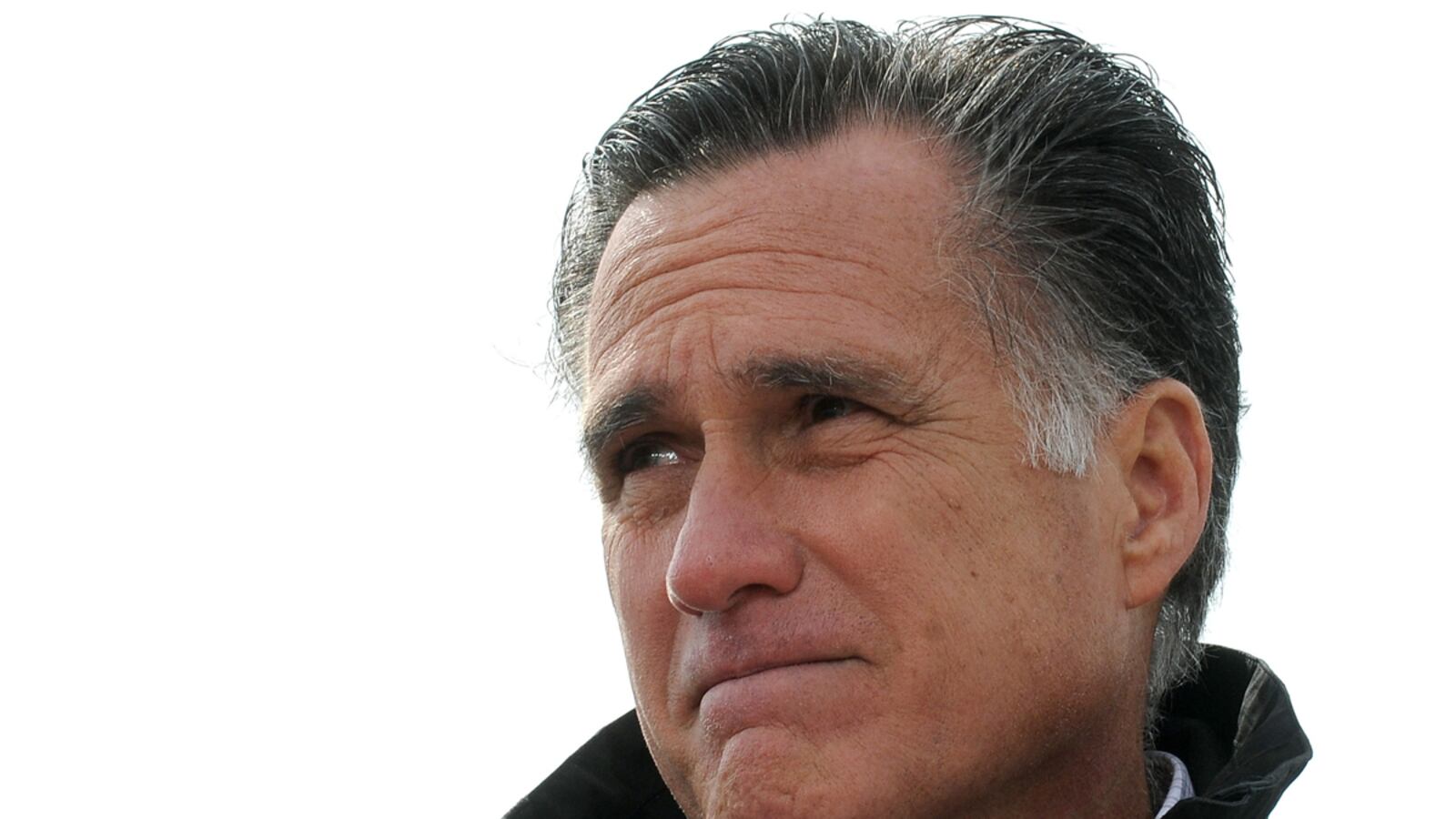

In Newsweek this week, David Stockman dissected the performance of Bain Capital during the Mitt Romney years. His conclusion: the company was no job creator. Here are some of the stories of those years, with questions for the candidate appended.

THE ZOMBIES Stockman says Bain’s billions of profits were not rewards for the hard slog of making viable businesses. They were mostly unearned windfalls collected from gambling on markets that were rigged to rise. He calls the companies you left with unsustainable debt “zombies.”

Stockman says the “startling fact” is that four of the ten deals that made big money for Bain ended up in bankruptcy, and for an obvious reason: Bain got its money out at the top of the economic boom of the late 1990s and then these companies hit the wall during the 2000-2002 downturn, weighed down by the massive load of debt Bain had bequeathed them. In fact, nearly $600 million, or one-third of the profits earned by the these companies, had been extracted from the hide of four eventual debt zombies.

One example is American Pad and Paper. Bain Capital invested a mere $5 million in 1992, then loaded it with debt at the purchase and through acquisitions. Four years later, Bain pulled out of the company without making it viable. In fact, it was so in debt that it went bankrupt in 1999. But Bain had made $100 million on the financial dealing.

QUESTION: Wasn’t American Pad and others just an exercise in cash stripping that could not occur in an honest free market where the central bank was not in the tank for Wall Street?

**

DEATH BY DEBT Bain invested $10 million in 1988 then borrowed $300 million to buy about 300 small Main Street stores. The year before, it had borrowed $300 million to buy a 250-store chain of family-clothing stores. The acquisitions formed a combined operation dubbed Stage Store. When Bain unloaded its shares in the parent company for a profit of $100 million. Stage Stores was so loaded with debt it had to file for bankruptcy.

QUESTION: Bain Capital says the company “grew for years” under your stewardship. But isn’t it true that the growth came from inflated inventory and vastly overstated assets? Wasn’t the growth—as with Stage Stores—actually the result of financial engineering games you played from the very beginning?

**

FLIP FLOP In September 1996, Bain Capital invested $88 million inequity in a consumer credit company called Experian and sold it to a British conglomerate seven weeks later for $1.7 billion, producing $600 million profit for investors, and a spectacular $165 million windfall for Bain.

QUESTION: How does that kind of quick-flip gambling represent building a business and creating jobs?

**

ITALIAN YELLOW PAGES In late 1997, Bain invested $17 million for less than 10 percent of the stock of the Italian yellow pages company. About 30 months later, Bain took out a profit of $375 million—or 22 times its investment. This was Bain’s largest profit during your tenure.

QUESTION: How do you explain such gigantic profits from a phone book in so little time, and what does that have to do with your alleged experience as a builder of businesses and creator of jobs?