President Donald Trump’s sweeping overhaul of crypto enforcement has provided a boon to his pals in the sector, a New York Times investigation has found.

The newspaper reports that under the second MAGA administration, investigators at the Securities and Exchange Commission have dramatically revised their approach toward digital asset companies, with several lawsuits against politically connected crypto firms being slowed, softened, or abandoned altogether.

Trump and his family hold sizable assets in the sector, and the president otherwise sanctioned massive rollbacks to the way the industry is regulated.

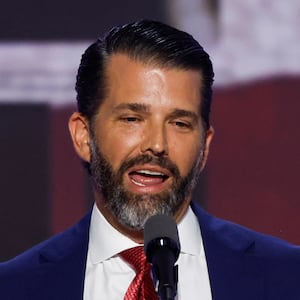

Prior to January of this year, the agency had been pursuing aggressive litigation against several major players in the sector. These included Gemini Trust, controlled by Cameron and Tyler Winkelvoss, who are both long-time financial backers of President Trump, as well as business associates of his sons Eric and Donald Jr.

Prosecutors, according to the NYT’s reporting, had targeted Gemini for allegedly offering unregistered investment products. After Trump’s return, the agency is understood to have asked a judge to halt proceedings while a settlement is negotiated.

A separate action against Binance—the largest crypto-exchange globally, whose controversial founder Changpeng Zhao had been convicted of money laundering prior to a presidential pardon this summer—has now been dismissed outright.

The SEC has also sought to reduce the scale of penalties sought from Ripple Labs, a crypto firm that donated an estimated $5 million to Trump’s inaugural fund, though a judge is understood to have since rejected those efforts.

Overall, the NYT notes the agency has dismissed seven cases against groups in the sector since January of this year, of which five have known ties to the administration. In a further seven cases, three of which pertain to allies of the president, proceedings have either been frozen, conceded, or seen favorable settlements proposed.

Of the nine cases the SEC continues to pursue against crypto firms, none are known to have ties to MAGA. The number of fresh cases brought against companies in the sector since January stands at zero.

The agency has denied any favoritism in moves on cases pertaining to Trump allies, saying politics “had nothing to do with” its decisions and pointing instead to doubts about its legal authority over cryptocurrencies.

Chairman Paul S. Atkins argued that prior leadership relied on enforcement to set policy, declaring, “I’ve made clear that we would end regulation by enforcement.” Republican commissioners have long maintained that many digital tokens fall outside securities law.

The Times stressed there’s no evidence the president directly intervened in individual cases, and that it found no proof donations or relationships were used to influence outcomes.

Former senior SEC lawyer Christopher E. Martin nevertheless characterized the retreat as “a complete surrender,” adding “they’ve really just thrown investors to the wolves.”

The Daily Beast reached out to the White House and the SEC for comment on this story.

“The SEC’s authority is defined and limited to securities enforcement. While the prior administration classified without precedent nearly all digital assets as securities and used enforcement to shape policy, Chairman Atkins and Acting Chairman Uyeda have rightly restored focus to fair process, sound judgment, and legal integrity,” a spokesperson for the agency said. “This approach reflects their longstanding, publicly-expressed legal views, not political motives, on what constitutes a security under the law.”