In the criminal and civil investigations of the biggest Ponzi scheme ever, the searchlights never blink. And now, more than ever, Andrew Madoff, the 44-year-old younger brother of Mark Madoff, who killed himself on Saturday, will be a key focus.

One look at the bankruptcy trustee's complaint against the Madoff brothers makes it clear that from a legal point of view, they might as well be twins. No doubt prosecutors from the U.S. Attorney's Office in Manhattan have been seeing the duo as one, and possible joint co-defendants, since the brothers turned in their father, Bernie, to the FBI on Dec. 10, 2008, and asserted their lack of knowledge about the Ponzi scheme that funded the family businesses.

The Madoff brothers shared titles and alleged responsibilities at Bernard L. Madoff Investment Securities in New York and were directors of the separately incorporated Madoff operation in London. Mark Madoff was the trustee of Andrew's children's trust funds and vice versa. Mark was a University of Michigan graduate; Andrew a Wharton School-University of Pennsylvania man.

But as a family friend told The New York Times, "Andy was always tougher than Mark."

And, on advice of counsel, neither one has apparently talked to their father or their mother Ruth in two years. Andrew still will not see or talk to his father any time soon, as the Bureau of Prisons already has decided that Bernard Madoff will not be allowed to take a furlough from the 150-year sentence he is serving at federal prison in Butner, North Carolina, for his son Mark's funeral.

While bankruptcy trustee Irving Picard said in a statement: "This is a tragic development and my sympathy goes out to Mark Madoff's family," it was hardly an apology. His counsel, David Sheehan, from Baker & Hostetler, also confirmed to The Daily Beast: "The trustee will move forward with all the litigation that has been filed, including the litigation in which Mark Madoff is named."

In other words, Mark Madoff's estate will now be a party to all the legal action.

The job of the bankruptcy trustee, in his pursuit of Madoff money, is to be implacable, unblinking, undeterred, and totally determined. In the case of the Madoff brothers, the trustee's legal papers say each brother got about $60 million from the family enterprises and their parents that was stolen from investors.

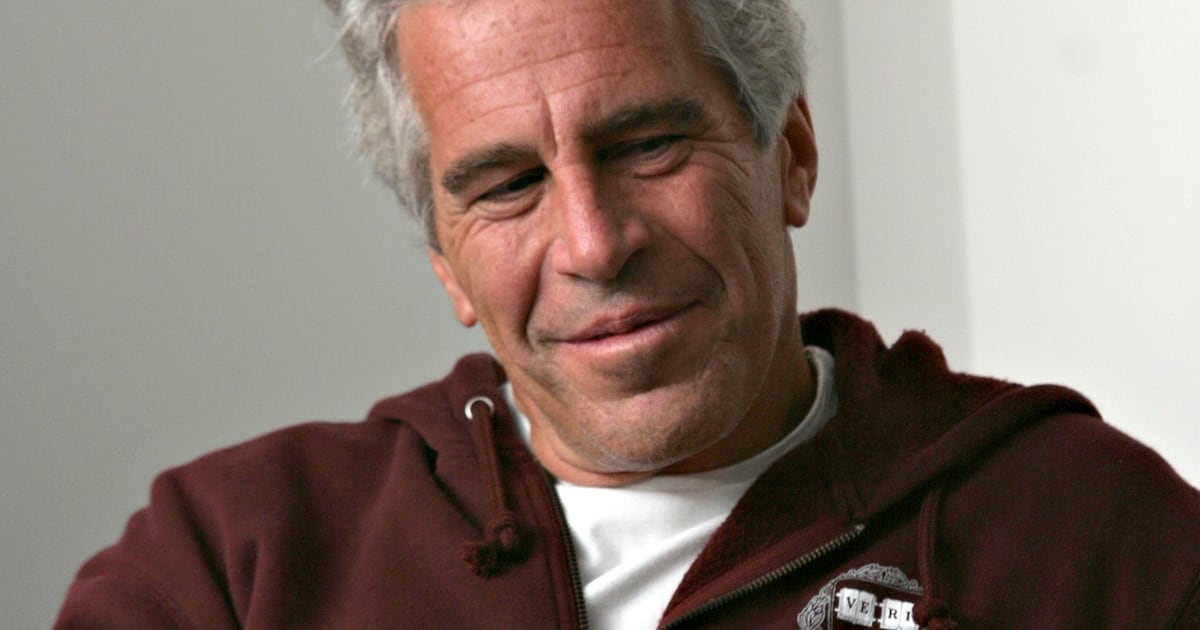

Gallery: Madoff Family Photos

• Allan Dodds Frank: Mark Madoff’s Agony • Frank: Madoff’s Devilish Female Partner in Crime • Complete coverage of Mark Madoff For the Madoff brothers, seeing Bernie's trusted assistants Annette Bongiorno and JoAnn Crupi indicted recently and stuck in jail, unable to raise $5 million in bail money, must have been unsettling. The federal prosecutors have long been after the two women to cut plea deals and testify about what the brothers may have known about all sorts of fraud, not just the $60 billion Ponzi, and to detail what they did in the way of falsifying documents to fund the seven accounts each brother had.

Frank DiPascali Jr., whom Bernie put in charge of making all the fake trading activity look real, also has been cooperating fully with prosecutors for months and may already have sunk the Madoff brothers, as well as Bernie's brother Peter and his daughter Shana, who was a "compliance officer" at the firm.

Prosecutors also will be scrutinizing allegations made by the trustee that the brothers engaged in all sorts of other crimes that include security fraud and tax fraud and making up fake backdated stock trades worth millions of dollars in Big Board securities including Dell Computer, Lucent Technologies, and Microsoft.

The trustee says in his complaint: "Between 2001 and 2008, Andrew was paid $31,105,505 in salary and bonus. His compensation included bonuses of over $4.8 million in 2006, and over $9 million in 2007, alone. Beyond this amount, in a proof of claim filed with this Court, Andrew seeks an additional $40,624,525 in deferred compensation. Although the Trustee has discovered self-serving documents, created by Andrew, stating that he is owed over $9.5 million in deferred compensation as of March 2008, there is no evidence that anywhere near this level of compensation was, in fact, deferred. At any rate, in documents filed in connection with Andrew's divorce proceeding, he disclosed that his unpaid deferred compensation was only $52,173."

Of the two brothers, Andrew seemed to be emotionally stronger. Last year, Andrew allegedly punched a disgruntled former Madoff employee named Reed Abend in the nose when Abend confronted him on the street. And the Associated Press reported after Mark's suicide: "A person who had recent contact with Mark Madoff, speaking on condition of anonymity because of the sensitivity of the case, said Sunday that Andrew Madoff, a cancer survivor, has occupied himself by helping his fiancee in a business venture. 'He's been doing much better than his brother,' over the past two years, the person said of Andrew Madoff."

The brothers particularly enjoyed deep sea fishing with their father off Montauk and in other exotic locales. Andrew took a tremendous interest in fly fishing, buying a venerated fishing reel company called Abel Reel Co. His wife, Deborah, filed for divorce the day after her father-in-law was arrested, and Andrew is reportedly living with Catherine Hooper, who was affiliated with the Urban Angler, an upscale Fifth Avenue fly fishing store in which Andrew Madoff also took an ownership stake.

Since Madoff senior's arrest, Andrew has disengaged his financial interests from those fishing ventures. Both he and Mark had agreements with the bankruptcy trustee not to dissipate or try to move assets.

"The trustee will move forward with all the litigation that has been filed, including the litigation in which Mark Madoff is named."

According to the trustee's accounting: "In 2003, the $12,000 down payment on Andrew's boat was paid with a check issued by one of the BLMIS operating accounts;

• In 2002, BLMIS paid $68,900 to the Beacon Point Marine in Connecticut where, on information and belief, Andrew kept the boat paid for, in part, by BLMIS;

• In 2001 and 2002, BLMIS funds were used to pay $75,000 to 'Lock and Hackle,' a fly fishing and hunting membership club in Miami, Florida on Andrew's behalf;

• Between 2002 and 2008, BLMIS funds were used to pay for $813,287 in personal expenses charged to Andrew's American Express card such as clothes, boat rentals, and vacation travel for his wife and daughters."

Still Andrew Madoff and Hooper apparently have been trying to make a go of a family disaster counseling business called Black Umbrella, according to a recent profile in The New York Times.

While that may sound a little odd, it may have been more realistic than Mark Madoff's efforts to find work. The Wall Street Journal and others have reported that Mark still held out hope that he could someday once again be employed in a Wall Street job. One person involved with the case was incredulous about how that might have pushed Mark Madoff to suicide, telling The Daily Beast: "He was apparently just beginning to realize that he was unemployable."

Allan Dodds Frank is a business investigative correspondent who specializes in white collar crime stories. He also is the former president of the Overseas Press Club of America, one of the many journalism organizations that protests the arrests of journalists abroad and repression of freedom of speech.