Lloyd Blankfein, Goldman Sachs CEO: We Did Nothing Wrong

After a day of testimony by Goldman execs, the Senate panel finally brought out the firm’s top dog: maligned CEO Lloyd Blankfein. In a prewritten statement, Blankfein called the day the SEC suit landed “one of the worst days in my professional life”—yet he denied any wrongdoing. “We have been a client-centered firm for 140 years, and if our clients believe that we don’t deserve their trust, we cannot survive,” he said. “We certainly did not bet against our clients.”

Senator Carl Levin, Chairman, Senate Investigative Panel: It Was a Shitty Deal!

The hearings took an unexpectedly rowdy turn when Democratic Senator Carl Levin, chairman of the Senate investigative committee, began repeatedly cursing. After accusing the firm of “unbridled greed” in his opening statement, Levin focused on an email in which execs described one of their failing investments as a “shitty deal.” Taking seemingly everyone by surprise, Levin proceeded to use the word “shitty” again…and again…and again.

Senator Claire McCaskill, Member, Senate Investigative Panel: Goldman Execs Are Like Bookies

The colorful language continued when panel member Claire McCaskill of Missouri painted an elaborate analogy comparing Goldman executives to bookies. “Most people in America understand about a football bet,” the Democratic senator said. She then asked: “What is the ‘vig’ you make, assuming all you’re doing—not playing in the market—but all you’re doing is trying to stay close to home, like a bookie would do, in order to try to minimize their risk?” Needless to say, the analogy ended when Goldman’s Daniel Sparks attempted to respond.

Fabrice Tourre, Goldman Sachs VP at the Heart of the Suit: I’m the Victim

Think Goldman's Fabrice Tourre was going take the charges lying down? Think again. The VP at the center of the SEC’s lawsuit—who’s been known to call himself “the fabulous Fab”—“categorically” denied the charges. He went on to call the last week "challenging,” saying he’s been the target of “unfounded attacks.”

Senator John McCain, Member, Senate Investigative Panel: Goldman Behaved Unethically

In his opening statement, panel member John McCain didn’t mince words: “I don’t know if Goldman Sachs has done anything illegal,” the Republican from Arizona said, but “there’s no doubt their behavior was unethical.” It’s up to the American people, he added, to render a judgment.

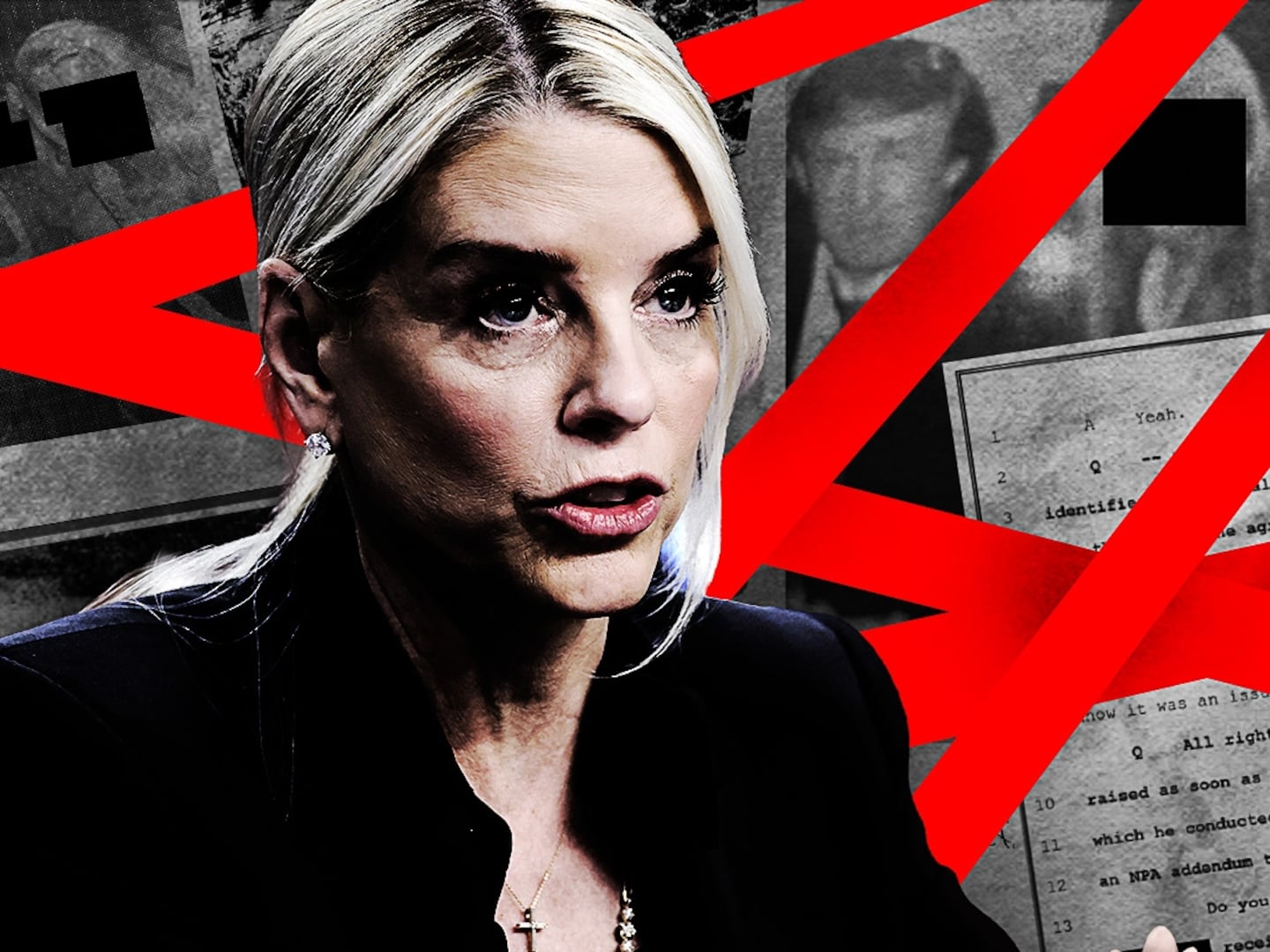

Susan Collins, Member, Senate Investigative Panel: Don’t Play Us for Fools!

As Goldman’s testimony continued, a strategy seemed to emerge: The more time the witnesses spent searching for emails and asking for questions to be rephrased, the less time they spent answering questions. Eventually, a panel member called them on it: “I cannot help but get the feeling that a strategy of the witnesses is to try to burn through the time of each questioner,” said Senator Susan Collins, a Republican from Maine. As it turns out, the employees may have been coached to do so, Talking Points Memo suggests.