internal memo says, they may be trying to conjure a bit of the old Bloomberg magic: turning the data pipe into the money pipe. It’s a feat that could be easier in the 21st century, when a Macbook can theoretically match a proprietary terminal. “It makes sense for them to move into Bloomberg’s backyard,” says Crockett. “There’s a lot to do. But it’s a big company that thinks over large spans of time.”