Ben Bernanke has long been seen as a market mover. The policy set by the Federal Reserve, which he chairs, has profound effects on both the markets and the real economy. Bernanke’s comments in June that the Fed might begin tapering back QE3 – the program through which it purchases $85 billion in bonds per month in an effort to keep interest rates down -- sent stocks tumbling and interest rates through the (comparative) roof. The spike of 10-Year U.S. Government bonds, from 1.63 percent in early May to 2.60 percent in early-July, had some serious ramifications for hedge funds and other prominent financial institutions. But now the impact has recently moved past the financial industry and worked its way into the very foundations of the real economy, specifically the mortgage market.

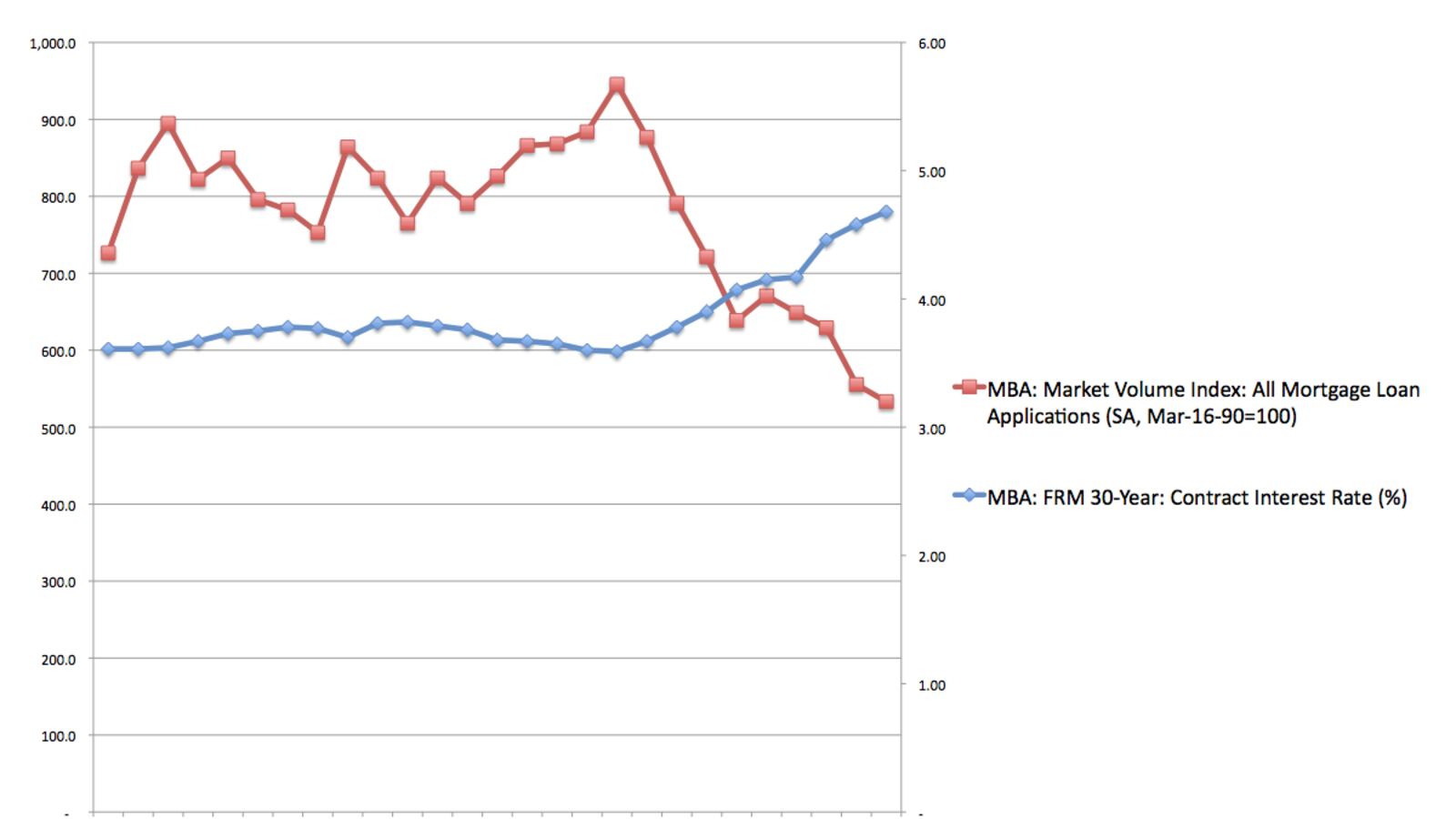

Mortgage activity boomed in post-recession America, mostly fueled by low interest rates. Consumers in the market for their first homes were able to buy new homes with a mortgage at historically low levels, and current owners were able to refinance their mortgages for a better deal. Now, with rising rates, many are feeling much less jubilant. As the chart below shows, the mortgage volume index (provided by the Mortgage Bankers Association) – which measures all mortgage applications, for purchase and re-fis – fell off exactly as rates began to rise. The U.S. economic recovery, largely driven by a recovery in housing, could be threatened by this drop-off. While many are rejoicing as equity-indexes top new highs, the real economy may be more fragile than markets show.