Carter Hull and Elizabeth Hofacre were IRS employees responsible for scrutinizing applications for tax-exempt status made by various organizations and called to testify in the ongoing investigation about whether the IRS had inappropriately targeted conservative Tea Party groups for special scrutiny. The two spent over three hours testifying before the House Committee on Government Oversight and Reform in the first panel of an extended hearing about the IRS scandal and occasionally they were even allowed to get a word in.

Most of the hearing was devoted to committee members lobbing back and forth attacks at each other. Elijah Cummings (D-MD) attacked Darrell Issa (R-CA), the committee’s chairman, for “peddling . . .unsubstantiated nonsense” and “making baseless accusations.” Issa responded by comparing Cummings to “a little boy whose hand has been caught in a cookie jar.” (He later apologized to Cummings, an African American, for any possible racial implication in using the word “boy.”)

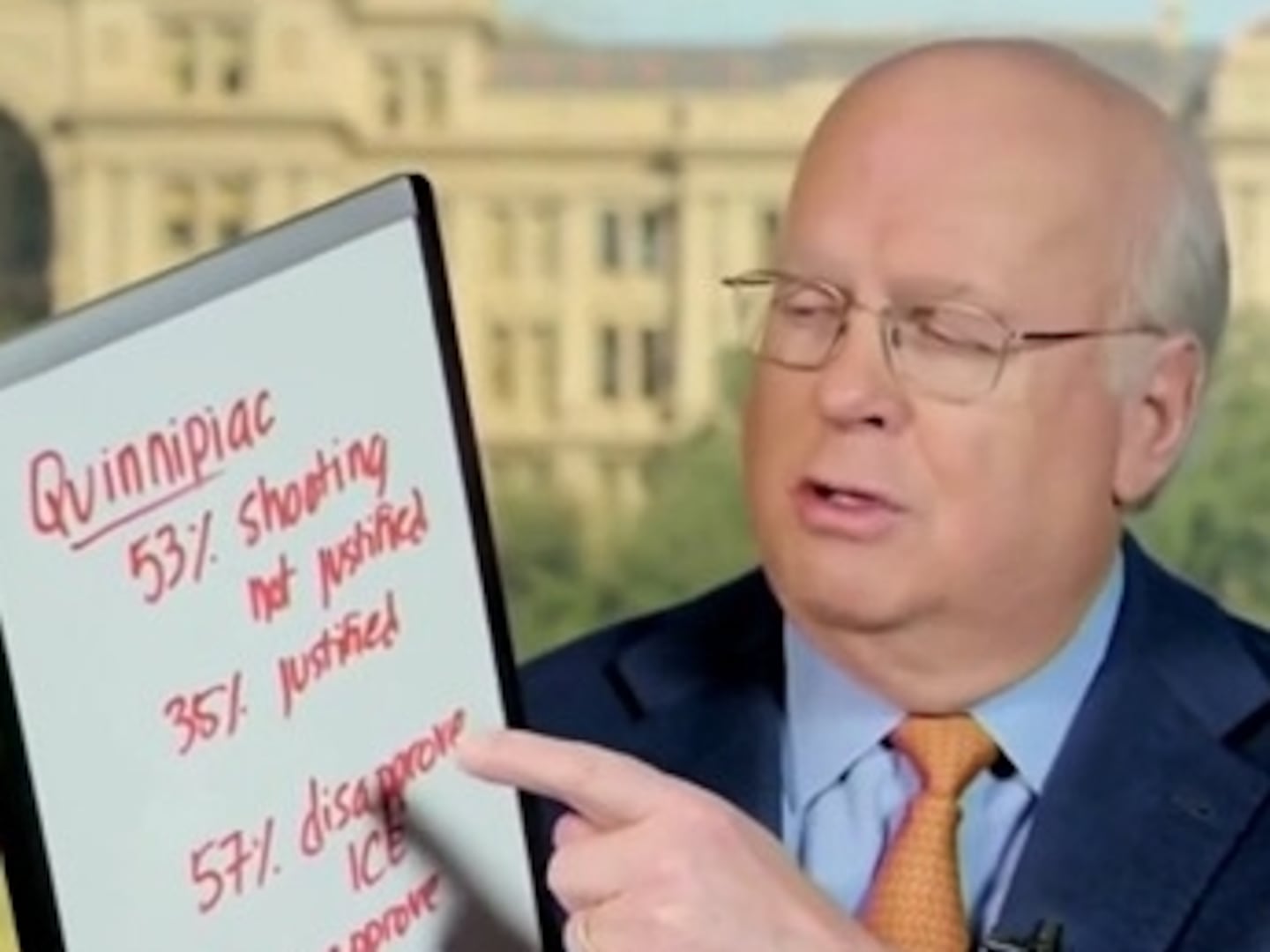

The fireworks continued as members from both parties used their time to attack colleagues on the other side of the aisle. Gerry Connolly (D-VA) berated Issa for calling White House press secretary Jay Carney “a paid liar” for his comments about the IRS scandal and Jason Chaffetz (R-UT) had a testy exchange with Cummings that required the two members to have a personal conversation afterwards to patch things up. Cummings even criticized Republicans who weren’t in the room, reciting the script of a new campaign ad from Senate Minority Leader Mitch McConnell about the IRS scandal and asking Hull and Hofacre if it was true. They said it was not.

The testimony during the hearing shed some new light on the scandal but there were no bombshells. Although Hull and Hofacre rebutted initial claims that the targeting of Tea Party groups could be blamed on “rogue agents in Cincinnati,” they repeatedly insisted that there was “no political motivation” and no connection to the White House or the Obama administration. Instead, all scrutiny of tax-exempt groups by the IRS was simply the result of an apolitical, but possibly dysfunctional, bureaucracy, they claimed.