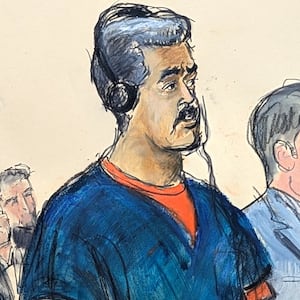

A mystery trader banked almost half a million dollars on low-odds bets that Venezuela would be invaded just before Donald Trump ordered a covert operation to seize President Nicolás Maduro.

The anonymous gambler opened an account with Polymarket, a cryptocurrency-based prediction market, in late December and started small. They wagered about $96 on Dec. 27 on the prediction of a U.S. invasion before Jan. 31, then ramped up with thousands more dollars over the next week.

The heaviest buying came in a short burst on Jan. 2, with the final wager landing at 9:58 p.m. ET, just hours before Maduro’s capture. The “Maduro out by Jan. 31” bets were trading at around 8 cents at the time, implying roughly an 8 percent chance of the wager proving successful.

Within hours, news of the U.S. operation in Venezuela broke, and explosions were reported in the capital of Caracas, sending the contracts’ value soaring.

The trader ultimately turned about $34,000 in wagers into nearly $410,000 in profit—a roughly 12-fold return—then began cashing out the morning of Jan. 3, according to Polymarket data analyzed by The Wall Street Journal.

Market watchers told the Journal that the pattern—a new wallet, clustered wagers, and a tight window before the operation surfaced—looked like the kind of activity they’d scrutinize for nonpublic information.

“It’s more likely than not that this was an insider. That’s a lot of money to put in at that price, without a lot of news,” said Tre Upshaw, the founder of Polysights, a firm that tracks unusual trading on the platform.

Trump’s boasts about how hush-hush the operation was, as he sought to explain why he had failed to tell Congress it was happening, have done little to quell those concerns.

The president said he did not seek congressional approval or give advance notice of the Maduro raid because he feared “leaky” lawmakers would blow the element of surprise, keeping operational details secret until after the action was underway.

Those who were in the know about the strikes reportedly included only Trump, Vice President JD Vance, Defense Secretary Pete Hegseth, and Secretary of State Marco Rubio. Observers now want to know who else may have had access to classified intelligence surrounding the operation.

Legal exposure could depend on who was behind the wallet, which was identified only by a series of numbers and letters. The Journal quoted Fenwick & West partner Noah Solowiejczyk as saying that a U.S. official misusing government information could be prosecuted under existing laws—but that a foreign trader operating abroad could be harder to pursue because of jurisdiction limits.

The controversy has caused Capitol Hill blowback. Rep. Ritchie Torres, 37, said he plans to introduce legislation that explicitly bars federal officials from betting in prediction markets when they hold—or can access—relevant nonpublic information.

Polymarket’s founder and CEO, Shayne Coplan, previously argued that the platform has a form of self-policing because suspicious activity is quickly called out in public.

“The moment there is a suspected insider, it’s pointed out on X, and it’s visible on Polymarket immediately,” he told the Journal.

The Daily Beast has reached out to Polymarket and the White House for comment.