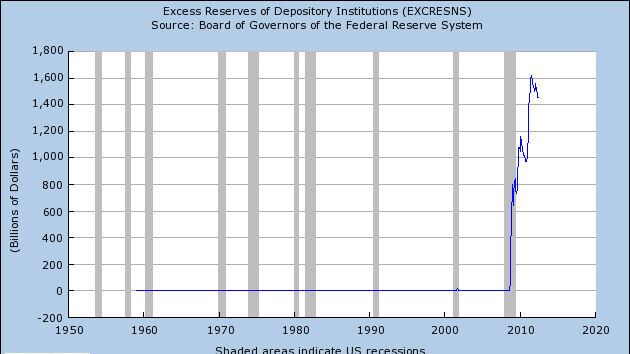

When would you rather hoard money instead of lending it out? When you are a bank and the Federal Reserve pays interest on the reserves you hold. Bruce Bartlett explains:

But rather than make loans, banks instead are simply sitting on the money, so to speak. According to the Federal Reserve, they have $1.5 trillion in excess reserves. This is extraordinary. It is as if individuals took $1.5 trillion of their savings out of stocks, bonds and every other income-producing financial asset and put it all into non-interest-bearing checking accounts back in 2009, and just left it there.

Economists have puzzled about this phenomenon for years. They note that historically the Fed never paid interest on reserves, but in October 2008 it began doing so. Moreover, the Fed pays interest on excess reserves as well as required reserves. Originally, the rate was 0.75 percent to 1 percent, but since Dec. 17, 2008, it has been fixed at 0.25 percent.

This may not sound like much, but keep in mind that interest rates on United States Treasury securities with maturities of less than two years are currently less than 0.25 percent. The effective fed funds rate is also lower than 0.25 percent. In recent weeks, it has been as low as 0.13 percent. Compared with these rates, a riskless return of 0.25 percent looks pretty good.

This chart from the Federal Reserve Bank of St. Louis shows just how extraordinary and unprecedented this level of cash holding is:

There is precedent for banks in other countries to encourage lending by charging interest on excess reserves, though currently it is not clear that the Federal Reserve will take action like that.