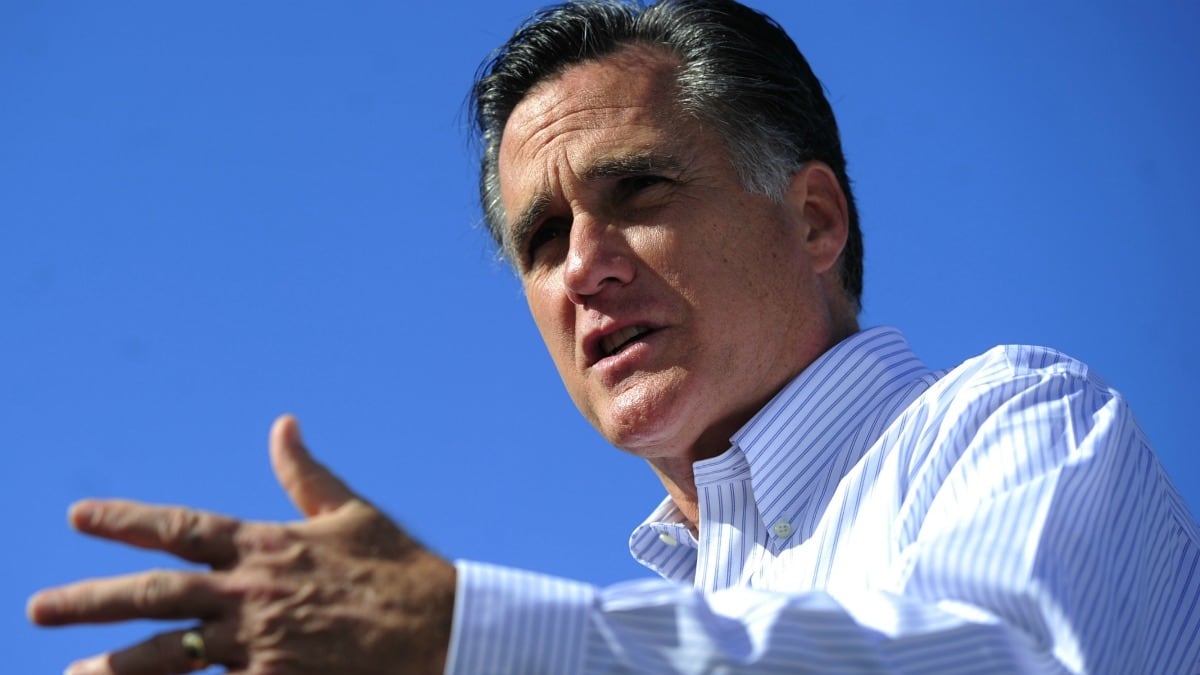

At Investors.com, the always interesting Jed Graham reminds us that back in 2007, Romney economist Greg Mankiw's criticized the carried interest rule that allows Mitt Romney to pay 15% on his earnings at Bain:

Krugman hit the nail on the head with this question: ‘why does (private equity titan) Henry Kravis pay a lower tax rate on his management fees than I pay on my book royalties?’ The analogy is a good one. In both cases, a person (investment manager, author) is putting in effort today for a risky return at some point in the future. The tax treatment should be the same in the two cases.

Graham himself wonders:

Why, for example, should stock options—another form of sweat equity—be taxed as regular income while carried interest is taxed as capital gains?

Graham suggests:

Perhaps there is a route by which Romney can propose to end the tax break as part of a deal that lowers tax rates while broadening the tax base. That would narrow the gap between taxes on regular income and investment gains, thus making favorable treatment of carried interest less meaningful.